The Coca-Cola Company's (KO 0.0%) roots date back to 1886. John Stith Pemberton, an Atlanta pharmacist, produced the syrup for Coca-Cola. He brought a jug of it to a local pharmacy, where it was combined with carbonated water to produce a soda fountain drink that initially sold for five cents per glass.

While it took Coca-Cola some time to catch on (sales only averaged about nine glasses a day in the first year), it has since grown into a global beverage behemoth. Coca-Cola has built a portfolio of top-selling beverage brands across several categories, including:

- Carbonated soft drinks like Coca-Cola, Sprite, and Fanta.

- Water, sports, coffee, and tea brands such as Smartwater, Vitaminwater, Powerade, and Gold Peak.

- Juice, value-added dairy, and plant-based brands, including Minute Maid, Simply, and Fairlife.

In 2022, Coca-Cola generated $43 billion in net revenue by selling its various beverage brands across more than 200 countries and territories.

Coca-Cola has steadily grown its sales and profits, creating wealth for investors along the way. The company's iconic brands and continued growth likely have many people wondering how to invest in its stock. Here's a step-by-step guide to buying shares of Coca-Cola and some factors to consider before investing in the beverage stock.

Revenue

How to buy Coca-Cola stock

How to buy Coca-Cola stock

To buy shares of Coca-Cola, you must have a brokerage account. If you need to open one, these are some of the best-rated brokers and trading platforms. Here's a step-by-step guide to buying Coca-Cola stock using the five-star-rated platform Fidelity.

Fidelity makes it easy to buy stocks. Its website offers a video tutorial and a step-by-step guide. Here's a screenshot of how to place a stock trade with Fidelity:

On this page, fill out all the relevant information, including:

- The number of shares you want to buy or the amount you want to invest to purchase fractional shares.

- The ticker symbol (KO for Coca-Cola).

- Whether you want to place a limit order or a market order. The Motley Fool recommends using a market order since it guarantees you buy shares immediately at the market price.

Once you complete the order page, click the "Place Order" button at the bottom and become a Coca-Cola shareholder.

Should you invest?

Should I invest in Coca-Cola?

Those considering buying shares of Coca-Cola need to decide whether the company is a good investment for their situation. Here are some factors to consider before adding the beverage stock to your portfolio:

- You love Coca-Cola's products and want to invest directly in its stock.

- You believe Coca-Cola will continue growing its revenue and earnings as it captures rising demand for beverages worldwide.

- You think the company can outperform the S&P 500 over the long term.

- You desire to earn dividend income.

- You're seeking to invest in a more mature company that should have a less volatile share price.

- You understand the risks, including the possibility that Coca-Cola stock could lose value.

Meanwhile, here are some factors to consider that might lead you away from investing in Coca-Cola stock:

- You're not a fan of Coca-Cola's products or want to avoid companies that sell sugary drinks.

- You don't have time to actively invest in stocks and monitor a diversified portfolio.

- You're seeking to invest in a more diversified food and beverage company than Coca-Cola.

- You already own shares of Berkshire Hathaway (BRK.A -0.76%)(BRK.B -0.69%), which has a sizable stake in Coca-Cola.

- You don't need dividend income.

- You're a younger investor seeking a company that can grow profits faster than Coca-Cola.

Here's a closer look at a few more factors to consider before buying shares of Coca-Cola

Is it profitable?

Is Coca-Cola profitable?

Coca-Cola is a very profitable company. In 2022, the beverage giant hauled in $43 billion of net revenue, an 11% increase from the previous year. The company produced slightly more than $9.5 billion of net income, or $2.19 per share. Its net income was down from the previous year (2% on an absolute basis and by 3% per share) due to a lower operating margin. The company's margin declined because of the unfavorable impact of its Bodyarmor acquisition, higher operating costs, and increased marketing investments.

Coca-Cola also produces a lot of cash. It generated $11 billion in cash flow from operations in 2022 and $9.5 billion in free cash flow. The company's cash-generating ability enabled it to invest in growing its business while returning money to shareholders through dividend payments and share repurchases.

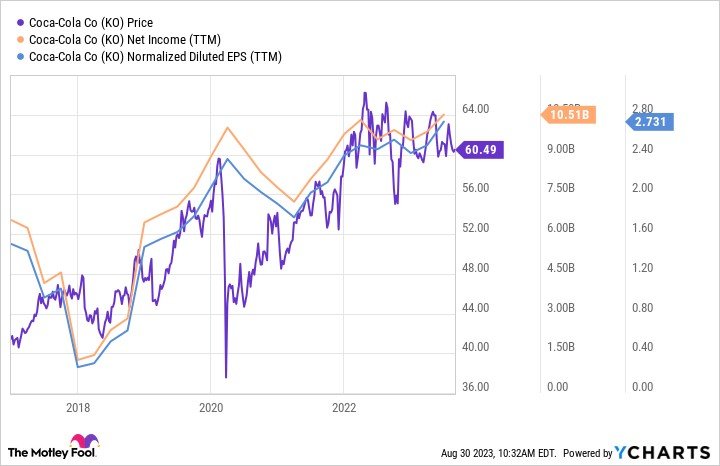

Although Coca-Cola's profits declined in 2022, it has a long history of earnings growth. The company's comparable earnings per share have grown at a more than 6% average annual rate since 2017, helping steadily drive the stock price higher in recent years:

Coca-Cola expects earnings to resume their growth trajectory in 2023. The beverage giant estimated its comparable earnings per share would rise by 5% to 6%. Meanwhile, it set a long-term target of growing its earnings per share by 7% to 9% per year. That earnings growth should help increase the company's stock price value while allowing Coca-Cola to continue raising its dividend.

