Semiconductor companies design and manufacture computer chips and related components. They are part of the technology sector but are also manufacturing businesses, which means their businesses are cyclical, like any industrial business.

Semiconductor

Picking top-performing semiconductor stocks in the industry can be tricky, and their performance is highly volatile since sales volumes ebb and flow. But the semiconductor sector is growing rapidly as the world enters a digital-first era in the wake of COVID-19. In fact, various estimates -- including from industry giants like Intel (INTC -9.2%) and ASML Holding (ASML 2.04%) -- have predicted annual global spending on semiconductors will reach at least $1 trillion by 2030. Global spending on chips was about $570 billion in 2022, according to the Semiconductor Industry Association.

Clearly, these building blocks of technology deserve investor attention.

Trends

What trends drive semiconductor stocks?

Computer chips have many uses, but up-and-coming semiconductor companies will likely focus on two areas of growth in the decade ahead:

1. Connectivity and mobility

Think 5G mobile networks, autonomous vehicles, and energy efficiency.

2. Computing accelerators

Graphics processing units (GPUs) -- which in the recent past were in demand among video gaming enthusiasts and cryptocurrency miners -- are now needed for data centers as artificial intelligence (AI) is adopted across the economy.

The U.S. accounts for about half of global semiconductor spending, according to the Semiconductor Industry Association. Semiconductor chips are now the nation’s fourth-largest export. With one-fifth of semiconductor manufacturing budgets being spent on research and development, these small hardware components are responsible for many technological advances in other areas of the economy.

The U.S. accounted for almost half of the $570 billion in global semiconductor spending in 2022.

Semiconductor stocks

Best semiconductor stocks to buy in 2023

Here are two top picks for semiconductor industry secular growth trends:

1. Qualcomm

1. Qualcomm

Qualcomm (QCOM 1.45%) is the longtime leader in mobile chip design.

Historically, Qualcomm has been a key Apple (AAPL -0.35%) supplier, having profited from the smartphone boom over the past decade. That era could come to an end in the next couple of years, though, as Apple moves to an in-house chip design for the iPhone and other mobile devices.

The entire smartphone market (including Android) also has matured in recent years. However, Qualcomm has used its connectivity chip know-how to expand into new areas to replace its Apple business and augment a slowing smartphone market, such as the Internet of Things and automotive technology.

Additionally, 5G networks are creating a massive upgrade cycle as telecom companies update their services and consumers buy new smartphones to take advantage of the new network performance. And in response to Apple's M-series chips for the MacBook laptops, Qualcomm has been working with Microsoft (MSFT 1.82%) to answer with its own energy-efficient, powerful processors to compete with Apple's best-in-class silicon.

Qualcomm's long-term growth is particularly tied to increases in connected devices ranging from wearables to "smart" household appliances to connected industrial equipment and vehicles. Profit margins in many of these end markets are even higher than in the older smartphone business.

Qualcomm hasn't been able to avoid some of the sales declines connectivity chipmakers experienced in late 2022 and early 2023 during the bear market. It has nevertheless positioned itself to earn more revenue as mobile networks and automotive technology evolve. With 5G changing the networking landscape, Qualcomm's mobile chip business could be about to get a second wind.

2. Nvidia

2. Nvidia

Nvidia (NVDA 6.18%) is far and away the industry's leading GPU designer. Generative AI (like Microsoft's partnership with ChatGPT creator OpenAI) is all the rage right now, and Nvidia has positioned itself as the platform for all types of AI, putting it in a pole position to pursue new markets and expand revenue.

Nvidia started out designing GPUs for high-end computer game graphics and has been benefiting from the expanding uses of GPUs. The company has also developed an extensive software library and cloud computing platform -- often bundled together with data center hardware for customers to use -- to facilitate the application of its chips to novel uses such as AI, machine learning, and self-driving cars.

As a GPU pioneer, Nvidia has a big head start on designing semiconductors for the AI super cycle. Global spending on AI-centric systems is expected to increase 27% year over year and reach $154 billion in 2023, according to technology research firm IDC. More than just a semiconductor designer, Nvidia is also developing an ever-expanding library of subscription software and services (such as a business AI software platform) built on its powerful hardware. This subscription revenue could eventually help balance the highly cyclical sales of its chips.

Nvidia has been applying its technology to other areas. It completed its acquisition of the data center networking and connectivity company Mellanox in early 2020. Additionally, Nvidia has started using ARM Semiconductor designs to go after other parts of the modern data center, including the release of new central processing units (CPUs) to make further inroads against legacy chip leaders such as Intel.

Semiconductor ETFs

Best semiconductor ETFs to buy right now

If you would rather not select among the stocks of individual companies in the semiconductor industry, you can gain exposure to the more gradual overall growth of the sector by investing in exchange-traded funds (ETFs).

Two top semiconductor ETFs are:

1. iShares Semiconductor ETF

1. iShares Semiconductor ETF

iShares Semiconductor ETF (SOXX 2.11%): The ETF contains 30 chip companies, has an annual expense ratio of 0.35%, and manages $7.7 billion in assets.

