Cloud computing boomed during the 2010s, but growth in this next-gen IT industry is still in the early innings. For years, organizations around the globe have been migrating their operations to the cloud -- digital data and services stored within a remote data center and accessed via the internet. However, the rise of remote work during the pandemic accelerated the trend. Now, generative AI has kicked off the next wave of cloud expansion.

Tech researcher Gartner (IT 0.55%) projects that spending on global cloud computing (including data center infrastructure and edge computing) will increase from $250 billion in 2020 to almost $600 billion in 2023 and an estimated $725 billion in 2024.

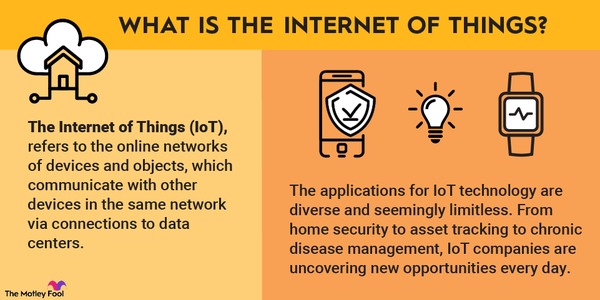

Cloud computing is also closely tied to other tech developments such as mobile 5G networks, the Internet of Things, and artificial intelligence. By the end of the decade, some estimates put total annual global cloud spending at $1 trillion. Cloud computing stocks are a top investment theme for 2021 and the decade ahead.

Investing in the best cloud computing stocks of 2024

Investing in the best cloud computing stocks of 2024

To get started, the best cloud stocks to invest in are the five largest public cloud giants: Amazon (AMZN 3.43%) Web Services (AWS); Microsoft (MSFT 1.82%) Azure; Alphabet (GOOGL 10.22%) (GOOG 9.96%) Google Cloud; Oracle (ORCL 2.02%) Cloud; and IBM (IBM -1.05%) Cloud. Although these companies aren’t pure plays in the cloud industry, all five provide infrastructure and services for organizations undertaking a digital transformation (a phrase that encompasses the migration to cloud-based operations). They have the most complete ecosystems of software and partnerships with third-party software-as-a-service providers.

Beyond those big five, here are seven more focused companies that provide portfolio exposure to the development of the cloud:

Cloud Computing

1. Salesforce

1. Salesforce

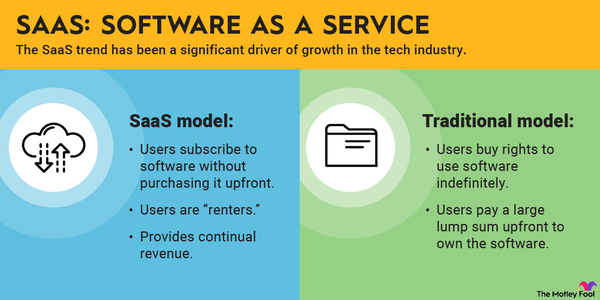

When talking about cloud computing, Salesforce (CRM 0.42%) needs to be part of the conversation. The customer relationship management (CRM) specialist was a pioneer of software that uses cloud technology starting in the late 1990s. Salesforce has since branched out to other areas of enterprise software via organic growth and a steady stream of acquisitions.

Salesforce’s takeover of remote work and collaboration tool Slack put it on a collision course with Microsoft’s Teams collaboration suite. Today, Salesforce offers a complete suite of software aimed at helping business teams manage data and get work done efficiently.

Due to its success in becoming a full-blown tech platform for businesses of all types and sizes, Salesforce is also a top way to play smaller cloud upstarts. It regularly invests in or acquires stakes in smaller cloud peers -- such as when it invested in Snowflake (SNOW 3.69%) before its initial public offering (IPO) in 2020 (and sold it for a profit in 2021). It also acquired a stake in hot IPO Monday.com (MNDY 2.81%).

