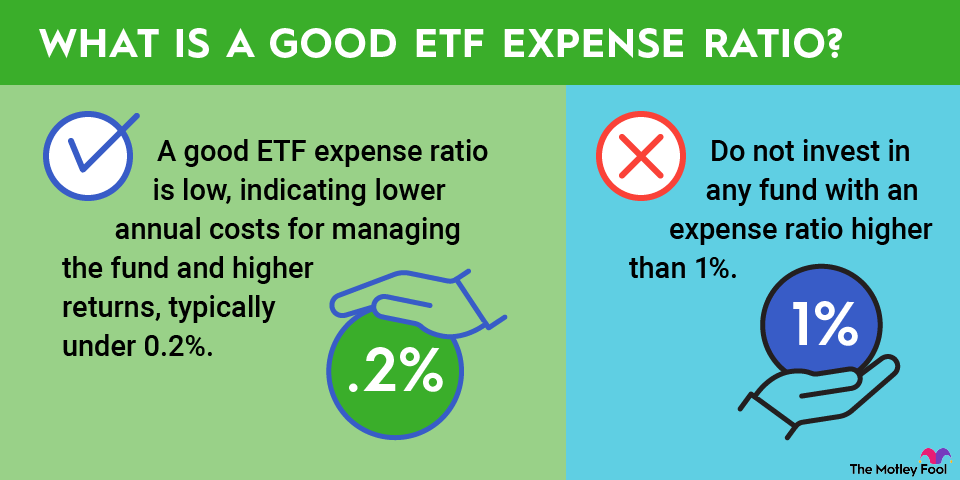

Typical ETF expense ratios are less than 1%. That means that, for every $1,000 you invest, you pay less than $10 a year in expenses.

How the ETF expense ratio works

Let's say you invest $100,000 in the Horizon Kinetics Inflation Beneficiaries ETF (INFL +0.68%), which, according to the fund's fact sheet, has a current expense ratio of 0.85%. You will pay $850 to the fund's manager this year and increasing amounts in following years, assuming the value of your investment continues to grow. If the fund's value increases by 10% annually for the next 10 years, then your initial investment will be worth $259,374. Over the 10 years, you would pay fees totaling $19,360.