Nio (NIO 8.72%) is among the many electric vehicle (EV) start-ups racing to build manufacturing capacity to capture the growing demand for cleaner vehicles. The Chinese company launched in 2014, focusing on the premium smart EV market.

Nio has launched several electric vehicles, including its flagship SUV, the ES8. The company has also developed several breakthrough technologies, including its industry-leading battery-swapping technology (battery-as-a-service, BaaS) and autonomous driving-as-a-service (ADaaS).

While Nio is a leader in China, it has global growth ambitions. It entered its first foreign market in Norway in 2021 and aims to be in 25 countries, including the U.S., by 2025. Nio is investing heavily to expand its production capacity to sell more EVs. It's also investing in lithium supplies and battery manufacturing to reduce costs.

Nio's growth potential is driving many investors to consider investing in its stock. Here's a step-by-step guide on how to buy shares of the electric car stock and some factors to consider before adding it to your portfolio.

How to buy

How to buy Nio stock

You'll need to take a few steps before buying shares of any stock, including Nio. Here's how to add the EV stock to your portfolio.

Step 1: Open a brokerage account

You'll want to open and fund a brokerage account before buying shares of any company. If you need to open one, here are some of the best-rated brokers and trading platforms. Take your time to research the brokers to find the best one for you.

Step 2: Figure out your budget

Before making your first trade, you'll need to determine a budget for how much money you want to invest. You'll then want to figure out how to allocate that money. The Motley Fool's investing philosophy recommends building a diversified portfolio of 25 or more stocks you plan to hold for at least five years.

You don't have to get there on the first day, though. For example, if you have $1,000 available to start investing, you might want to begin by allocating that money equally across at least 10 stocks and then grow from there.

Step 3: Do your research

It's essential to thoroughly research a company before buying its shares. You should learn about its competitors, its balance sheet, how it makes money, and other factors to make sure you have a solid grasp on whether the company can grow value for its shareholders over the long term. Continue reading to learn some crucial factors to consider before investing in Nio's stock.

Step 4: Place an order

Once you've opened and funded a brokerage account, set your investing budget, and researched the stock, it's time to buy shares. The process is relatively straightforward. Go to your brokerage account's order page and fill out all the relevant information, including:

- The number of shares you want to buy or the amount you want to invest to purchase fractional shares

- The stock ticker (NIO for Nio)

- Whether you want to place a limit order or a market order. (The Motley Fool recommends using a market order since it guarantees you buy shares immediately at the market price.)

Once you complete the order page, click to submit your trade and become a Nio shareholder.

Stock Ticker

Should I invest?

Should I invest in Nio?

When conducting research before purchasing a stock, you might uncover something that could change your mind about purchasing shares of that company, or it could confirm your investment thesis. On the one hand, here are some reasons you might want to buy shares of Nio:

- You want to invest in clean technology companies helping decarbonize the global economy.

- You believe Nio will eventually turn the corner and start generating accelerating profits.

- You're seeking investments with high growth potential.

- You're not worried about Nio's cash burn and believe it can continue raising capital to fund its operations.

- You think the company's strategy of investing to secure lithium supplies and build battery manufacturing plants will reduce costs and eventually help Nio turn a profit.

- You think the company's global growth plans will help drive accelerated revenue growth in the coming years.

- You don't need dividend income from your investment.

On the other hand, here are some factors to consider that might lead you away from investing in Nio:

- You have serious doubts about whether EVs will displace gas-powered cars.

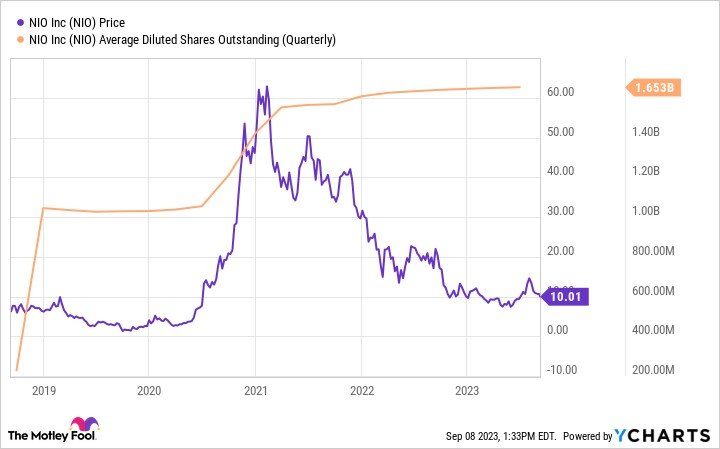

- You're worried that Nio could continue to dilute existing investors by issuing more shares, which could further depress the value of the stock price.

- You're concerned about growing competition in the EV space, which could lead to price wars and prevent Nio from making money.

- You're in or nearing retirement and need investments that produce income.

- You're seeking investments with lower risk profiles and less volatility than Nio.

Profitability

Is Nio profitable?

Looking under the hood at a company's profitability is vital to an investor's stock research process. Rising profits tend to drive stock price performance over the longer term.

