The Vanguard Growth ETF (VUG 1.08%) is one of the most popular exchange-traded funds (ETFs) on the stock market and one of the best choices out there for growth stock investors. The fund has more than $200 billion in net assets, making it one of the world's largest ETFs, and it has a track record of outperforming the S&P 500, something most professional fund managers don't do in a typical year.

The fund owns many of the top growth stocks in the S&P 500, but there are important differences between the Vanguard Fund ETF and the broad-market index. In this look at the Vanguard Growth ETF, we'll examine how to buy it, whether you should invest in it, whether it pays a dividend, its expense ratio, and its historical performance. Keep reading to learn more.

Exchange-Traded Fund (ETF)

What is it?

What is the Vanguard Growth ETF (VUG)?

The Vanguard Growth Fund ETF included 179 growth stocks as of the end of 2024, tracking the CRSP US Large Cap Growth Index. More than half of the ETF's value comes from the tech sector, which represents 59% of the fund.

That's not surprising, considering the largest stocks on the stock market hail from the tech sector. The next-largest sector is the consumer discretionary sector, which makes up 20% of this growth ETF. No other sector represents more than 10% of it.

How to buy

How to buy the Vanguard Growth ETF (VUG)

The process for buying this ETF isn't much different from buying a stock or any other ETF, and it's easier than buying a mutual fund. Let's review the process step by step.

Step 1: Open a brokerage account

The first step to buying the Vanguard Growth ETF is to open a brokerage account if you don't already have one. There are many options for opening an account, including brokerages like Charles Schwab (SCHW 0.23%), Fidelity, Robinhood (HOOD -3.6%), or E*TRADE from Morgan Stanley (MS 0.9%). Each is different and has its own pros and cons depending on your investing style, so it's worth researching before investing.

Step 2: Figure out your budget

Once you have a brokerage account, you'll want to decide how much you're investing or what your budget is. The advantage of investing in ETFs rather than stocks is that an ETF does the diversifying for you.

So, you could even consider putting all the money you have to invest into an ETF like the this Vanguard ETF. You could also buy individual stocks or diversify into different kinds of ETFs, like those focused on value stocks and dividend stocks.

Step 3: Do your research

It's always a good idea to do your own research on your investments. Since the Vanguard Growth ETF holds almost 200 stocks and is already diversified, the threshold for doing research isn't as high as it is for individual stocks. However, it's a good idea to keep tabs on its performance, holdings, and any relevant information that could impact its performance, such as what's happening with interest rates.

Step 4: Place an order

Finally, once you have a brokerage account ready, you know how much you want to invest, and you've done your research, it's time to hit the buy button and place an order.

There are two principal types of orders in investing: limit orders and market orders. With a limit order, you set the maximum price you are willing to pay for the stock, and your order will be completed only if the price falls at or below that. With a market order, you'll buy the stock at its current price.

Each order type has pros and cons. Overall, the market order is better if you want to make sure you buy the stock and you want to do it quickly. A limit order is better when you want to be sure you have control over the price being paid.

Holdings

Holdings of the Vanguard Growth Index ETF (VUG)

This Vanguard ETF has about 179 stocks. Its largest holdings are similar to that of the S&P 500. Among its top holdings:

- Microsoft (MSFT 1.58%): The enterprise software giant

- Apple (AAPL 0.53%): The consumer electronics leader

- Nvidia (NVDA 1.28%): Chipmaker leading the artificial intelligence (AI) revolution

- Amazon (AMZN 1.62%): Leader in e-commerce and cloud computing

- Meta Platforms (META 0.73%): Owner of Facebook and Instagram

- Alphabet (GOOG 0.51%)(GOOGL 0.54%): Leader in search and parent of YouTube and Google Cloud

- Tesla (TSLA 0.04%): Leading electric vehicle (EV) maker

- Eli Lilly (LLY 0.16%): Pharmaceutical giant and maker of weight-loss drug Mounjaro

- Broadcom (AVGO 1.9%): A diversified semiconductor and software company

Should I invest?

Should I invest in the Vanguard Growth ETF (VUG)?

Investing in the Vanguard Growth ETF is a sensible move for almost any investor who wants exposure to growth stocks and diversification. The Vanguard Growth ETF has a very low expense ratio and a track record of beating the S&P 500.

Expense Ratio

While an investor could allocate a large chunk of their portfolio to this ETF, they could also just purchase a small piece to get some exposure to large-cap growth stocks. The only reasons you might not want to buy this ETF are that you don't want exposure to growth stocks or you're the kind of investor who dislikes the lack of control inherent in ETFs.

Dividends

Does the Vanguard Growth ETF (VUG) pay a dividend?

The Vanguard Growth ETF pays a dividend because some of its holdings pay dividends. However, the dividend yield is relatively modest, as you might expect for an ETF focused on growth stocks. Currently, the Vanguard Growth ETF offers a dividend yield of 0.4%.

