What happened

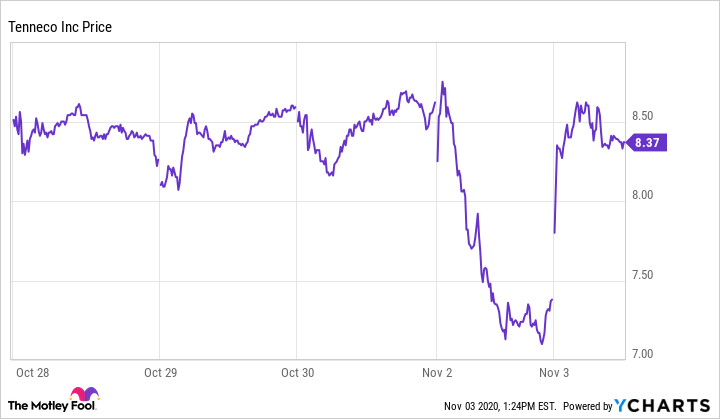

Shares of Tenneco Inc. (TEN), a leading designer, manufacturer, and marketer of automotive products, jumped over 17% higher Tuesday before giving some gains back, after the company received a vote of confidence from one bank analyst.

So what

In a welcome move for investors, shares of Tenneco are rebounding from Monday's downturn.

Deutsche Bank analyst, Emmanuel Rosner, increased his price target on Tenneco after the company released its third-quarter results, despite keeping a "hold" rating on the stock. Rosner increased his Tenneco price target from $10.00 to $11.00, a sizable upside from the current trading price of $8.38 per share, which includes today's roughly 13.5% gain.

Image source: Getty Images.

The rebound in stock price Tuesday is a breath of fresh air for investors after Tenneco shares declined a similar amount Monday. The company's third-quarter $0.33 adjusted earnings per share failed to meet analysts' estimates of $0.44 per share but, on the bright side, revenue checked in at $4.3 billion, only a 2% decline compared to the prior year and ahead of analysts' estimates of $3.9 billion. https://investors.tenneco.com/news-and-events/press-releases/2020/11-02-2020-123120002

Now what

Management has done well navigating choppy waters caused by COVID-19's ripple effects. Management set up the Accelerate+ program that has delivered structural cost savings, improved cash flow and margins, and is driving the company's momentum as 2020 comes to a close. Management has even managed to increase liquidity to $1.8 billion while reducing the company's total debt. Investors should also take these pops and drops in stock price with a grain of salt as uncertainty surrounding COVID-19 and its negative impacts continues to mount. With new cases spiking overseas and valid concern the U.S. will experience an even more alarming growth of infections this winter, the automotive industry's near term is up in the air despite the industry rebounding from the initial wave of COVID-19.