Buckeye Partners, L.P. (BPL), Wal-Mart Stores (WMT -0.08%), and ExxonMobil (XOM -2.78%) could be top stocks for retirees to add to their portfolios right now, according to some top Motley Fool contributors. Each of these companies has intriguing catalysts that could help their share prices climb and their dividend payments grow, so let's take a closer look at these stocks.

A big yield that's relatively cheap

Reuben Gregg Brewer (Buckey Partners, L.P.): If you're retired and looking for income, then you need to be thinking about Buckeye Partners, L.P. Although larger pipeline companies like Enterprise Products Partners and Kinder Morgan often come to mind when looking at the midstream space, Buckeye has existed since 1886. It may be relatively small, but it's been around the business longer than either of those competitors. In other words, it's no fly by-night newcomer and deserves a place among the industry's leading names.

IMAGE SOURCE: GETTY IMAGES.

And it's got more impressive stats. For example, Buckeye's distribution yield is around 7%. That's higher than Enterprise's 5.8% and way more than Kinder's 2.3% yield. Moreover, Buckeye's distribution history is just as strong as Enterprise's, since both have at least 20 years of annual hikes under their belts. Note that industry giant Kinder was forced to cut its dividend not too long ago.

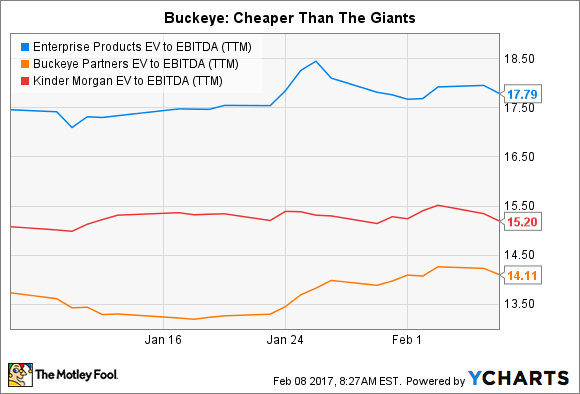

EPD EV to EBITDA (TTM) data by YCharts

But wait, there's more! Not only does Buckeye offer a higher yield, but it's also cheaper. The limited partnership's enterprise value (EV) to earnings before interest, taxes, depreciation, and amortization (EBITDA) ratio is around 14 times. Kinder, with a much lower yield, is at 15 or so, and Enterprise's EV/EBITDA ratio is nearing 18.

Higher yield, relatively cheap price, and at least as strong a dividend history... now that's something worth digging into. If you're retired and looking for income, put Buckeye Partners, L.P. on your short list today.

Things aren't as bad as they seem

Demitri Kalogeropoulos (Wal-Mart): Retailing isn't a popular industry on Wall Street right now, especially at the competitive discount side of the business. The good news is that this pessimism opens the door for value investors to take advantage of e-commerce disruption fears to grab solid businesses at bargain prices.

Take Wal-Mart, which is one of just five members of the Dow that's priced at less than 15 times trailing earnings. Yes, the retailing titan's profits are weakening as it plows investments into improving its in-store shopping experience and attacking the e-commerce channel. Traffic only inched higher in the third quarter, too, and if rival Target's holiday results are any indication, that figure could slip back into negative territory when Wal-Mart posts its fourth-quarter numbers on Feb. 21.

Its operating efficiency is as impressive as ever, though. Over the past nine months, Wal-Mart's free cash flow improved by over $5 billion and passed $12 billion. The retailer's return on invested capital is nearly 15% of sales -- good enough to place it in the top third of all Dow components.

Over the coming decade, senior citizens should benefit from the company's unusually low dividend-payout ratio. At less than 50%, it provides plenty of room for market-beating annual increases on what's already one of the Dow's most generous income stocks.

Another opportunity to buy big oil

Todd Campbell (ExxonMobil): If you don't own ExxonMobil yet, a recent sell-off in its shares is giving you another opportunity to buy. This dividend-paying company is an energy Goliath, and as global economic expansion drives revenue higher in the coming decades, you can bet that more of ExxonMobil's profit will be returned to shareholders in the form of a bigger dividend payout.

ExxonMobil's got its fingers in all aspects of finding, extracting, and marketing oil and gas. As a result, the company's stock price depends heavily upon the spot prices of those commodities.

Unfortunately, oil and gas prices have fallen from their post-recession peak, and that's weighed down sales and profits. But U.S. economic growth and a drastic reduction in U.S. drilling activity last year is starting to boost spot prices, and since the company will be comparing this year's sales to weak quarters in 2016, year-over-year sales and profit growth should improve, potentially boosting ExxonMobil's share price.

In the past year, West Texas crude oil prices have climbed from around $30 per barrel to more than $50, and ExxonMobil plans to capitalize on that by increasing its capital expenditure budget. Recently, it acquired significant acreage in the Permian basin, an area for development that has historically been less costly to develop than others. Management estimates that wells in the Permian basin can yield a 10% rate of return at $40 per-barrel oil prices.

Although ExxonMobil's net income is way off peak, the company has remained profitable, with $8.9 billion in trailing 12-month net income. Assuming that commodity prices don't retreat to new lows, and spending programs boost production, shareholders should expect ExxonMobil to build upon its solid history of dividend increases. (The company's increased its dividend for over 30 consecutive years.)

ExxonMobil's recent share price sell-off and the fact that its shares are yielding a solid 3.6% make this is a top dividend stock to buy.