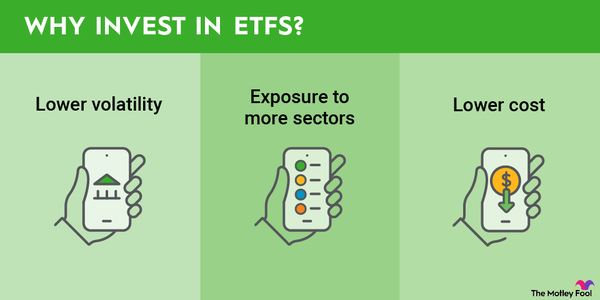

Cathie Wood's stock picks receive considerable scrutiny, but investors are also acutely focused on the exchange-traded funds (ETFs) that Ark Invest manages, such as the ARK Space Exploration & Innovation ETF (ARKX 1.31%).

Launched in March 2021, the ARK Space Exploration & Innovation ETF is an ideal opportunity for investors looking to benefit from the burgeoning space economy. The consulting firm McKinsey projects that the space economy could soar from $630 billion in 2023 to $1.8 trillion by 2035.

Exchange-Traded Fund (ETF)

What is it?

What is ARK Space Exploration & Innovation ETF?

One of several ETFs under the umbrella of Ark Invest's products, the ARK Space Exploration & Innovation ETF is focused on providing exposure to companies operating in the final frontier. According to Ark Invest, the fund "seeks to provide exposure to companies involved in space-related businesses like reusable rockets, satellites, drones, and other orbital and sub-orbital aircrafts."

Operating in space is no small feat, so almost all the companies represented in the ETF are associated with advanced technologies. About 32% of the stocks in the ETF, for example, are leaders in autonomous mobility (the largest sort of tech in the fund), followed by intelligent devices and advanced battery technologies, representing 16% and 15%, respectively.

Large-cap stocks (defined by Ark Invest as those with market capitalizations of $10 billion to $100 billion) are the most common type found in the ETF, representing 42% of the portfolio. Medium-cap stocks (market caps of $2 billion to $10 billion) and mega-caps (market caps with more than $100 billion) are the next most common. Medium caps represent 34%, while mega caps represent 18% of the ETF.

Although the ETF includes both telecommunications and consumer discretionary stocks, industrials and information technology stocks account for most of the ETF, representing 57% and 25%, respectively.

