Congratulations! You defied astronomical odds to win a multimillion-dollar lottery prize. And now, having become suddenly rich (or richer), it's time to answer a very important question: What do you do with your newfound wealth?

Playing the lottery is more about paying to dream than planning for a lifetime of wealth. The largest lottery prize in U.S. history, which amounted to more than $2 billion, was won by a single person in California who defied 292.1 million-to-1 odds. So, let's face it: Playing the lottery and expecting a massive payout is an exercise done by poor math students. But let's say you defy the odds. What do you do if you win the lottery? Read on to find out.

Investing options

Where to invest your lottery winnings

For most of us, a lottery jackpot will involve more money than we can ever spend (even though you might like to try). The money has to go somewhere, even after a new house or two, cars, and vacations have been purchased. Here are a few ideas to put your money where it will be safe and ensure multigenerational wealth for your descendants.

Savings accounts

You might have had a savings account when you were younger, but a lottery jackpot will take you to an entirely different level. A high-yield savings account can be an excellent place to keep your money safe and still working for you.

Advantages of a high-yield account include:

- A higher-than-average annual percentage yield (APY).

- Compound interest.

- Relatively low fees.

- Liquidity that makes it easy to withdraw money.

You will also have the Federal Deposit Insurance Corp.'s promise to reimburse people as much as $250,000 per deposit per institution in case of a bank failure. Of course, that's also a downside -- if you've won the lottery, chances are good that you'll have to spread your money across multiple banks to keep from going over the FDIC limit.

Other downsides include withdrawal limits and fluctuating interest rates, which can cause your savings to dwindle when inflation climbs.

Bonds

Lending money can be profitable, and bonds can be a safe and effective way to make your new wealth work for you. When you buy a bond, you're basically loaning money to a government or a business, and they're paying you interest to use your money. The biggest advantages of bonds are:

- They provide you with a predictable and steady source of income.

- They let you keep your capital safe since you get the full loan amount returned when a bond matures.

- They ensure you have a diversified portfolio.

Disadvantages include:

- A higher degree of risk for speculative "junk bonds" that promise high yields but may wind up being worthless.

- Value shrinks when interest rates rise.

- Smaller returns than other investments such as stocks.

Bonds

Funds

A mutual fund can be an excellent source of portfolio diversification. It allows investors to pool money into a professionally managed fund that often spreads the money across a number of different assets that can include stocks, bonds, money market funds, and other potential sources of income.

The pros of mutual funds include:

- Instant diversification.

- Professional management.

- The ability to "set it and forget it."

Cons include:

- Fees, which can be significant.

- A lack of control over your money.

- Difficulty in assessing potential funds since past performance is no guarantee of future returns.

Stocks

One of the best ways to make a small fortune in the stock market is to start with a large fortune and a short-term mentality. As the saying goes, it's better to have time in the market than to try to time the market. As a general rule, you shouldn't consider buying individual stocks unless you plan to spend a considerable amount of time researching and evaluating stocks.

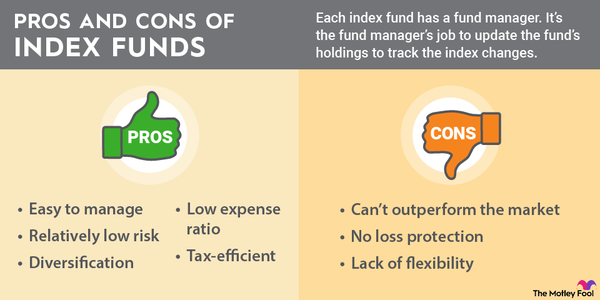

Lottery winners who place a higher value on their leisure time can consider options like index funds, which seek to match the returns of an index like the S&P 500 or Dow Jones Industrial Average, or exchange-traded funds (ETFs), which amount to a basket of similarly themed stocks that spread risk across multiple companies. Whatever approach you choose, remember that a buy-and-hold strategy is always your best bet.

Fixed Annuity

Hiring a financial advisor

Hiring a financial advisor to manage your winnings

Chances are good that if you've won the lottery, you're not going to want to spend the equivalent of a full-time job trying to keep track of your money. Enter a financial advisor who can handle everything from investments to tax planning, saving you a massive amount of time and headaches.

