Artificial intelligence is everywhere, and GPU stocks are a great way to invest in the transformative technology. GPUs, or graphics processing units, were introduced decades ago to handle the computationally intensive task of putting graphics on a computer screen. The math necessary to calculate the color of millions of pixels can quickly overwhelm a CPU, or central processing unit. GPUs are designed to do these calculations in parallel, using hardware designed for the task.

The number crunching that must be done to train and use AI models can also be accelerated with GPUs. While gaming remains a key growth driver for the industry, AI may end up being more important in the long run.

What are GPU stocks?

What are GPU stocks?

GPU companies design semiconductor chips that feature a large number of cores capable of chewing through certain types of computational workloads. Personal computers, smartphones, gaming consoles, and anything that displays images on a screen ultimately have a GPU working behind the scenes.

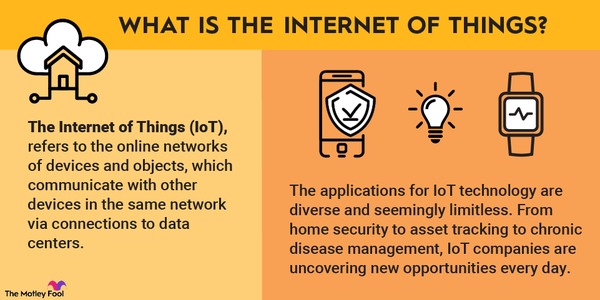

In recent years, GPUs have found uses outside of graphics. In data centers, GPUs can be used to accelerate any task that can be effectively split up into chunks. This includes scientific simulations, data analytics, AI training, and AI inference.

Gaming is a huge industry that can drive growth for GPU companies in the long run, but artificial intelligence (AI) may be a bigger opportunity. Advanced large language models like ChatGPT from OpenAI require so much memory and computing power to train and run that clusters of ultra-powerful GPUs are necessary. Cloud computing providers are scooping up GPUs to offer AI services. Tech giant Microsoft (MSFT 1.82%) sees its AI cloud services revenue growing to $10 billion.

With demand for GPUs soaring, there are a few GPU stocks that could deliver market-beating returns for investors.

Three top GPU stocks with sky-high potential

Three top GPU stocks with sky-high potential

There are plenty of companies that design GPUs in one way or another, but there are only three that can tap into the booming demand for AI chips:

| Company | Market capitalization | Revenue (2022) |

|---|---|---|

| Nvidia (NASDAQ:NVDA) | $1.21 trillion | $27.0 billion |

| Advanced Micro Devices (NASDAQ:AMD) | $180.5 billion | $23.6 billion |

| Intel (NASDAQ:INTC) | $137.2 billion | $63.1 billion |

1. Nvidia

1. Nvidia

Nvidia is the premier GPU stock. The company has long dominated the market for gaming GPUs, particularly at the high end, where gamers are willing to pay sky-high prices to get the absolute best performance.

Nvidia’s most recent family of gaming GPUs is the RTX 4000 series. One reason why Nvidia has been able to maintain its lead is the work it’s done in bringing advanced features like AI and ray tracing to its gaming graphics cards. Nvidia's Deep Learning Super Sampling feature uses AI to create additional frames on the fly and intelligently upscale frames to higher resolutions. The result is dramatically higher frame rates.

Gaming is an important business for Nvidia. In the first quarter of fiscal 2024, the gaming segment generated $2.2 billion of revenue for the GPU giant. However, the data center business has grown in importance over the years, and it’s now the largest segment for Nvidia. Data center revenue reached $4.3 billion in the quarter, and demand for AI will drive it even higher.

Nvidia's AI-centric GPUs are incredibly powerful and incredibly expensive. The new H100 GPU has been selling for more than $40,000 each as businesses race to deploy AI technology. For the most demanding AI workloads, thousands of these GPUs must be linked together to churn through the incredible amount of data necessary to train an AI model.

Nvidia's market capitalization has soared past $1 trillion as excitement over AI reaches a fever pitch. While the stock is just as expensive as the company’s GPUs, Nvidia is the best-positioned GPU company to tap into the demand for AI chips.

2. Advanced Micro Devices

2. Advanced Micro Devices

AMD is the distant No. 2 player in the discrete graphics card market. The company’s latest gaming graphics cards, the RX 7000 series, have done little to change that.

AMD is competitive with Nvidia in the low-end and mid-range portions of the gaming graphics card market, but the company has difficulty competing at high price points. The company’s priciest graphics cards are powerful, but AMD has fallen behind in terms of advanced features like ray tracing. Even Intel, which only entered the discrete graphics card market last year, has pulled ahead in ray tracing performance, providing better lighting effects for video games and other applications.

Outside of PC graphics cards, AMD’s semi-custom chips power both the PlayStation 5 and the latest Xbox game consoles. In each case, AMD pairs its CPU cores with a powerful GPU on a single chip. While AMD’s PC-centric businesses struggled in early 2023 as demand for PCs plunged, the semi-custom business fared much better.

AMD is aiming to catch up to Nvidia in the AI GPU market, but it will be a long road ahead. The company unveiled its power-hungry MI300X GPU in June, which features a whopping 192GB of high-bandwidth memory and AMD’s latest graphics architecture. The chip is squarely aimed at generative AI workloads, like training powerful large language models. Unfortunately for AMD, Nvidia has a years-long head start building a software ecosystem around its AI GPUs.

