Investing in bonds can be an excellent way to earn some return with your capital while reducing the risk of capital losses. This is especially valuable as you get close to a financial goal and when stock market volatility can result in big -- and fast -- capital losses.

When it comes to earning the highest yields, corporate bonds often come out ahead of Treasury bonds issued by the federal government and municipal bonds issued by state and local governments.

A corporate bond is a debt obligation issued by a business to raise money. Corporate bond buyers are lending money to the company, while the company has a legal obligation to pay interest as agreed to bondholders. When a corporate bond matures, or reaches the end of the term, the company repays the bondholder.

How do they work?

How do corporate bonds work?

A corporate bond is a loan to a company for a predetermined period, with a predetermined interest yield it will pay. In return, the company agrees to pay interest (typically twice per year) and then repay the face value of the bond once it matures.

Let's use a typical fixed-rate bond as an example. If you invest $1,000 in a 10-year bond paying 3% fixed interest, the company will pay $30 per year and return your $1,000 in a decade.

While fixed-rate bonds are the most common, there are others to consider, including:

- Floating-rate bonds, which have variable interest rates that change based on benchmarks such as the U.S. Treasury rate. These are usually issued by companies considered below investment grade, i.e., those that are considered junk bonds.

- Zero-coupon bonds, which don't come with interest payments. Instead, you pay below face value (the amount the issuer promises to repay) and receive full value at maturity.

- Convertible bonds, which give companies the flexibility to pay investors with common stock instead of cash when a bond matures.

How to buy them

How to buy corporate bonds

In general, there are three ways to buy corporate bonds:

- New issue

- Secondary market

- Bond funds

New issue bonds are newly offered from a company looking to raise cash through an intermediary broker-dealer. You will pay face value and the company will receive the proceeds, net of any fees retained by broker-dealers for their services.

The secondary market is where you can buy already-issued bonds from investors who own them and are looking to sell before maturity. The price may be higher or lower than face value, depending on interest rates (to keep the yield competitive with yields paid by new issues), as well as on the financial condition of the issuing company. For instance, bonds issued by a company that may not be able to meet its financial obligations often trade at a discount to face value on the secondary market. This is to compensate buyers taking on the risk that a company won't be able to pay its obligations.

A bond fund lets you invest in a broad group of bonds, and a number of bond funds invest exclusively in corporate bonds. Individual bonds typically require a minimum $1,000 investment, which could make it difficult for many people to build a diversified bond portfolio. If you're working with smaller amounts of money, a bond fund could be ideal since the minimum investment is the price of a single share of a bond exchange-traded fund (ETF). Bond funds do come at a price. The fund manager has expenses to cover and want to earn a profit as well. Make sure to understand the fees you'll pay -- measured as an expense ratio -- before investing in a bond fund.

Gross Expense Ratio

How to make money from corporate bonds

Investing in corporate bonds is generally part of a strategy to protect your capital and earn a profit from the interest paid as part of a diversified portfolio of stocks and bonds.

You can also make money by investing in bonds trading for a discount to face value (also called par value). This can occur for a couple of reasons. One reason is a change in the interest rate environment. If interest rates rise, investors can earn more with new issues, so existing bonds will be discounted to compete with new issues.

A bond may also be discounted if a company is at risk of not being able to meet its debt obligations or may be forced to issue stock to pay off convertible bonds. In these instances, bondholders are often willing to sell below face value -- how much the bond investments cost at issuance -- to reduce the risk of higher possible losses. There's certainly more risk with bonds in such situations since these companies could default on their debts, resulting in losses for their bondholders.

Corporate bonds vs. stocks

Corporate bonds vs. stocks

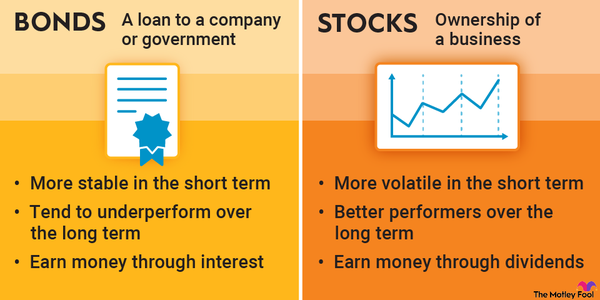

Stocks represent direct ownership in a business, while bonds are a loan with a predetermined rate of return. This is why, even for a strong and profitable company, the value of its bonds will hold stable even if the stock price changes substantially. You usually know exactly what you're getting with a bond.

A company's stock price, however, can substantially fluctuate and is often based on projections of what people think it could earn in the future. As a result, stock prices can be volatile, while corporate bonds tend to hold their value. You trade the potential upside of stocks for the predictability of bonds.

Pros and cons

Pros and cons of corporate bonds

As noted, the biggest benefit of corporate bonds is stability. Bonds tend to hold up across every economic environment as long as the issuing company remains in good shape. Even the best companies' stocks can crash with the market, and this volatility can lead to big losses if you need to sell at a specific time.