Obviously, the first and most important criterion for a financial advisor is trustworthiness; you don't want to entrust your new fortune to a person who will disappear with your money. References are crucial. You should also be prepared to conduct a thorough interview with a potential financial advisor. Some of the more important questions include the following:

- Are you a fiduciary? You're essentially asking the financial advisor if they will put your financial interests ahead of their own interests.

- How are you paid? Many advisors will charge a fee that amounts to 1% of assets under management (AUM). Others might charge an hourly rate or a fixed fee.

- What is your investment philosophy? This question is essentially all about risk tolerance. Your financial advisor's philosophy should align with your own, whether you're willing to make speculative investments or stick to low-risk investments.

- What are your financial credentials? Your most accomplished financial advisors will usually be either chartered financial analysts (CFAs) or certified financial planners (CFPs). The designations mean the advisor has gone to a great deal of trouble to demonstrate their commitment to managing your money.

- Do you offer tax planning? A good financial advisor will be thoroughly conversant with tax rules that affect investors, such as capital gains taxes and retirement accounts. Although you're likely to need an accountant, a financial advisor can give you valuable advice on how your new nest egg might be affected by tax regulations.

- How often will we communicate? For some investors, one or two meetings every year with their financial advisor might be enough; others might want weekly emails or monthly phone conferences. Be sure to check out your advisor's thoughts and see if they align with your needs.

Related investing topics

Investing your lottery winnings

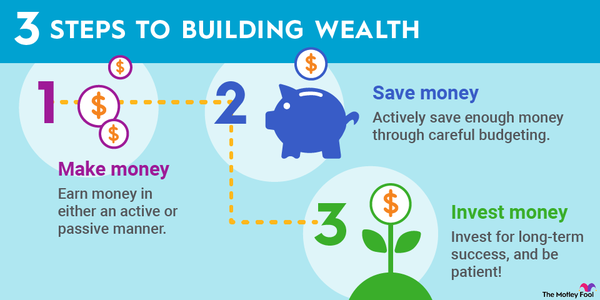

If you've defied the odds and won a lottery jackpot, you should be able to enjoy your new wealth -- not spend countless hours managing it and worrying over it.

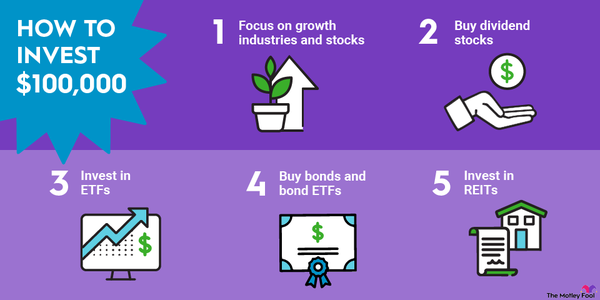

A common recommendation is to put your money to work for you in a diversified portfolio that includes a mix of cash and cash-like instruments, such as certificates of deposit (CDs) and high-yield savings accounts; bonds from sources that include corporations, municipalities, and the federal government; funds that can be professionally managed and guarantee some degree of diversification; and a portfolio of stocks that can either be selected by you or part of another fund such as an ETF or index fund.

Find a good financial advisor, outline your goals, and enjoy wealth that you can pass down to future generations.

FAQ

Investing lottery winnings FAQ

What is the best option if you win the lottery?

Your best plan is to work with a financial advisor to determine your risk tolerance and the best mix of investments for you.

Where do you put your money if you win the lottery?

It would be a poor idea to put all your eggs in one basket; a balanced and diversified portfolio consisting of cash, stocks, bonds, and other assets is key to preserving your new wealth.

What should you not do with lottery winning?

Unless you're already a financial expert, don't try to white-knuckle managing your money. Be wary of newfound friends, relatives, and amazing investment opportunities.

Where is the safest place to keep your lottery winnings?

U.S. Treasurys are generally considered to be the safest investment vehicles in the world. Although they offer low returns and little liquidity, they're generally the gold standard of safe investments.