How to buy

How to buy ARK Space Exploration & Innovation ETF

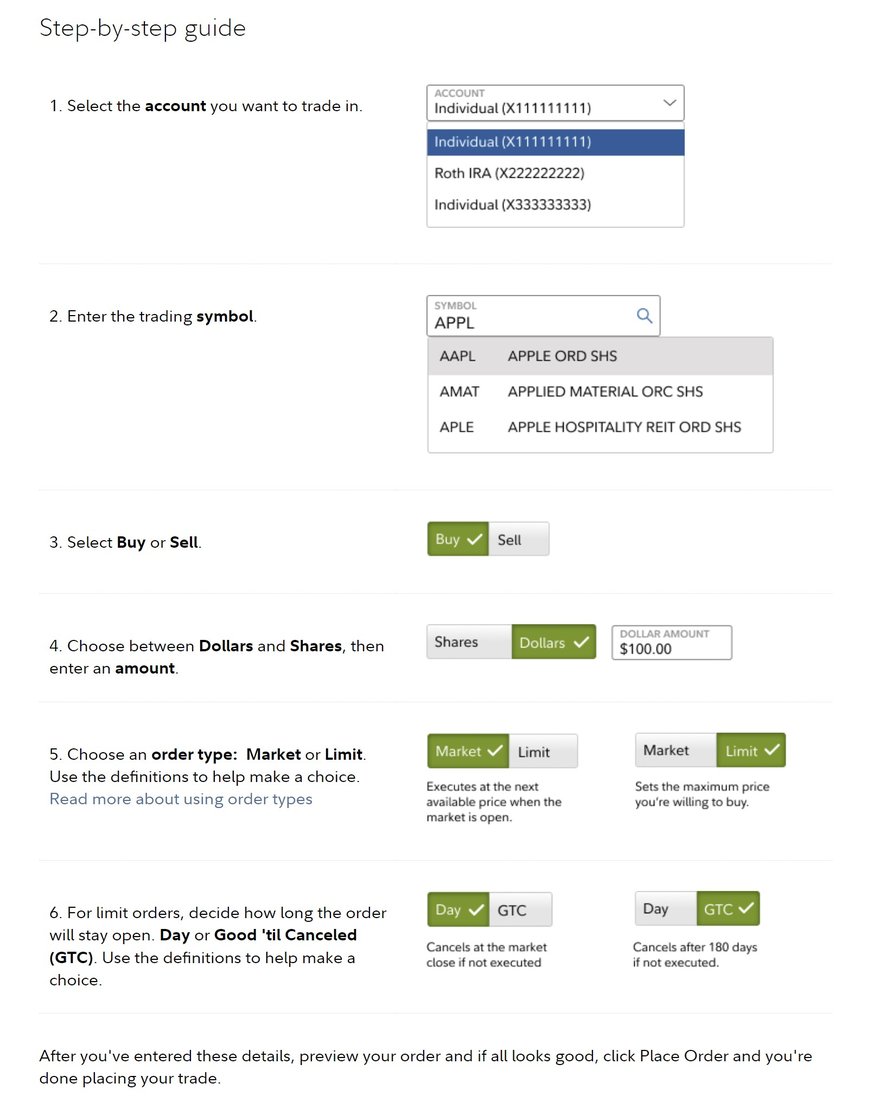

Whether you have or haven't taken flight with an ETF investment, there are some elementary steps to gain exposure to ARK Space Exploration & Innovation ETF, which trades under the stock ticker ARKX.

- Open your brokerage app: Log into your brokerage account where you handle your investments.

- Search for the stock: Enter the ticker or company name into the search bar to bring up the stock's trading page.

- Decide how many shares to buy: Consider your investment goals and how much of your portfolio you want to allocate to this stock.

- Select order type: Choose between a market order to buy at the current price or a limit order to specify the maximum price you're willing to pay.

- Submit your order: Confirm the details and submit your buy order.

- Review your purchase: Check your portfolio to ensure your order was filled as expected and adjust your investment strategy accordingly.

Holdings

Holdings of ARK Space Exploration & Innovation ETF

As of January 2025, this Ark ETF had 32 holdings in the fund -- around the usual 35 to 55 holdings. The top 10 holdings in the fund reflect a variety of businesses, while the top three positions made up more than 27% of the ETF's holdings.

A leading space stock, Rocket Lab (RKLB -0.11%) was the largest holding in the ETF, with a 10.1% weighting, followed by Kratos Defense & Security (KTOS 3.07%), a leading drone stock also specializes in developing drones and a notable defense contractor. Satellite company Iridium Communications (IRDM 0.89%) was the third-largest position, with an 8.5% weighting.

The fourth-largest holding in this Ark ETF was air taxi stock Archer Aviation (ACHR 1.55%), with a 7.5% weighting. Additionally, Archer Aviation appears in another Ark Invest fund: the ARK Autonomous Technology & Robotics ETF (ARKQ 1.15%), the fifth-largest holding.

Providing automation solutions for the semiconductor industry, Teradyne (TER -1.38%) represented the fifth-largest holding, with a 6.6% weighting, while positioning technology stock Trimble (TRMB 1.21%) was the sixth-largest position, with a 6.1% weighting.

Should I invest?

Should I invest in ARK Space Exploration & Innovation ETF?

There's no answer as to whether the ARK Space Exploration & Innovation ETF is a smart investment for every investor. The best ETF choice for some people may be a poor selection for others. But there are some factors investors can consider to help decide whether the ARK Space Exploration & Innovation ETF is right for them.

For one, the Ark Invest ETF is a smart choice for those eager to gain exposure to a growth industry. The space economy is expected to grow considerably in the coming years. Consequently, the space-focused ETF could be a smart choice for investors with longer investing horizons and the patience to let the space economy develop.

Another consideration is the amount of risk investors are willing to accept. Investing in a single space stock could be a speculative investment that ends up earthbound instead of soaring through the stratosphere. Choosing an ETF with 32 holdings, on the other hand, helps to mitigate the risk of a single space stock failing to launch.

