The best long-term ETFs allow investors to easily build a diversified portfolio. They can provide broad exposure across many asset classes, industries, and geographies. This diversification can help an investor reduce risk without sacrificing long-term returns.

There are many exchange-traded funds (ETFs) built for long-term investors. Here's a closer look at several top ETFs that make ideal buy-and-hold investments.

Best long-term ETFs

Best long-term ETFs

The best ETFs for the long term hold a diversified portfolio of stocks while charging a very low ETF expense ratio. Although many funds share those two key characteristics, here are the top ETFs for long-term investors:

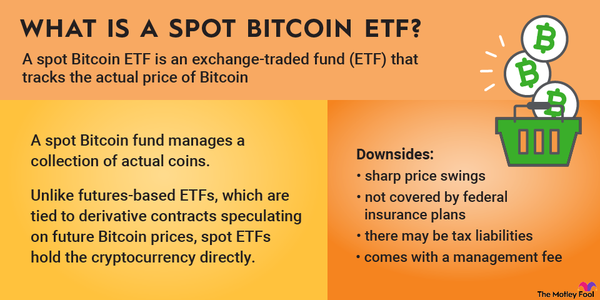

Exchange-Traded Fund (ETF)

ETFs 1 - 2

1. Vanguard S&P 500 ETF

The Vanguard S&P 500 ETF (VOO 0.84%) is an index fund designed to track the S&P 500 index. The index represents 500 of the largest U.S. publicly traded companies. The ETF's goals are to closely follow the S&P 500's returns, the primary benchmark for the overall returns of the U.S. stock market.

It offers a high potential for growth, making it an ideal long-term investment. Over the last 50 years, the average stock market return was 8% annually, as measured by the S&P 500. The Vanguard S&P 500 ETF has only slightly underperformed that benchmark's returns since its inception due to its modest ETF expense ratio.

Like the S&P 500, the ETF uses a market weight strategy, giving a higher weighting to the largest companies. Its top 10 holdings made up almost 35% of its total net assets in mid-2025, giving investors relatively concentrated exposure to the largest companies in the index.

The ETF offers investors exposure to the largest U.S. stocks for a very low cost. Its expense ratio of 0.03% is significantly less than the 0.22% average expense ratio of similar funds. Investors would only pay $0.30 in annual management fees per $1,000 invested in the ETF, compared to $2.20 per year for every $1,000 invested in the average fund.

2. Invesco S&P 500 Equal Weight ETF

The Invesco S&P 500 Equal Weight ETF (RSP 0.48%) is also an index fund designed to track the stocks in the S&P 500. However, it uses an equal weight approach instead of one based on market cap. As a result, the ETF's top 10 holdings represent less than 3% of its total assets.

This approach reduces concentration risk by providing broad exposure across the 500 stocks in the S&P 500. The ETF rebalances its holdings quarterly to ensure each holding remains a relatively equal portion of the fund's assets.

The ETF has a relatively low expense ratio of 0.2%. That's a reasonable fee to gain broad, equal-weight exposure to 500 of the largest public companies in the U.S.

Gross Expense Ratio

ETFs 3 - 4

3. iShares Russell 1000 Growth ETF

The iShares Russell 1000 Growth ETF (IWF 1.15%) provides exposure to U.S. companies expected to increase their earnings at an above-average rate compared to the broader stock market. The fund held shares of slightly less than 400 companies as of mid-2025.

The ETF takes a market-weighted approach. Its top 10 holdings made up more than 55% of its total assets. Given its growth focus, technology stocks comprised a significant portion of the fund's holdings at more than 45% in mid-2025.

The ETF charges investors a reasonable expense ratio of 0.19%. That's a fair price to pay to gain long-term exposure to growth stocks.

4. Vanguard Real Estate ETF

The Vanguard Real Estate ETF (VNQ 0.17%) invests in real estate stocks with a focus on real estate investment trusts (REITs). These entities typically own income-producing commercial real estate, such as apartments, office buildings, retail properties, and industrial complexes.

As of mid-2025, the REIT ETF had almost 160 total holdings. The top 10 made up more than half of its assets. However, it's worth noting that its largest holding was a real estate index fund also managed by Vanguard (more than 14% of its assets), which helped reduce its overall concentration.

