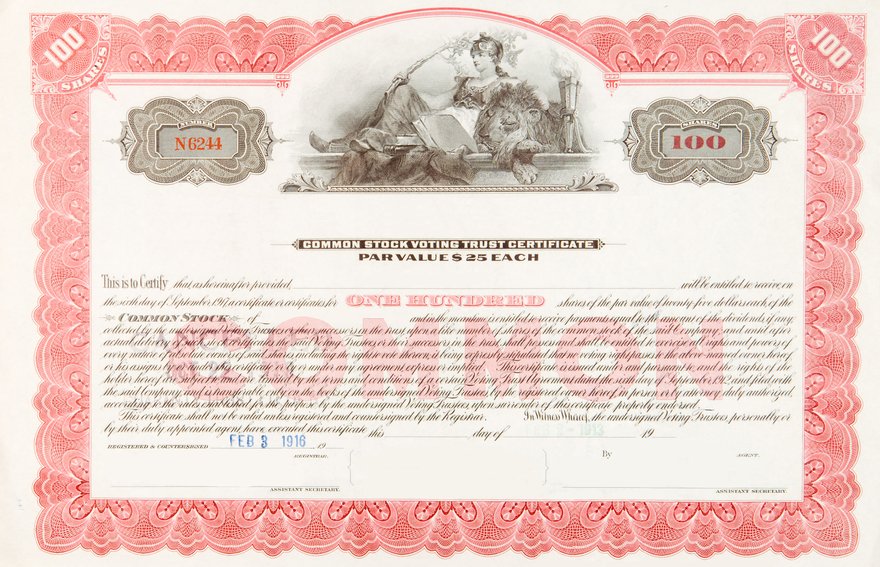

Common stock is a representation of partial ownership in a company and is the type of stock most people buy. Common stock comes with voting rights, as well as the possibility of dividends and capital appreciation. You can find information about a company's common stock in its balance sheet.

What is a common stock, and why do people invest in it?

What is a common stock, and why do people invest in it?

Simply put, each share of common stock represents a share of ownership in a company. If a company does well, or the value of its assets increases, common stock can go up in value. An asset is any resource that holds value. On the other hand, if a company is doing poorly, common stock can decrease in value. Shares of common stock allow investors to share in a company's success over time, which is why they can make great long-term investments.

In general, common stock comes with the right to vote for corporate directors, as well as the right to vote on policy changes and stock splits. There are a few exceptions to this rule, however, such as companies that have two classes of common stock -- one voting and one non-voting. Alphabet (Google) is one example of this. The company's class A shareholders (GOOGL 0.55%) have voting rights, while its class C shareholders (GOOG 0.74%) do not.

Some companies choose to distribute some of the profits on their balance sheet to common stockholders in the form of dividends, and each common stockholder is entitled to a proportional share. For example, if a company declares a dividend of $10 million and there are 20 million shareholders, investors will receive $0.50 for each common share they own.

The other main type of stock is called preferred stock and works a bit differently. The main difference is that preferred stock has a fixed, guaranteed dividend, while common stock dividends can change over time or even be discontinued. For this reason, share prices of preferred stocks generally don't fluctuate as much as common stock.

The bottom rung of the ownership ladder

The bottom rung of the ownership ladder

Common shareholders have the most potential for profit, but they are also last in line when things go bad. In the event of bankruptcy, holders of common stock have the lowest-priority claim on a company's assets and are behind secured creditors such as banks, unsecured creditors such as bondholders, and preferred stockholders.

As a result, when companies liquidate or go through a bankruptcy restructuring, common stockholders generally receive nothing, and their shares become worthless.

Common stock on a balance sheet

Common stock on a balance sheet

Equity is the value of what the stockholders own. On a company's balance sheet, common stock is recorded in the "stockholders' equity" section. This is where investors can determine the book value, or net worth, of their shares, which is equal to the company's assets minus its liabilities.

The main point to remember is that the total stockholders' equity is the book value of the stock, but that doesn't necessarily mean the stock trades for this amount. Rapidly growing companies may trade for several times their book value, while riskier or struggling companies may trade at a discount.

Related investing topics

Common stock is the default

Common stock is the default

When buying a stock, investors don't have to wonder exactly what type of stock it is. Common stock is the default. Preferred stock will indicate in the name that the shares are preferred. Common stock is called common for a reason.