You've probably heard that there's a recession forecast, but a term that doesn’t come up as often is the closely related "economic depression." A depression can be a very serious situation for global economies, but they (fortunately) don't happen very often.

What is an economic depression?

America has experienced just one depression in the modern era, beginning in 1929. But it was so impressive that it earned a very special moniker: The Great Depression. Don't be confused: There was nothing great about this economic depression.

In the most basic of definitions, an economic depression is a severe form of recession that is prolonged over many years and causes a decline in gross domestic product (GDP) of at least 10% per year. There is also generally massive unemployment, and the results ripple across the globe.

The characteristics of an economic depression

Although the modern United States has only experienced one true depression, they have happened enough elsewhere and across time that economists have developed a short list of common characteristics. These include the massive drop in GDP and appalling unemployment rates, but these two factors together also contribute to things like:

- A reduction in global commerce.

- Lower manufacturing output.

- Low inflation / possible deflation.

- Less available credit from banks.

- Sovereign debt defaults.

- Personal and business bankruptcies.

- Failing currency values.

- Bear market for stocks.

It's essentially a vicious cycle where companies struggle, let go of workers, and the workers can't find new jobs, so they contribute less to the economy to the point that businesses really struggle to make enough to keep their doors open. They file bankruptcy or close entirely, so the government experiences a shrinking tax base, it can't pay its bills, faith in currency falls, and the entire world feels it.

Economists agree on this much, but they're not so much in agreement on how long these crises last. For some, the depression ends when economic activity stops declining, but others say the depression is still in effect until economic activity has returned to historical norms.

Depression versus recession

Depressions are really an extreme form of recession, which is why it can be easy to get the two confused. However, while a recession is a pretty normal part of the business cycle, a depression is a severe result of the perfect storm of negative economic issues colliding, or worse, feeding into each other.

Globalization

It can be difficult to tell a very bad recession from a less terrible depression, but a general rule of thumb is that a recession is contained within the originating country, whereas a depression spills over globally and causes a lot of ripple effects. However, increased globalization can make them less of a differentiator.

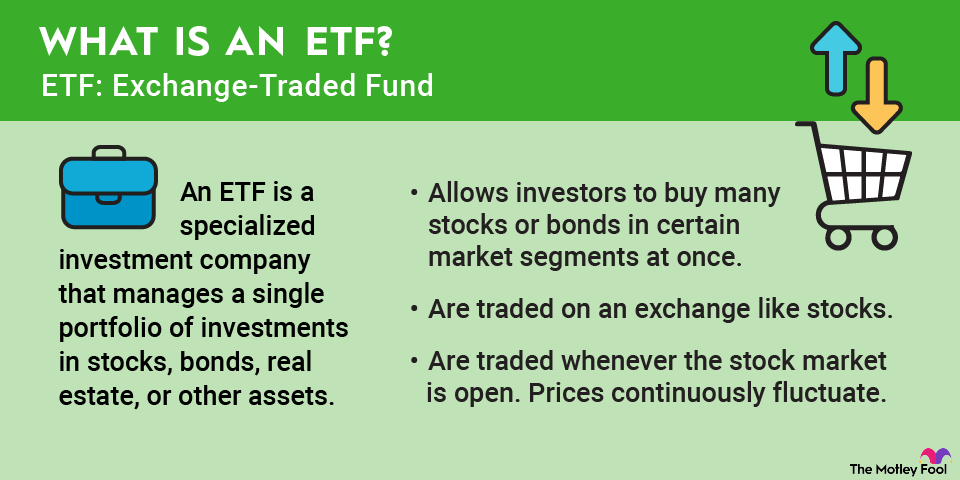

Related investing topics

How many depressions have there been?

Prior to modern economic practices, depressions weren't uncommon. There are very obvious examples of depressions reaching back into the 17th century in Europe, though they weren't necessarily called economic depressions at the time. In America, we've only had one depression, and it was great.

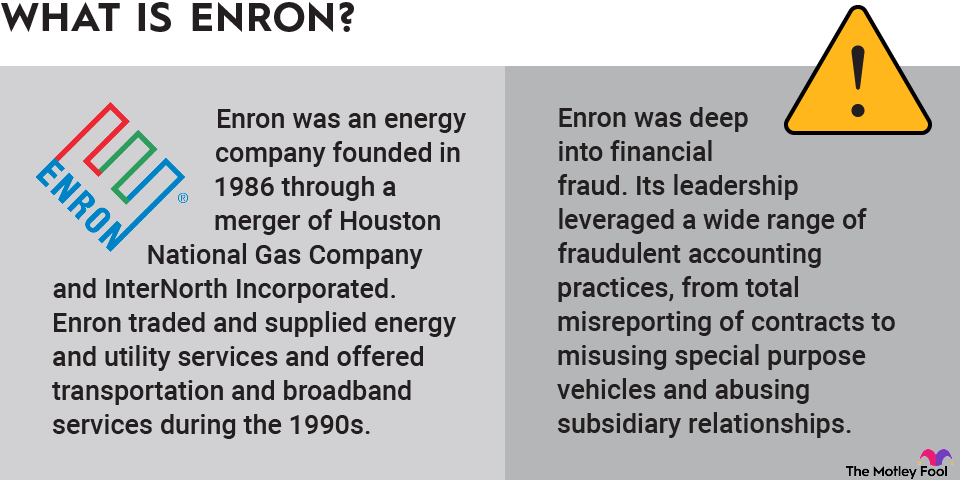

The Great Depression lasted from 1929 to 1939, triggered by a crash in the stock market that sent investors running from the markets and regular people scrambling to pull their life savings out of banks. They pulled so much money out of banks that they caused many to fail entirely in the days before the creation of the Federal Deposit Insurance Corporation (FDIC), established as a direct result of those early days of the Great Depression.

It's unlikely that another depression will occur in the United States soon, however, due to a variety of controls that have been put in place. These include the ability of Congress and the president to enact fiscal policy that injects money into the economy either directly or through job creation, the Federal Reserve's ability to adjust monetary policy to encourage or discourage lending and borrowing, and fiscal policy measures to curb government spending when revenues are lean.