Salesforce did fall on hard times in 2022 and faced activist investor pressure to boost profit margins. Founder and CEO Marc Benioff and the top team have made progress, though, and hope to become the world’s largest and most profitable enterprise software company within the next few years.

2. Adobe

2. Adobe

Software company Adobe (ADBE 0.87%) got its start in an IT era that predates both the cloud and the internet. But it has transformed itself into a leader in cloud services by adapting its large and expanding platform to the cloud era. Adobe’s core competencies in providing creativity software and document editing have made it a staple of digital transformation.

Although it isn’t a serial acquirer like Salesforce, Adobe has made some big moves to round out its software suite. In 2018, it acquired small firms Marketo and Magento to bolster its position as a partner for e-commerce companies. In late 2020, it purchased Workfront to add workflow and project management solutions to its arsenal. Most recently, Adobe announced its intent to acquire fast-growing work collaboration software upstart Figma.

As a creative software specialist, Adobe is also well suited to tackle the new generative artificial intelligence (AI) era. Its work with top chip designer Nvidia (NVDA 6.18%) helped it quickly release its Firefly suite of apps aimed at helping creatives increase their image and video creation, as well as expanding editing capabilities.

Paired with the organic growth that Adobe’s legacy offerings still generate, this firm is a top free cash flow generator in the cloud industry. It deserves consideration as a core portfolio holding.

3. Snowflake

3. Snowflake

The cloud increases a company's flexibility, often unlocks cost savings, and helps them get more done with the data they have on their operations and customers. However, with the adoption of the cloud comes an explosion of digital data and new security risk considerations. Managing that data is a complex task.

That's where Snowflake comes in. It hit the public markets in 2020 with incredible fanfare due to its triple-digit-percentage revenue growth. The stock has fallen since then, and revenue growth has moderated a bit, but Snowflake is now much more reasonably valued.

Snowflake is an important business that has pioneered new ways for businesses to store, migrate, and process massive amounts of digital information. It continued to expand at a rapid pace even during the bear market of 2022 and despite fears of a recession in 2023. It also began turning a healthy profit, as measured by free cash flow.

Snowflake is a young company, though, and the stock will likely be highly volatile for some time. It's all about growth for this business right now, and even small changes in management's expectations can cause some wild fluctuations in share price. Snowflake could, nevertheless, be a very promising investment for the long term.

4. Zoom Video Communications

4. Zoom Video Communications

Few companies have skyrocketed out of obscurity and into household name status as quickly as Zoom (ZM 1.57%). The videoconferencing service became a staple during the pandemic by helping family members and business teams stay in touch from afar (as it turns out, many pre-pandemic in-person meetings weren’t all that necessary after all). Zoom is poised to continue as a basic necessity of corporate communications services for a long time.

Zoom is eyeing a bigger piece of the massive global telecom industry by going after large business communications accounts. Zoom Phone accounts, a service for transferring calls across different devices, has steadily grown for years. Zoom's contact center services to manage inbound calls and customer contact have also remained a key growth initiative.

However, in the wake of the pandemic, Zoom has struggled as many individual and small business subscribers canceled their service. The company is still benefiting from changes in communications, but it's no longer a growth company. Zoom's top priority now is managing modest revenue expansion while figuring out how to steadily increase earnings for shareholders.

Artificial Intelligence

5. ServiceNow

5. ServiceNow

There are greater complexities involved in managing big cloud computing infrastructure, but the cloud also offers the ability to continuously streamline and automate operations. That's ServiceNow's (NOW 1.02%) software specialty.

Be it digital customer experiences, employee workflow management, or software development, ServiceNow enables companies to find chokepoints in their operations. Once finding these pain points, ServiceNow can help suggest and automate fixes.

In a new era of AI, ServiceNow could be a big winner. It's using Nvidia hardware to make automation even better and even landed Nvidia as a bigger customer using automation software that Nvidia is helping ServiceNow to create. With challenges like labor shortages persisting following the pandemic, ServiceNow is primed to keep growing.

