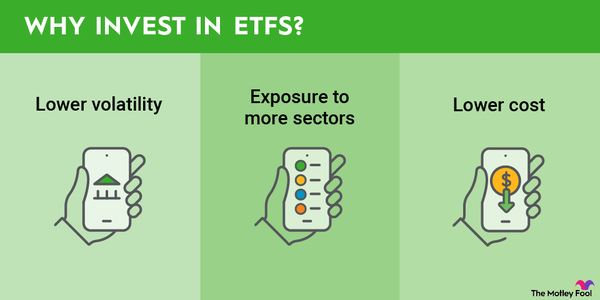

Dividend stocks are one of the most underappreciated ways to build wealth. Whether you're looking to create a steady stream of dependable income, own the best companies that will gain in value (increasing the stock price along the way), or some combination of both, dividend stocks can help you accomplish those goals. The hard part is often picking the best individual dividend stocks to buy. This is where dividend ETFs can come to the rescue. ETFs, or exchange-traded funds, are funds that allow investors to buy entire groups of stocks all at one time.

ETFs are a great way to gain exposure to a specific idea. This can include entire indexes like the S&P 500, individual sectors (such as healthcare or tech stocks), or even specific characteristics such as dividend-paying stocks. When you buy shares of an ETF, you buy a tiny piece of all of the stocks that are included in the fund, creating instant diversification and a customized stock portfolio built to meet your financial goals.

Finding the best ETF for your goals

Finding the best dividend ETF for your goals

There are a lot of ETFs that pay dividends and a select group that is built around specific dividend-stock characteristics. So, as a starting point to finding the best dividend ETFs for you, it's important to outline what you're trying to accomplish.

In the following sections, we will review four top dividend ETFs, each with different characteristics. Whether you're looking for a high dividend yield, dividend growth, stability with income, or the best total returns, there's something for every dividend ETF investor.

1 - 2

Two of the best dividend growth ETFs

When companies earn a profit, they have three things they can do.

- Reinvest it in the business to increase profits even more.

- Keep it for a future need or opportunity.

- Return it to investors (dividends or share buybacks).

History has shown us that the companies with the strongest economic moats generate so much profit that they always end up with a little bit extra every year to return to shareholders in dividends and grow the payout (almost) every year. These dividend growth stocks are the cream that rises to the top.

Two of our top dividend ETFs for this year focus on dividend growth: The Vanguard Dividend Appreciation ETF (VIG -0.2%) and iShares Core Dividend Growth ETF (DGRO 0.16%).

Let's start with the Vanguard Dividend Appreciation ETF, the flagship dividend fund operated by industry behemoth Vanguard. The fund, which tracks the S&P U.S. Dividend Growers Index -- U.S. stocks with 10 or more years of dividend growth -- is also one of the lowest-cost, with a minuscule expense ratio of 0.06%, or six cents for every $100 invested. It's also one of the lower-yielding dividend ETFs, with a yield of around 1.6% at market price in late 2024.

But what the Vanguard fund may lack in yield, it more than makes up for in dividend growth. Over the trailing-10-year period, the ETF has increased the dividends it passed along to investors by more than 80% and delivered a total return of around 200%. It has trailed the wider S&P 500 index in total returns over the same period, when non-dividend-paying growth stocks were the market's biggest winners.

However, as rising interest rates have lowered tech and growth stock valuations in recent years, the gap has narrowed. While interest rates are slowly but surely coming down, dividend ETFs like this one can still provide a steady form of income generation and portfolio growth moving forward.

The iShares Core Dividend Growth ETF is another attractive choice for dividend growth. The ETF, managed by BlackRock (BLK 1.48%), offers a similar low-cost structure with an expense ratio of 0.08% and a roughly 2.2% dividend yield that's slightly higher but still not a high yield.

The iShares ETF, which tracks the Morningstar US Dividend Growth Index, has been a similar, if not slightly higher, performer than the Vanguard fund when looking at its total return in the last decade. Over the past 10 years, it has generated a total return of about 210%, compared to the S&P 500's roughly 260% return in that time frame. There's no reason to think that it can't continue this superior performance.

