What happened

Shares of Camber Energy (CEI -1.25%) are down 14.2% at 12:56 p.m. EST on Dec. 28, putting its stock price down by more than one-third over the past two trading days as investors cash out before the end of 2018. While part of the recent sell-off was likely due to a sharp drop in oil prices on Dec. 27, oil prices are actually moving higher today. West Texas Intermediate crude, the benchmark that sets the market for much of Camber Energy's holdings, is up 1.6% at this writing.

So what

Camber's stock price is falling sharply today, even as many other oil stocks move higher. There's good reason to believe that sellers are continuing to drive the company's stock price down because it's already been a huge loser so far this year and plenty of investors are selling before year-end to harvest the loss for tax reasons.

Camber Energy has yet to make any money producing oil. That's not good when you're an oil company. Image source: Getty Images.

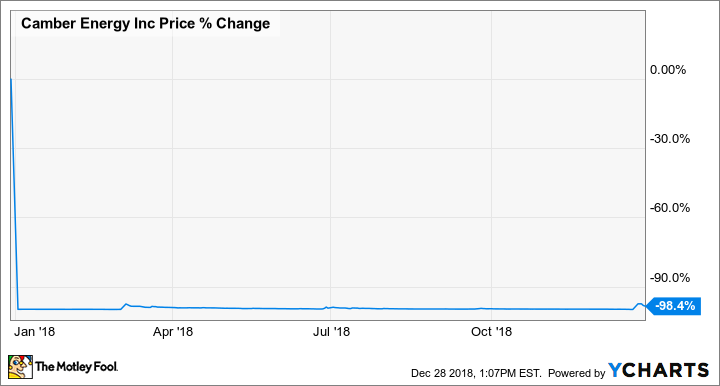

Camber Energy shares are down 98% year to date.

And with only a couple of trading days remaining, tax-loss selling is likely exacerbating selling due to oil price fears.

Now what

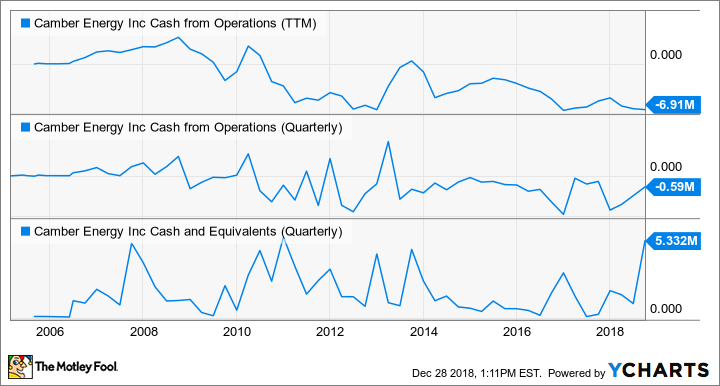

Sometimes a sharp sell-off in a stock like this can make for a buying opportunity, but I think that's not the case with this company. Camber Energy has never in its history generated positive cash flows from its business operations over a full year, and has only managed a handful of positive operating quarters.

CEI Cash from Operations (TTM) data by YCharts.

This has caused it to have to steadily raise capital via equity issuance, diluting investors and destroying shareholder equity without ever getting to a scale that is self-supporting. As a matter of fact, its stock price had fallen so low that it recently completed a 25-for-1 reverse stock split simply to continue trading on the exchange. The company barely has enough shareholder equity to remain listed, and it continues to destroy per-share value with each passing quarter.

Add it all up, and this isn't a turnaround bet that I'd be willing to make. It's possible that oil prices could climb and Camber could start generating positive cash flows. But the company has never demonstrated the ability to do so, and in the current oil price environment, investors are likely to see more capital get destroyed. I say stay away until management proves they can make money.