Nio had yet to turn the corner on profitability as of mid-2023. The EV company reported a net loss of $835.1 million in the second quarter. That was more than double the company's net loss in the previous year.

A big driver of that widening loss was a deceleration in the company's sales. Nio's revenue declined by almost 15% in the second quarter to $1.2 billion, driven down by a nearly 25% decrease in vehicle sales. In 2022, the company also reported a net loss of more than $2.1 billion -- a 37% increase from 2021's net loss -- and a net loss on a non-GAAP ( non-generally accepted accounting principles) basis at $1.7 billion.

Nio is burning through cash as it invests in research and development (R&D) and scales its operations, so it routinely needs to raise more cash from investors to fund its operations. It raised over $700 million by selling stock to an investment vehicle owned by the Abu Dhabi government in mid-July 2023. That added to its cash balance, which stood at $4.3 billion at the end of June.

The company will need to continue raising money to fund its operations if it doesn't start turning a profit. The mounting losses and stock dilution have greatly impacted Nio's stock price.

Shares have cratered more than 80% from their high, largely driven by a tremendous surge in outstanding shares as it issued more stock to fund its operations. If the company continues to lose money and burn through cash, it might need to dilute investors further, potentially putting more weight on its share price.

Dividends

Does Nio pay a dividend?

Nio had yet to initiate a dividend as of mid-2023. It likely won't start paying dividends anytime soon. The EV company was burning through cash to fund its operations and continued expansion.

ETF options

ETFs with exposure to Nio

An alternative to actively investing by purchasing Nio shares is to consider a passive investment in the EV company through a fund that holds its stock. One of the most common passive investment vehicles is an exchange-traded fund (ETF).

Exchange-Traded Fund (ETF)

According to ETF.com, 72 ETFs held 56.1 million shares of Nio as of mid-2023. The iShares Core MSCI Emerging Markets ETF (IEMG 1.09%) was the biggest holder, with over 12.6 million shares. However, the ETF had a tiny allocation to Nio, at about 0.2% of the fund's holdings, so there are better ways to gain passive exposure to Nio.

KraneShares MSCI China Clean Technology Index (KGRN 2.65%) is a potentially better option. At almost 9%, Nio was the fund's third-largest holding. That makes it an option for investors seeking to invest passively in Nio and other China-based clean technology companies.

Another option is to consider an electric vehicle ETF or lithium ETF holding Nio shares. These ETFs allow investors to passively invest in Nio and other leading EV stocks.

Stock splits

Will Nio stock split?

Nio didn't have an upcoming stock split as of mid-2023. The EV company hasn't split its stock since coming public in 2018 and likely won't split it anytime soon.

The company is burning through cash, causing it to sell stock to fund its operations, driving up its outstanding shares. That dilution has weighed on the stock price, which had tumbled more than 80% from its peak as of mid-2023. If the company continues to issue stock and the share price keeps falling, it might instead need to consider a reverse stock split to increase its trading price.

The bottom line on Nio

Nio is still very early in its journey. The Chinese EV start-up has yet to reach profitability as it invests heavily in R&D and building manufacturing capacity. The company has tremendous growth potential as it capitalizes on growing demand for EVs. If the company can turn the corner on profitability, its share price could see accelerating gains in the future.

However, since Nio is still losing money, it routinely needs to raise cash to fund its operations. That's diluting investors and weighing on its share price. If it's unable to start turning a profit, it might continue to be a money-losing investment.

FAQs

Investing in Nio FAQs

Is Nio stock a good investment?

Nio has tremendous potential. It's a leading EV manufacturer in China, giving it inroads to a potentially massive market opportunity. In addition, Nio has global growth ambitions. The company's investments to grow its product line and enhance its operations could drive accelerated revenue and profit growth in the future.

However, Nio appears to be a long way from turning a profit. Thus, it might need to keep selling stock to outside investors, diluting existing shareholders. That could keep its share price stuck in neutral at best. While Nio could be a good investment, it's likely not the best stock for most investors. It's more suited for those with a high risk tolerance seeking a high upside opportunity.

How do I buy Nio stock?

You can buy shares of Nio in any brokerage account. You will need to:

- Open and fund a brokerage account.

- Set your investment budget by determining how much you want to invest in Nio.

- Do your research and make sure you understand the risks before buying shares.

- Place an order with your broker by filling out the order page, including the number of shares to buy, the correct stock ticker (NIO for Nio), and whether you want to place a market or limit order.

Is Nio on Robinhood?

You can buy and sell shares of Nio on Robinhood.

Can Nio stock reach $1,000?

Shares of Nio traded around $10 a piece in mid-2023. So, they had a long way to go to reach $1,000 a share. At its peak in early 2021, Nio closed at an all-time high of $62.84 per share. The stock plunged from that pinnacle, driven down by continued losses and dilution from stock issuances to fund its operations.

To reach $1,000 a share, Nio would need to reverse its losses and deliver rapidly accelerating profit growth. It would also likely need to start repurchasing shares to reverse the impact of dilution on its stock. Those factors make it unlikely that Nio would ever reach $1,000 a share.