The fund charges a relatively low fee of 0.13%, making it an inexpensive way to gain exposure to the real estate market, which has historically been an excellent long-term investment. REITs also tend to pay above-average dividends. As a result, this ETF offered a dividend yield above 3.5% in mid-2025.

ETFs 5 - 7

5. Schwab U.S. Dividend Equity ETF

The Schwab U.S. Dividend Equity ETF (SCHD 0.07%) tracks an index focused on holding dividend stocks known for the quality and sustainability of their dividend payments. The ETF enables investors to benefit from the power of dividends in producing attractive total returns for investors over the long term.

The ETF held shares of more than 100 dividend-paying stocks in mid-2025. The fund offered a dividend yield of around 4%, more than double that of the S&P 500 (less than 1.5% at the time).

Its top 10 holdings made up more than 40% of the total. Meanwhile, its overall holdings are fairly well diversified. Energy stocks have the highest weighting at 21.1% of its holdings. Rounding out the top five sectors are consumer staples (19.1%), healthcare (15.7%), industrials (12.4%), and the financial sector (8.4%).

The ETF charges an ultra-low expense ratio of 0.06%. That lets investors keep a significant portion of the dividend income generated by its holdings. These features make the ETF a very low-cost way to collect passive income via dividend stocks, which have historically been exceptional long-term investments.

6. iShares Core MSCI EAFE ETF

The iShares Core MSCI EAFE ETF (IEFA 0.05%) is an ETF focused on international stocks. It provides investors with broad exposure to companies in Europe, Australia, Asia, and the Far East. That enables anyone to add some international diversification to their portfolio, which has outstanding long-term growth potential.

The ETF held more than 2,600 stocks as of mid-2025. It provides fairly broad exposure to global stocks, with its top 10 holdings making up about 11.5% of its net assets. The ETF is also reasonably diversified by sector and geography:

| Top 5 Sectors | Top 5 Geographies |

|---|---|

| Financials (21.9% of the fund's holdings) | Japan (23.6%) |

| Industrials (18.5%) | United Kingdom (14.8%) |

| Healthcare (11.2%) | France (10.3%) |

| Consumer discretionary (10.7%) | Switzerland (9.2%) |

| Information technology (8.0%) | Germany (9.1%) |

The iShares Core MSCI EAFE ETF charges a very low expense ratio of 0.07%, allowing investors to add some international exposure to their portfolios at a low cost and benefit from the long-term growth of the global economy.

7. iShares Core 60/40 Balanced Allocation ETF

The iShares Core 60/40 Balanced Allocation ETF (AOR 0.13%) offers investors a simple way to build a highly diversified portfolio. It provides access to several asset classes through one ETF. The fund provides investors with exposure to a broad mix of stocks (roughly 60% of its allocation) and bonds (40%) by holding seven ETFs:

- iShares Core S&P 500 ETF (IVV 0.76%): This S&P 500 index fund made up 36% of the ETF's assets.

- iShares Core Total USD Bond Market (IUSB -0.22%): This U.S.-focused bond ETF totaled 32% of the fund's holdings.

- iShares Core MSCI International Developed Markets ETF (IDEV 0.16%): This international ETF focused on developed markets accounted for 16.8% of its assets.

- iShares Core MSCI Emerging Markets (IEMG 0.5%): This emerging markets-focused ETF made up 6.7% of the fund's assets.

- iShares Core International Aggregate Bond ETF (IAGG 0.18%): This international bond ETF comprised 5.7% of the fund's assets.

- iShares Core S&P Mid-Cap ETF (IJH 0.58%): This mid-cap stock-focused ETF accounted for 2% of the fund's assets.

- iShares Core Small-Cap ETF (IJR 0.56%): This small-cap stock-focused ETF totaled 0.9% of the fund's assets.

The ETF allows investors to easily set up a balanced long-term portfolio, helping to reduce their risk profile while still delivering attractive returns. It charges investors a reasonable fee of 0.15% after adjusting for the fees and associated waivers on the ETFs in the fund.

Related investing topics

Why choose ETFs

Why ETFs are good for long-term investors

ETFs can be great building blocks for long-term investors. They can provide broad exposure to market sectors, geographies, and industries and help investors quickly diversify their portfolios while reducing their overall risk profile.

The best long-term ETFs provide this exposure for a relatively low expense ratio. The low cost allows investors to earn returns roughly matching the underlying index that the funds aim to track over the long term.