Expense ratio

What is the Vanguard Growth ETF (VUG)'s expense ratio?

Not only is this Vanguard ETF one of the best ETFs to get exposure to a broad range of growth stocks, but it's also one of the cheapest ETFs out there in terms of management costs.

Investors pay an expense ratio of 0.04% to own the stock, meaning it costs just $0.04 a year for every $100 of the ETF they own. If you held $10,000 in this ETF, you would pay Vanguard an annual fee of $4 to manage the fund.

Historical record

Historical performance of the Vanguard Growth ETF (VUG)

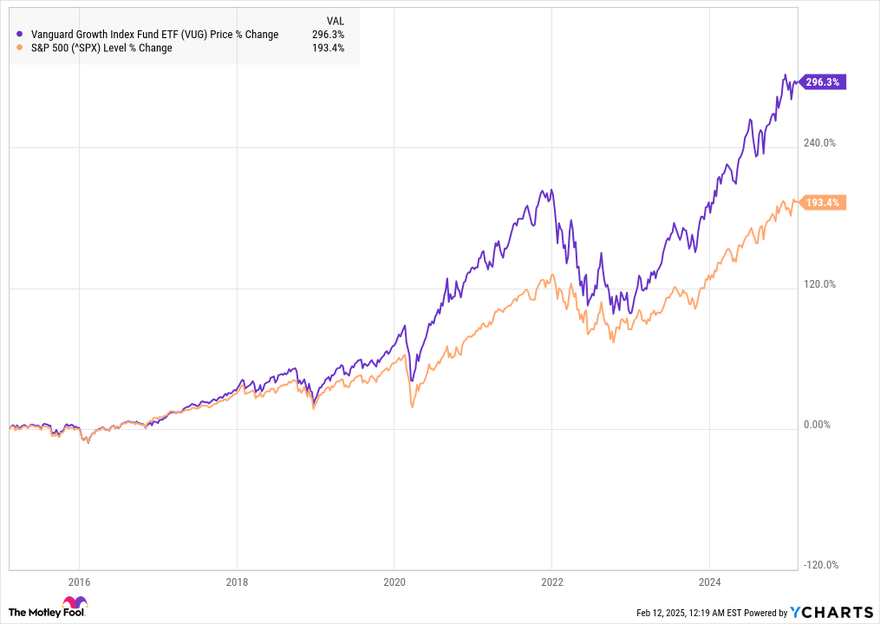

Over the last decade, this growth ETF has been a steady, strong performer. Growth stocks tend to be more volatile than the overall stock market, but this Vanguard ETF has outperformed the S&P 500 over almost any period in the last decade, as the chart below shows. You can also view its performance over various timeframes in the last decade.

| Period | Performance | S&P 500 |

|---|---|---|

| 1 year | 32.3% | 26.4% |

| 3 years | 46.5% | 40.1% |

| 5 years | 129.8% | 102.6% |

| 10 years | 346.9% | 263.0% |

As you can see, this Vanguard ETF has steadily outperformed the S&P 500, though it tends to be more volatile than the broad market index and is likely to underperform it in a bear market. Growth stocks tend to do better in bull markets but fall further in bear markets.

Related investing topics

The bottom line

The bottom line on Vanguard Growth ETF (VUG)

Overall, the Vanguard Growth ETF is an excellent choice for long-term investors who want exposure to growth stocks and the diversification that an ETF offers. It has a track record of outperforming the S&P 500 and offers one of the lowest expense ratios you'll find among ETFs. Better yet, there are no major drawbacks to investing in this Vanguard growth-focused ETF.

FAQs

Investing in Vanguard Growth ETF FAQs

How do I buy the Vanguard Growth ETF?

You can buy the Vanguard Growth ETF like you'd buy any other stock. ETFs allow you to easily buy and sell shares of funds that hold large groups of stocks. To buy the Vanguard Growth ETF, just search for "Vanguard Growth ETF" or "VUG" in your brokerage platform and hit the buy button.

Is Vanguard Growth ETF a good investment?

Yes, the Vanguard Growth ETF has been an excellent investment over its history. It also has a long track record of outperforming the S&P 500. Although it tends to be more volatile than the broad-market index, long-term investors should be rewarded for holding this ETF.

How do I buy Vanguard ETF funds?

You have a number of choices among Vanguard ETF funds. Some of the best-known options are the Vanguard S&P 500 ETF (NYSEMKT:VOO), the Vanguard Growth ETF, the Vanguard Total Stock Market ETF (NYSEMKT:VTI), and the Vanguard Value ETF (NYSEMKT:VTV).

To buy one of those funds, simply look up the associated stock ticker on your brokerage platform and hit the buy button. You can learn more about other Vanguard ETFs from the Vanguard website or a stock market news portal.

What is the ticker for Vanguard Growth ETF?

The stock ticker for the Vanguard Growth ETF is VUG, and it's traded on the New York Stock Exchange (NYSE).