2. VanEck Vectors Semiconductor ETF

2. VanEck Vectors Semiconductor ETF

VanEck Vectors Semiconductor ETF (SMH 2.56%): The fund owns 25 stocks encompassing semiconductor chip companies from around the globe. It has an annual expense ratio of 0.35% and manages $8.2 billion in assets.

Undervalued semiconductor stocks

Undervalued semiconductor stocks

When looking for the best chipmakers and long-term undervalued semiconductor stocks to buy, consider these four key factors:

1. Sustainable revenue growth

Companies that gradually increase their sales over time are the best investments, but overall revenue growth matters even more for semiconductor stocks.

Revenue

Many companies in this sector struggle to cope with the industry’s cyclical nature. Hardware, such as PC and laptop chips, tends to become a commodity as the years progress and more advanced chips come out. If a new market is growing quickly, other chipmakers might pile on with similar products. Supply swells, prices fall, and individual company sales decline.

If a semiconductor chip company isn’t constantly innovating and finding new outlets for its hardware tech, weathering the cycle can be unsustainable. That being said, some chip designers are able to protect their work with patents that are not easy to replicate by other means. This can create a type of moat for the company's long-term growth, although it doesn't completely prevent up-and-down sales cycles.

2. Above-average profit margins

Sales need to translate to profits. Companies that cannot control their expenses have low profit margins, and companies with high profit margins have a greater ability to reinvest in research and improve their operations. High gross profit, operating profit, and free cash flow generation are also positive indicators that the company is operating efficiently.

Because of the very high amount of expense needed to get into the semiconductor business, established companies tend to be able to ramp up its profit margins as revenue increases over time.

3. Attractive returns on invested capital

A company’s return on invested capital (ROIC) indicates how well it’s able to generate profit from the cash it raises via debt and equity it receives. A high ROIC means the company is likely innovating strategically, improving operations to increase efficiency, and targeting secular growth trends with new chip designs.

4. Strong balance sheet

Semiconductors are arguable the most complex things ever developed by humankind. Manufacturing chips is very expensive, so it’s especially important to understand how semiconductor companies obtain the necessary financial resources to expand. Take, for example, chip manufacturers such as the world’s largest, Taiwan Semiconductor Manufacturing (TSM 1.26%). For a chip business, the company has above-average debt compared to its revenue. However, it also has more cash and investments than it does debt, which signifies a healthy and profitable business that has no problems getting funding.

A company's balance sheet that has more cash than debt, and low debt relative to operating profit, is a key element to watch. Plenty of cash relative to debt means that a company is well-positioned to pay interest and principal payments, even in a pinch. It also can mean return of excess cash in the form of dividends and stock repurchases.

Related investing topics

Are semiconductors a good investment?

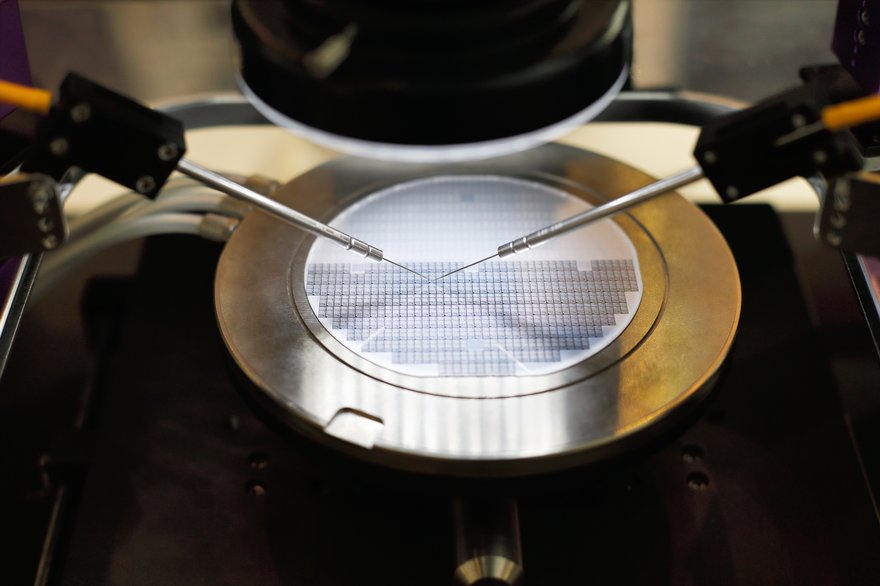

The performance of semiconductor stocks can be unpredictable, and the semiconductor industry is wildly complex. There are hundreds of steps involved in manufacturing the most advanced circuitry, and dozens of players are involved in producing the equipment used to make semiconductor chips.

Shares in even the most promising companies in the industry can be volatile, so investing in top-performing semiconductor stocks requires a willingness to accept a degree of uncertainty. Over the long term, though, investing in these building blocks of technology will likely continue to be a market-beating and profitable investment motif as demand for semiconductor chips continues to rise.

Nicholas Rossolillo has positions in ASML, Apple, Nvidia, and Qualcomm. The Motley Fool has positions in and recommends ASML, Apple, Microsoft, Nvidia, Qualcomm, and Taiwan Semiconductor Manufacturing. The Motley Fool recommends Intel and recommends the following options: long January 2023 $57.50 calls on Intel and long January 2025 $45 calls on Intel. The Motley Fool has a disclosure policy.