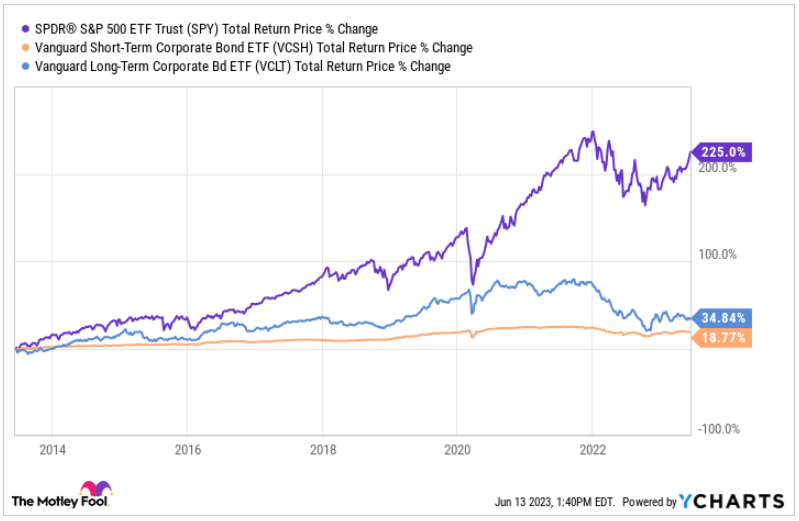

The drawback is that this stability comes at the expense of lower long-term returns. Here's how the SPDR S&P 500 ETF Trust (SPY -0.87%) has performed over the past decade versus the Vanguard Long-Term Corporate Bond ETF (VCLT 0.16%) and the Vanguard Short-Term Corporate Bond ETF (VCSH 0.04%):

The takeaway: Corporate bonds are ideal stores of value for wealth you'll depend on in the next five years or less. Over longer periods, bonds don't match the wealth-building power of stock ownership.

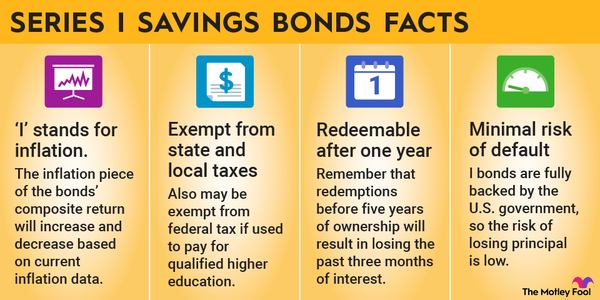

There are also tax implications to holding corporate bonds. If you'll hold bonds in a taxable account, Treasury bonds may be the better choice. They may pay a lower yield, but after the taxes on corporate bond interest, a tax-free government bond could mean more after-tax total income.

Choosing corporate bonds

How to choose corporate bonds for your portfolio

Let's start with credit ratings. There are three well-known bond rating agencies: S&P Global (SPGI -0.2%), Moody's (MCO 0.02%), and Fitch.

In general, the lower a credit rating, the higher the interest rate a company has to offer to compensate for higher risk. Corporate bonds rated below BBB- by S&P and Fitch and Baa3 by Moody's are considered junk bonds. Most investors should avoid junk bonds since the risk of permanent losses is much higher than with investment-grade corporate bonds.

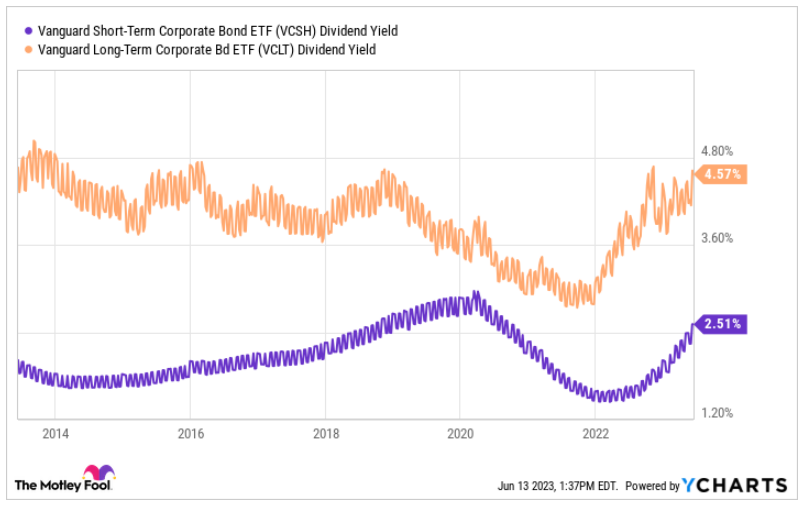

In addition to credit rating, a bond's interest rate is generally a product of its term. The longer the term, the higher the interest rate. For example:

But don't just buy bonds with the highest yields based on your time frame; make sure you diversify for risk factors. For instance, buying only bonds in companies in the same industry or with exposure to the same risks could result in a riskier bond portfolio than you realize. So, think through each bond purchase and how it fits into your portfolio.

Related investing topics

Are corporate bonds right for you?

Are you only a few years from a financial goal? If so, it may be time to start shifting your assets away from the volatility of stocks and adding more corporate bonds to your holdings. Just remember that, as the chart above shows, corporate bonds have historically underperformed stocks over the long term. Too much exposure to bonds too early can hamper your returns, leaving you with less wealth than you had planned.

There's also a psychological side to consider. Many investors struggle with holding stocks through a market downturn. If owning more bonds reduces the likelihood you'll sell out of stocks in a market crash, then owning more bonds than what is recommended for your age and stage of life could be the right move for you. In that case, the higher yields of corporate bonds versus Treasury bonds can help offset the "lost" returns from not owning more stocks.