It’s a litigious society, and litigation can affect you, your business, and even your investments. Enter errors & omissions (E&O) insurance, a type of financial protection against mistakes and errors, whether they’re real or imagined. Read on to learn more about this important form of financial protection.

What is errors & omissions insurance?

Most businesses need some form of general liability insurance to protect themselves against accidents, property damage, personal injury, and other frequent mishaps. Errors & omissions (E&O) insurance is a special type of liability insurance that covers businesses against a wide range of other potential issues, such as bad advice, business disputes, and faulty goods and services provided by professionals or licensed individuals.

Why carry errors & omissions insurance?

Who needs errors & omissions insurance? A lot of people: lawyers, tech firms, accounting, barbers, beauticians, architects, engineers, real estate brokers, home health aides, consultants, contractors, fitness instructors, plumbers, painters, tax preparers, event planners, restaurant owners, therapists, and tattoo artists should all consider E&O insurance. Many physicians and other health professionals carry a type of E&O insurance described as “malpractice insurance.”

Liability

Granted, the likelihood of a business being on the receiving end of a lawsuit is small -- but it’s not impossible. Personal injury/product liability lawsuits climbed 150% in federal courts in 2021, an increase of 138,436 filings.

According to the National Ethics Association, the four most common causes of E&O insurance claims include:

- Inadequate communication and documentation.

- Misrepresentation.

- Inadequate coverage.

- Breach of duty.

Typically, E&O policies cover an adverse legal decision, attorney fees, court costs, and settlements. They can cover temporary workers and independent contractors, personal injury awards for libel or slander, claims made for services that have already been provided, and actual loss or damages.

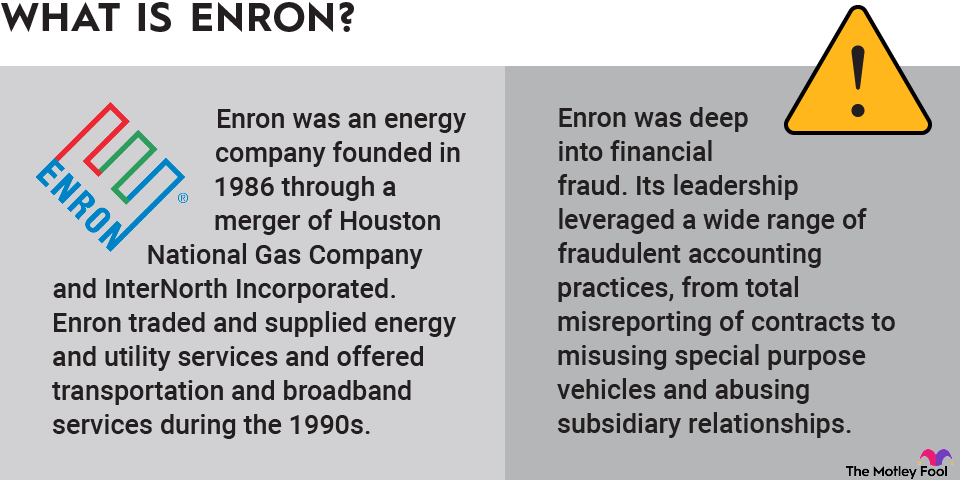

E&O policies, however, don’t protect a business or professional from every potential piece of litigation. Lawsuits that stem from employment practices, fraud, bodily or property damage, trade secrets, and false advertising usually are excluded from errors & omissions coverage.

Like other policies, E&O insurance costs are based on policy limits. A higher amount of coverage generally will require higher monthly premiums. Companies and individuals without a record of being involved in lawsuits typically will pay less than frequently sued professionals or businesses.

Although E&O policies vary from company to company and individual to individual, costs appear to be rising. Premiums for insurance agencies, for example, have risen for three consecutive years, according to an annual survey by Insurance Journal, with 68.6% predicting another increase at their next renewal.

E&O policies also have to be highly tailored, depending on the requirements of the insured business or professional. The COVID-19 pandemic, for example, deeply affected the construction industry, which suffered from project delays and cancellations, staffing difficulties, job site outbreaks, and shortages of materials.

Related investing topics

Example of E&O insurance

A consulting firm, CDM Smith, was sued by a California district in 2018 for its design and construction of a pond that was an important part of a $13 million water treatment plant. The pond, which was designed to deal with brine discharge, was too small to treat the water and had to be shut down in 2017 after a storm increased water levels above state limits.

The district claimed in court that the pond was poorly designed, with “significant errors in the analysis,” and needed repairs that cost about $2.5 million. The district also argued that the firm didn’t build an emergency water project to provide water to the community in non-emergency situations.

The consulting firm paid $1.75 million for breach of contract and professional negligence, not including $250,000 in estimated legal costs. Paul Lansky, manager of professional liability for the Toronto brokerage Burns & Wilcox, cited the case as an example of the importance of requiring contractors to carry E&O insurance, noting, “The bigger the project, the bigger the potential price tag to correct any errors.”