Ford's results have been good -- but two segments may weigh in 2017. Image Source: Getty Images.

Heading into the fourth quarter, investors knew that North America, as usual, would generate the vast majority of Ford Motor Company's (F -1.92%) profits. But two factors that continue to be critical for Detroit's second-largest automaker are Europe and Ford Credit, as I posited here. Unfortnately, results between these two increasingly important divisions were mixed. While full-year operations in Europe hit a record, Ford Credit posted a fourth-quarter pre-tax decline of 28%. Let's look at some of the details and where Ford goes from here.

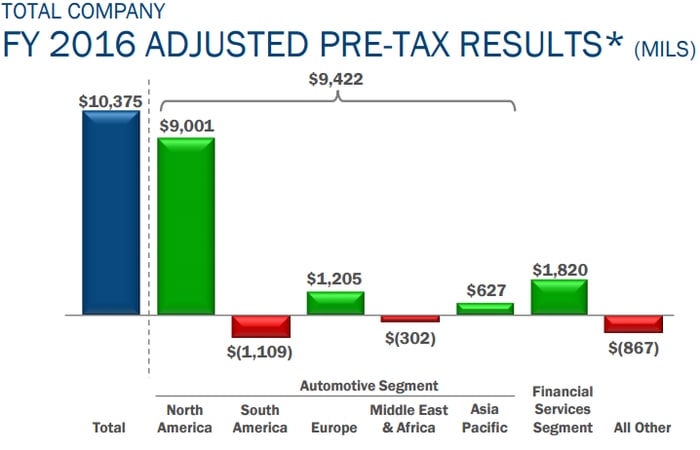

Image source: Ford Motor Company's Q4 presentation.

Europe

Once a constant source of red-ink, Ford has since turned its European operations around and now they are one of the few positives contained within its recent operating results. . Ford posted a record full-year $1.2 billion pre-tax profit driven by a record operating margin of 4.2%. That was $946 million higher than 2015's result. The fourth quarter marked the seventh consecutive profitable quarter -- although an accounting change helped move some quarters from a loss to a gain -- and operating margins were up more than 25% compared to the prior year.

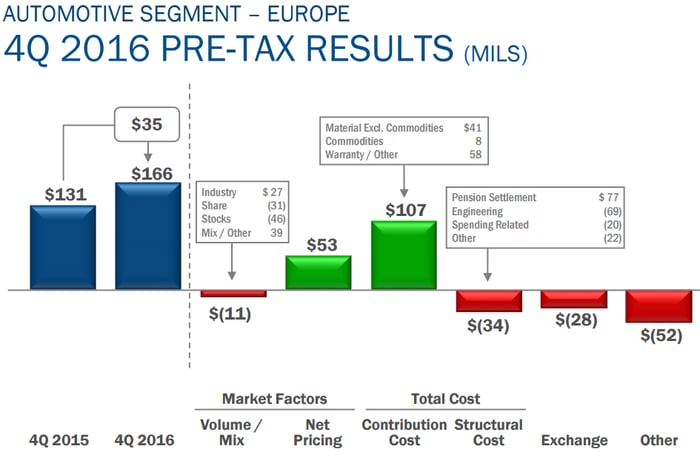

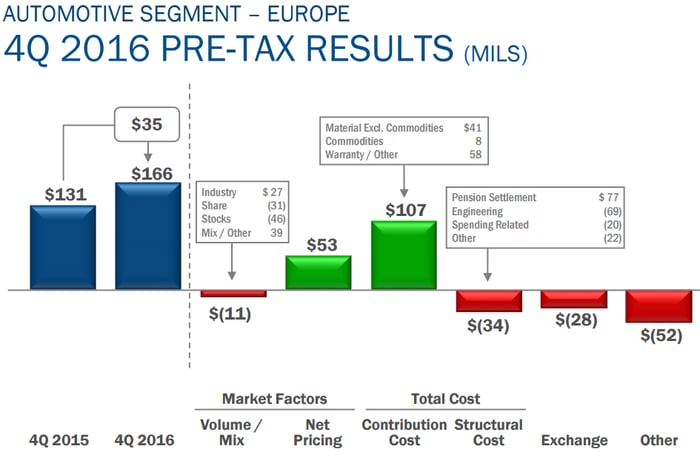

Despite Ford's impressive full-year results in Europe, the fourth quarter was a slight step back in terms of revenue and market share. Wholesales (cars shipped to dealers that have not been sold) remained flat year over year, with revenue checking in 2% below last year's $7.3 billion and market share dropping 20 basis points from 7.6% to 7.4%. Operationally, Ford continued to improve during the fourth quarter, with operating margin up 50 basis points from 1.8% to 2.3% and pre-tax results up 27% from $131 million to $166 million.

As you can see below, cheaper commodity costs and a favorable pension settlement helped fuel the region's fourth quarter.

Graphic source: Ford Motor Company's Q4 presentation.

Looking ahead, expect 2017 earnings to be weaker than those of 2016, although still profitable. Part of the tepid guidance is due to higher costs from the Fiesta and EcoSport launch, as well as overall uncertainty about the trade implications of Brexit, which could theoretically cost the company hundreds of millions of dollars should the worst come to pass.

Ford Credit

Ford Credit continues to be one of the most underappreciated assets under Ford's umbrella, with many investors overlooking the vast profits it contributes on a quarterly basis. However, there is downside to owning a financial arm, because when off-lease vehicle residual values decline faster than anticipated -- as has happened recently -- Ford Credit is to blame for the hit to the bottom line. . Heading into the fourth quarter, investors knew there would be trouble. We just weren't sure how bad it would be.

Looking at the data, Ford Credit's net receivables increased 7% to a healthy $130 billion, but its pre-tax results decreased 28% from $556 million, in the prior comparable quarter, down to $398 million. Ford Credit's over-60-day delinquencies moved three basis points higher, from 0.13% to 0.16%, which is fine historically. You can see below the negative impacts of residual losses and depreciation.

Image source: Ford Motor Company's Q4 presentation.

Ford Credit's charge-offs and loss-to-receivables ratio did increase last year, from $206 million and 0.33% in 2015 to $324 million and 0.47% in 2016, but the positive news is that Ford continues to finance stable customers, as its higher-risk business only represents about 5%-6% of its portfolio and has remained consistent over the past decade. While not at risky levels, investors would prefer those losses to stabilize in 2017.

The National Automobile Dealers Association index of used-vehicle prices fell in each of the last six months in 2016, and the average used car depreciated 23% during 2016, worse than the historical norm of about 18%. Investors would be wise to watch the overall trend of depreciation and used-vehicle prices, as vehicles will continue to come off-lease in accelerated numbers over the next couple of years.

Ultimately, it was another historically strong quarter for Ford Motor Company, despite multiple one-time charges that lowered net income. But it's also important to note that two of Ford's most important segments, Ford Credit and Europe, do face headwinds from Brexit and declining residual values in 2017.