Cheap stocks can be the best stocks, especially if you get the chance to buy a steady company at a solid price and hold on until Mr. Market realizes his mistake. Of course, it's not always easy to tell if a stock presents good value. When it comes to companies such as The Scotts Miracle-Gro Company (SMG 2.72%) and International Paper (IP 1.31%) -- two stocks that had an amazing year in 2016 -- it can be even more difficult to convince yourself that you didn't miss an opportunity on the way up.

The reverse can also be true. For instance, specialty metals company Allegheny Technologies (ATI 0.19%) reported full-year 2016 EPS of negative $5.97. That is awful on paper, but when put in the context of the company's restructuring -- and perhaps the strongest and most profitable operations in the business' history -- then it could quickly ascend to the top of your watchlist.

Initial reservations aside, let's take a closer look at what makes these three stocks undeniably cheap.

Image source: Getty Images.

Planting the seeds of growth

After reorganizing operations in the last several years, consumer home and lawn specialist The Scotts Miracle-Gro Company is beginning to reward investors for their patience. Revenue and gross profit have grown in three consecutive fiscal years (which end in September), while cash flow from operations and net income have remained strong. Indeed, the company reported EPS of $4.09 in fiscal 2016 -- well above $2.23 from the previous year. Steady performance and steady growth are big reasons for the stock's 30% gains in the past year.

Despite the gains, shares are still historically cheap. The Scotts Miracle-Gro Company trades at just 17 times trailing earnings -- well below its historical average -- and that's even after accounting for a monstrous gain in share price (nearly doubling EPS will have that effect). Better yet, the consumer market for lawn and garden products is much more insulated from industry cycles than your typical commodity fertilizers and agricultural products.

Analysts are calling for EPS to dip slightly in the next 12 months, which puts the stock's forward PE ratio at a slightly higher 19, according to estimates compiled by Yahoo! Finance. That is still below historical levels, of course, and the estimates actually may be underestimating the strength of the current business.

Management has guided for adjusted EPS between $4.10 and $4.30 for fiscal 2017. While that allows for the possibility of a minor regression from last year's achievements, the company reported a strong performance in the first quarter of the year -- when the highly seasonal business is the weakest. Revenue and gross profit grew 27% and 165%, respectively, from the prior-year period. Investors were faced with a loss of $1.08 per share, compared with the year-ago's loss of $1.30 per share.

Making up significant ground in the fiscal first quarter bodes well for The Scotts Miracle-Gro Company to report earnings near the high end of its guidance, and would force analysts to increase their estimates. Given that shares are already undeniably cheap, investors may want to consider poking around the company in more detail.

More efficient, more potential

It was a rough year for Allegheny Technologies. How rough? The stock's low point in 2016 was actually worse than levels witnessed when the sky was falling during The Great Recession. In fact, shares are currently trading just above the lowest point achieved in March 2009.

There's good reason for the pessimism. Management is currently in the midst of executing a painful restructuring process. The strategy is clearly working -- gross profits soared 169% in 2016 compared to the year-ago period despite a 16% drop in revenue -- but investors were forced to live with a loss of $5.97 per share after accounting for $527 million in (mostly non-cash) restructuring charges.

The good news is that the worst is now over. Although management cautioned that 2017 will be a transition year, it also signaled multiple signs that the company is moving in the right direction.

It's well-positioned to continue supplying higher-margin applications in aerospace and defense, which comprised 80% of total sales last year. Both of its operating segments will see revenue growth and margin expansion in the year ahead. In fact, Allegheny Technologies expects to realize at least an additional $270 million in gross profits compared to last year.

Throw in a $75 million reduction in capital expenditures, which is expected to fall another $25 million in 2018 and for several years thereafter, and suddenly the business becomes capable of achieving consistently profitable operations. It takes a bit of digging to uncover the opportunity at hand, but for just $19 per share-- or a historically low price to sales ratio of 0.65 -- the new and improved Allegheny Technologies is undeniably cheap.

Boring is good, cheap is better

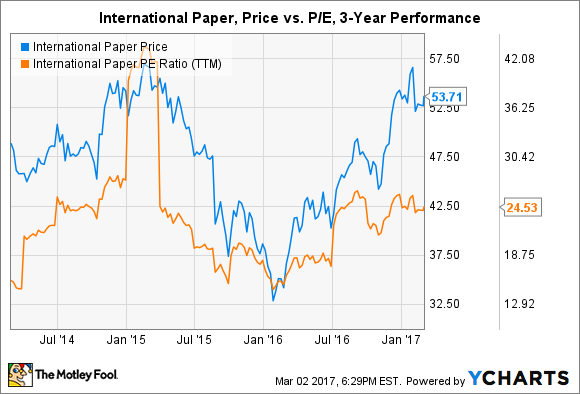

Success may not come easily in the boring and low-margin pulp and paper industry, but International Paper has remained a shining example of consistency over the years. The dividend stock -- which yields over 3.4%, by the way -- has reported four straight years of revenue over $21 billion and cash flow from operations over $2.5 billion. To be fair, both categories have declined in recent years, although the factors have been mostly out of the company's control. The important thing is that management has done its best to respond to the factors that it can control.

One of the largest catalysts for the company and investors was the $2.2 billion acquisition of Weyerhaeuser's pulp business, which should result in growing revenue and margins and save $175 million in synergies once integrated. Specifically, International Paper will take control of four pulp mills in the American Southeast and a handful of facilities elsewhere. The softwood pulp in the former region is highly coveted in high-margin personal care products, which just so happen to be manufactured en masse in the same geographic locale.

Indeed, analysts are expecting EPS to nearly double in the next 12-month period, according to estimates compiled by Yahoo! Finance. That puts the stock at less than 13 times future earnings, well below current and historical levels.

Management has told investors that it will focus on margin improvement for existing operations and integrating the new pulp business in 2017, in addition to paying down debt. If management continues to execute against its strategy, then International Paper stock will likely continue its gains.

What does it mean for investors?

Whether a stock is near multiyear highs or all-time lows doesn't necessarily tell you if it's cheap. To make that conclusion, you'll need to dig a bit deeper into the business and industry trends that it can exploit to its advantage. If you uncover cheap stocks that others may overlook, then you could position your portfolio for long-term gains.