3 - 4

Schwab U.S. Dividend Equity ETF

If you're looking for a higher yield, the Schwab U.S. Dividend Equity ETF (SCHD -0.07%) and its 3.7% yield at recent prices might be more compelling. The nice thing about this dividend ETF is that there's even more to like than just a juicy yield.

Like the previous two ETFs, it has a relatively low expense ratio of 0.06% and a long record of dividend growth in most years. It also focuses on U.S. companies, many with long records of dividend growth.

However, there are some key differences in the companies it targets. The ETF tracks the Dow Jones U.S. Dividend 100 Index, which, according to S&P Global, looks for "high-dividend-yielding stocks in the U.S. with a record of consistently paying dividends, selected for fundamental strength relative to their peers, based on financial ratios."

The key criteria are financial strength, a high yield, and a history of paying -- not necessarily increasing -- a dividend. As a result, perfectly good companies that lower dividends for temporary reasons or don't raise a dividend from one year to the next get excluded or dropped from dividend-growth ETFs, while they can remain part of the Dividend 100 Index and, by extension, this ETF.

The strategy has paid off well over the long term. Since the fund's inception in 2011, the Schwab U.S. Dividend Equity ETF has generated a total return of more than 400%. It's likely that the same factors that have helped it deliver strong returns will keep it a winner in the future.

So, whether it's an above-average yield or strong total returns you're after, the Schwab US Dividend Equity ETF is worth a close look.

Related investing topics

Is energy back for good? If so, this sector ETF is attractive for dividends.

For much of the past decade, energy stocks have been poor performers. When oil prices fell from the $100-plus range in 2014, the industry went through a protracted downturn that resulted in billions of dollars in investor losses, as oil companies had to adjust their operating model to a lower-cost, lower-capital environment. The 2020 COVID-19 pandemic came in like a second hammer, forcing many companies through an existential crisis where only the strongest survived.

The economic recovery and subsequent Russian invasion of Ukraine have resulted in a massive recovery in the energy sector, making this sector one of the best investments over the past few years.

That's been incredible for dividend investors since most of the biggest and strongest energy companies pay very generous dividends that are well-protected by their cash flows and strong operations, making the Energy Select Sector SPDR ETF (XLE -0.69%) increasingly appealing for dividend investors.

Slightly more expensive than the other ETFs we have discussed, the Energy Select Sector SPDR expense ratio is 0.09%, but its yield of almost 4% is one of the highest in the group.

Maybe most important is the makeup of its holdings, the majority of which are companies like ExxonMobil (XOM -0.12%), Chevron (CVX -0.23%), Marathon Petroleum (MPC -1.16%), and EOG Resources (EOG -1.03%).

One caveat for this sector ETF: While the yield is high now, and most of the dividends are likely to remain steady and strong, a significant and protracted downturn in oil prices could lead to dividend cuts for the oil producers that pay a variable dividend.

The ETF is also likely to be the most volatile; the stock prices of many of these companies tend to move up and down with oil prices. If you're looking for less volatility, this may not be the right ETF for you.

But if your focus is generally high dividends with some short-term risk and more volatility in the share prices, the Energy Select Sector SPDR could be the biggest winner of the bunch.

FAQ

Best Dividend ETFs of 2024 FAQ

What is the best high-dividend ETF?

There are numerous ETFs that pay generous dividends to investors with enviable yields. The Schwab U.S. Dividend Equity ETF and the Energy Select Sector SPDR ETF both have above-average yields of more than 3%, compared to the S&P 500's 1.2% yield.

What is the downside of a dividend ETF?

Not all investments will be the right fit for all investors, but dividend ETFs can be a great addition to a wide range of portfolios. Ultimately, it's important to understand your investment goals, risk tolerance, and investment preferences before you buy shares of any stock or ETF.

What is the best Vanguard ETF for dividends?

Vanguard is known for a wide variety of ETFs focused on dividend stocks. One that is definitely worth considering is the Vanguard Dividend Appreciation ETF, the flagship dividend fund operated by industry giant Vanguard.