In addition to steady growth, ServiceNow also recently turned profitable by all metrics. This could be a great stock holding for the next decade and beyond as the cloud infiltrates more of the world's corporate operations.

6. The Trade Desk

6. The Trade Desk

Netflix (NFLX -0.63%) made streaming TV from the cloud an everyday staple. Lots of new internet-based services have come to market in the past couple of years. This has been a boon for digital advertising technologists such as The Trade Desk (TTD 1.67%), a cloud-based offering that helps marketers automate the purchase of digital advertising (known as programmatic advertising).

Digital ads are dominated by the likes of Google and Meta Platforms (NASDAQ:FB) (Facebook, Instagram, and WhatsApp), but The Trade Desk’s cloud-based marketing management tools have won over lots of users. It now ranks as the largest independent digital ad management software company.

Despite massive internet growth in the past decade, just over half of marketing spending takes place in a digital format. Digital ads will continue to be a fast-growing industry in the next decade -- especially in at-home entertainment as TV and movies move to an on-demand internet streaming format.

In the coming years, streaming services will pick up millions of new household subscribers and account for billions of additional hours spent viewing content. That creates a huge opportunity for The Trade Desk as it manages connected TV advertising activity. Still a small company in a global marketing industry approaching $1 trillion annually and growing, the sky’s the limit for The Trade Desk.

7. DigitalOcean

7. DigitalOcean

DigitalOcean (NASDAQ:DOCN) is a fresh face in the cloud computing space. It completed its public offering of stock in early 2021. It’s a public cloud infrastructure and software provider similar to Amazon’s AWS, Microsoft Azure, and Google Cloud. While the big three are focusing their attention on large enterprises, DigitalOcean is aiming at the massive but underserved small business and start-up community.

This is a lucrative niche. Most IT innovations are developed for and funded by large organizations. Yet small businesses still make up about half of the global economy’s production. Most are far behind the curve in making needed digital transformation. That’s where DigitalOcean comes in, providing a full range of affordable services to help small companies find their way in the new cloud era.

Besides offering cloud infrastructure for small businesses to test and host web-based services and apps, it also offers services for the non-tech-savvy outfit. It acquired a company called Cloudways that offers website building and hosting.

Despite its tiny size, DigitalOcean is an efficient operation. It generates healthy and growing free cash flow and is on a path to reach GAAP profitability very soon. This could be a quality small- to mid-cap stock worth investing in for the long haul.

Investing in cloud ETFs

Investing in cloud ETFs

For investors not interested in attempting to pick the best cloud stocks, exchange-traded funds (ETFs) are also an option. The First Trust Cloud Computing ETF (SKYY 1.5%) is the largest cloud ETF around, with about $2.9 billion in assets under management. The fund is a basket of 64 cloud infrastructure and software stocks. It has an ETF expense ratio of 0.6%, meaning it costs $6 per year for every $1,000 invested.

A more recent arrival is the Global X Cloud Computing ETF (CLOU 1.13%). Since the fund launched in early 2019, GlobalX’s cloud ETF has narrowly outperformed First Trust’s offering due to its focus on just 34 stocks, most of which are software companies. The fund is smaller, with slightly more than $600 million in assets under management. It has a slightly higher annual expense ratio of 0.68%.

Related investing topics

Cloud computing is a long-term growth trend

Cloud computing is a long-term growth trend

Cloud computing picked up steam during the COVID-19 pandemic and has remained an enduring growth story even during the bear market. More efficient than legacy IT, it enhances technology such as artificial intelligence (AI), and machine learning, and gaming. It gives organizations and their employees more flexibility with important functions such as remote work. The cloud is quickly becoming the basic infrastructure of the future.

As is the case with all high-growth stocks, though, investing in cloud companies will have bumps in the road. Investors should stay focused on the long-term potential, not just stock price performance over the course of a year or two. This long-term secular growth trend is poised to remain intact for the next decade and beyond. Cloud stocks should be a top investment priority in 2024.