Dividends

Does Coca-Cola pay a dividend?

Coca-Cola has a long history of paying dividends. In early 2023, the beverage giant increased its dividend by 4.6%, marking the 61st straight year of dividend increases. That kept the company in the elite group of Dividend Kings, companies with 50 or more years of consecutive dividend growth.

The company also offered an attractive dividend yield. As of mid-2023, Coca-Cola's dividend yield was slightly more than 3%, roughly double that of the S&P 500. The beverage company's attractive yield and steady dividend growth make its stock ideal for income-focused investors like retirees.

ETFs

ETFs with exposure to Coca-Cola

Investors interested in Coca-Cola have alternative options to buying shares directly. They could also consider passively investing in the beverage stock through a fund that holds its shares.

Coca-Cola is one of the larger companies by market capitalization. The iconic company is in several stock market indexes, including the Dow Jones Industrial Average and S&P 500 Index. As a result, index funds and exchange-traded funds (ETFs) that benchmark their returns against those indexes hold Coca-Cola, making it a widely-held stock.

Exchange-Traded Fund (ETF)

According to ETF.com, 295 exchange-traded funds (ETFs) held 415 million shares of Coca-Cola as of mid-2023. S&P 500 index funds and ETFs were among the largest holders, led by the SPDR S&P 500 ETF Trust (SPY 0.95%). The fund held 42.6 million shares. However, Coca-Cola was only its 26th largest holding at 0.6% of the fund's total, so there are better ways to gain passive exposure to Coca-Cola.

Several ETFs focus on consumer staples stocks, giving them a more meaningful allocation to Coca-Cola. The iShares U.S. Consumer Staples ETF (IYK -0.3%) has the largest allocation to Coca-Cola at 10.7%.

Another alternative to directly buying shares of Coca-Cola is to consider investing in Berkshire Hathaway, which has a significant stake in the company. It was one of Warren Buffett's largest stock holdings in mid-2023. Berkshire owned 400 million shares of Coca-Cola (9.2% of its outstanding shares). Those shares were worth more than $24 billion, making it Berkshire's fourth-largest holding at 6.7% of its investment portfolio.

Stock splits

Will Coca-Cola stock split?

Coca-Cola didn't have an upcoming stock split on the docket as of mid-2023. However, the company has completed several stock splits throughout its history. Here's a look at the company's stock splits over the years and how many shares an investor would now hold if they bought one share at its initial public offering in 1919:

| Record data | Activity | Cumulative shares |

| 9/5/1919 | IPO | 1 |

| 4/25/1927 | 1-for-1 Stock Dividend | 2 |

| 11/15/1935 | 4-for-1 Stock Split | 8 |

| 1/22/1960 | 3-for-1 Stock Split | 24 |

| 1/22/1965 | 2-for-1 Stock Split | 48 |

| 5/13/1968 | 2-for-1 Stock Split | 96 |

| 5/9/1977 | 2-for-1 Stock Split | 192 |

| 6/16/1986 | 3-for-1 Stock Split | 576 |

| 5/1/1990 | 2-for-1 Stock Split | 1,152 |

| 5/1/1992 | 2-for-1 Stock Split | 2,304 |

| 5/1/1996 | 2-for-1 Stock Split | 4,608 |

| 7/27/2012 | 2-for-1 Stock Split | 9,216 |

As that table shows, Coca-Cola has split its stock many times over the years. However, it hasn't completed a split in more than a decade. While shares have increased in value by more than 50% since the stock's last split, they still traded at an accessible price (around $60 a share in mid-2023). The company might continue to hold off on splitting its stock until shares trade at a higher value.

The bottom line on Coca-Cola

The Coca-Cola Company has grown from humble beginnings into a global beverage giant. The company expects to grow its earnings steadily in the coming years. Rising profits should help increase its stock price while allowing Coca-Cola to continue increasing its dividend, making it an attractive stock to buy for the long term.

However, Coca-Cola stock isn't for everyone. Investors need to ensure it's the right fit for their portfolio before buying shares.

Investing in Coca-Cola FAQs

Why does Coke have two stocks?

The Coca-Cola Company and Coca-Cola Consolidated (NASDAQ: COKE) are very different companies. The Coca-Cola Company is a leading global beverage company that sells products in more than 200 counties and territories. Coca-Cola Consolidated is the largest Coca-Cola bottler in the U.S. It makes, sells, and distributes beverages for The Coca-Cola Company and other partners in 14 states.

What is the highest Coca-Cola stock price?

Coca-Cola reached its all-time closing high of $63.82 per share on April 21, 2022 (adjusted for stock splits).

What is the dividend on $100 in shares of Coca-Cola?

Coca-Cola paid a dividend of $0.46 per share ($1.84 annualized) as of mid-2023. At the time, shares traded around $60 a piece, giving it a roughly 3% dividend yield. At that rate, the dividend on a $100 investment in Coca-Cola stock (assuming fractional shares) would be around $3 per year.