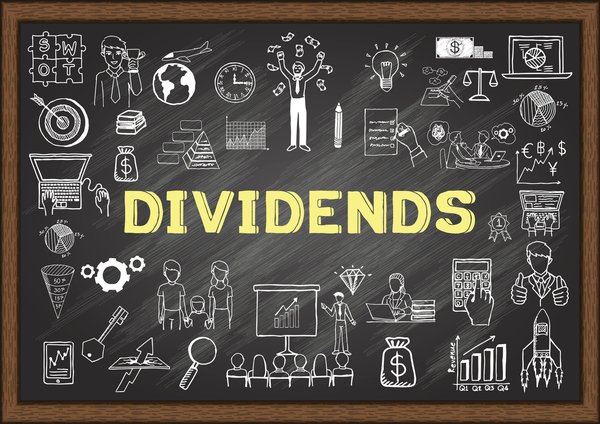

Investors often look to ETFs as another way to supplement passive income streams. Currently, this ETF doesn't provide investors with a distribution, so if collecting dividends is at the top of your priority list, it is not right for you.

Dividends

Does ARK Space Exploration & Innovation ETF pay a dividend?

Investors looking to boost their passive income streams with a dividend ETF will have to look elsewhere since the ARK Space Exploration & Innovation ETF didn't pay a dividend as of January 2025. In fact, investors committed to a Cathie Wood-backed ETF will find that they're out of luck since Ark Invest ETFs don't pay dividends.

Expense ratio

What is ARK Space Exploration & Innovation ETF's expense ratio?

It may not cost as much as a contract to launch into space with Rocket Lab, but owning the ARK Space Exploration & Innovation ETF will cost you. Like all the actively managed Ark Invest funds -- except the ARK Next Generation ETF (ARKW 1.21%), which has a 0.82% expense ratio -- the ARK Space Exploration & Innovation ETF has a 0.75% expense ratio. So, on a $10,000 investment, for example, you'll pay $75 annually in fees.

Whether you're considering an ETF or a mutual fund (or another investment vehicle), it's always important to be mindful of the fees you may be charged. Investors want to maximize the returns on their investments, and investments with high expense ratios can cut into some of the profits you may generate from your investments.

Expense Ratio

Historical record

Historical performance of ARK Space Exploration & Innovation ETF

Unlike some ETFs that seek to match the performance of a certain index -- one tied to a sector or otherwise -- this ETF states that it has the broad goal of "long-term growth of capital." To assess the degree to which the ETF has met this goal, we can use the S&P 500 as a yardstick.

It's important to remember, though, that the ARK Space Exploration & Innovation ETF only launched in March 2021, so there isn't a lengthy history to consider.

| Fund | 1-Year | 3-Year |

|---|---|---|

| ARK Space Exploration & Innovation ETF | 41.4% | 31% |

| S&P 500 Index | 23.2% | 37% |

Related investing topics

The bottom line

The bottom line on ARK Space Exploration & Innovation ETF

Although several aerospace ETFs provide exposure to stocks associated with the wild blue yonder, the ARK Space Exploration & Innovation ETF is the only one exclusively focused on companies that operate above the clouds. While the ETF's performance has provided much to celebrate, the prospect of a booming space economy in the coming years certainly makes it something for patient growth investors to give careful consideration.

FAQs

Investing in ARK Space Exploration & Innovation ETF FAQs

How can you invest in the ARK Space Exploration & Innovation ETF (ARKX)?

Investors can buy the ARK Space Exploration & Innovation ETF (ARKX) through online brokerage accounts or other investment platforms.

Can anyone invest in Ark?

If you're an investor with a brokerage account, you should be able to invest in Ark funds. There aren't strict requirements to invest, unlike those for private companies, where you must be an accredited investor to buy shares.

Where to buy Ark funds?

Ark funds can be purchased through most online stock brokerages or other investment platforms.

What is the stock symbol for ARK Innovation?

The ARK Innovation ETF trades under the stock ticker ARKK.

Scott Levine has no position in any of the stocks mentioned. The Motley Fool recommends Rocket Lab USA, Teradyne, and Trimble. The Motley Fool has a disclosure policy.