Even with AMD playing the role of perpetual second fiddle to Nvidia in the GPU market, demand for AI chips may be strong enough to fuel solid growth in AMD’s GPU business.

3. Intel

3. Intel

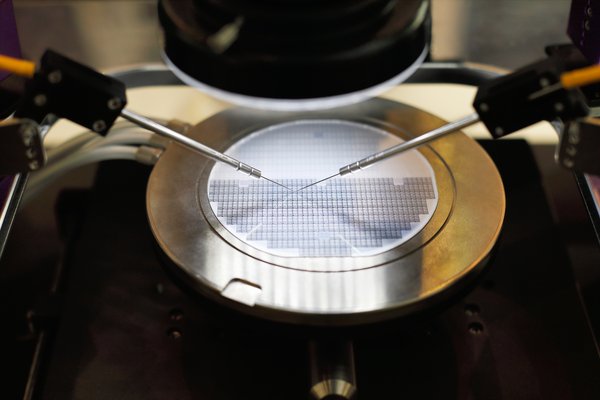

Semiconductor

Semiconductor giant Intel has been in the GPU business for a very long time, although it’s only recently branched out into discrete GPUs. Many of Intel’s PC CPUs feature integrated graphics, and if you include those GPUs in the tally, Intel is by far the market leader in terms of units. More than two-thirds of all PC GPUs, integrated and discrete, come from Intel.

In late 2022, Intel officially entered the discrete GPU market by launching its first-generation Arc graphics card products. Although early software driver bugs hindered sales, the company has been methodically improving those drivers and boosting performance across a wide range of games. Intel’s Arc graphics cards focus on mainstream price points, and they now deliver some impressive performance per dollar.

Intel also offers GPUs for data center applications, including AI workloads. The Intel Data Center GPU Max 1550, which launched in early 2023, is an AI powerhouse. The Aurora supercomputer at the Argonne National Laboratory features Intel’s latest Sapphire Rapids CPUs, along with more than 60,000 of its data center GPUs.

Intel faces the same challenge as AMD in the AI GPU market: Nvidia's hardware and software have become de facto standards. The good news for Intel is that it has a second way to tap into the booming demand for GPUs. The company is investing tens of billions of dollars in building out its own foundry business that will manufacture advanced chips for customers. As Intel rapidly brings new process nodes to volume production, Nvidia and AMD may eventually see Intel as a viable manufacturing partner for their own GPUs.

Exchange-Traded Fund (ETF)

There are also GPU ETFs

There are also GPU ETFs

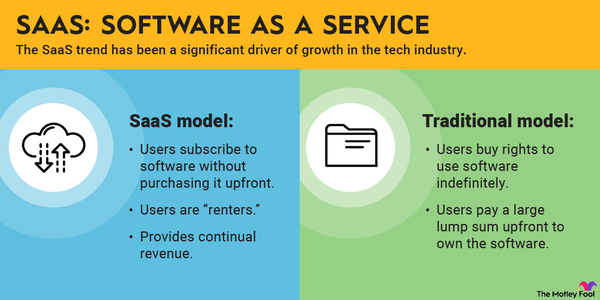

While there aren’t any exchange-traded funds focused solely on GPUs, there are some options that put GPU stocks front and center. These ETFs are focused on the tech sector, although they're weighted toward GPU stocks.

The VanEck Semiconductor (SMH 2.56%) ETF invests in the top 25 global semiconductor companies. Because Nvidia's market value has exploded, the GPU stock makes up a significant chunk of this fund. As of June 20, Nvidia accounted for almost 20% of the fund’s total assets, while AMD and Intel each accounted for a bit less than 5% of assets.

If you’re looking for something more diversified but still focused on cutting-edge technologies, the iShares Exponential Technologies (XT 1.06%) ETF may be a better option. The ETF holds nearly 200 distinct stocks, but GPUs are well represented. Nvidia was the top holding as of June 20, and AMD was No. 8.

While some investors may want to bet directly on GPU stocks, those with a lower risk tolerance should consider these GPU-heavy ETFs.

Related investing topics

Should you invest in GPU companies?

Should you invest in GPU companies?

The AI revolution is already driving demand for the most advanced GPUs into the stratosphere, and it appears that this demand is here to stay. One thing to be aware of, though, is that GPUs aren’t the only option for accelerating AI workloads. Specialized chips known as Application-Specific Integrated Circuits (ASICs) are built at the hardware level for a specific set of tasks, and they can provide significant performance and efficiency gains over more general GPUs.

Despite this threat, GPUs have become the standard way to train and run AI models, and that’s unlikely to change overnight. There are many ways to invest in AI, but for investors looking for a “pick-and-shovel” option, GPU stocks are a good bet.

FAQs about GPU investments

FAQs about GPU investments

What is a GPU in the stock market?

A GPU is a graphics processing unit, a specialized type of semiconductor chip used for graphics and AI tasks.

Should I invest in GPUs or CPUs?

Both GPUs and CPUs are necessary components of any PC or server, although the demand for GPUs is especially strong as companies adopt AI technology.

What is the biggest GPU company?

Nvidia is the largest GPU by market cap. The company is valued at more than $1 trillion.

Which GPU company is best?

Nvidia appears to be benefiting the most from the sky-high demand for GPUs capable of running AI workloads.