The coronavirus pandemic created a set of circumstances that rewarded some businesses while punishing others. Nonessential companies were forced to shut their doors, which hurt their competitive prospects. When governments reduced restrictions, it still wasn't business as usual.

The pandemic caused supply chains to slow to a crawl, making it challenging for retailers to secure inventory. Those that did get products on their shelves were rewarded with sales at higher margins. Tilly's (TLYS -1.00%) was fortunate, earning record profits in the quarters following its reopening.

Times are changing for Tilly's

In its first quarter of 2022, which ended on April 1, Tilly's net sales decreased by 10.7%. This comes after sales increased by 111% in the same quarter of the prior year. Consumers were more willing to spend on apparel at the same time last year after receiving stimulus checks from the government. Additionally, more business restrictions were in place during the comparable quarter last year, leaving folks with fewer options on where they could spend their money.

TLYS Revenue (Quarterly YoY Growth) data by YCharts.

Tilly's CEO Ed Thomas commented on the evolution of its customer in prepared remarks that accompanied its earnings results on June 2: "We continue to focus on growing and improving our business over time, despite the near-term challenges of the highly inflationary environment and lapping last year's record-breaking results, which were fueled by unprecedented pandemic-related factors."

Indeed, those factors led Tilly's to report earnings per share in the comparable quarter last year that was twice as high as its previous record. Management had done an effective job securing the inventory its customers wanted while competitors did not. That perfect storm allowed Tilly's to withhold sales or discounts, selling more of its products at full price.

TLYS Gross Profit Margin data by YCharts.

In its quarter ended in April, Tilly's gross profit margin decreased by 300 basis points from the same quarter last year as it returned to a more normalized discounted inventory rate. Still, its gross profit margin of 30.1% was 270 basis points better than the comparable quarter in 2019.

Management expects the more challenging conditions to last through its second quarter, forecasting product margins to fall by 225 basis points at the midpoint in Q2. It's expecting this to hurt the bottom line, with earnings per share forecast at $0.18 at the midpoint in Q2, following the record-high $0.66 last year.

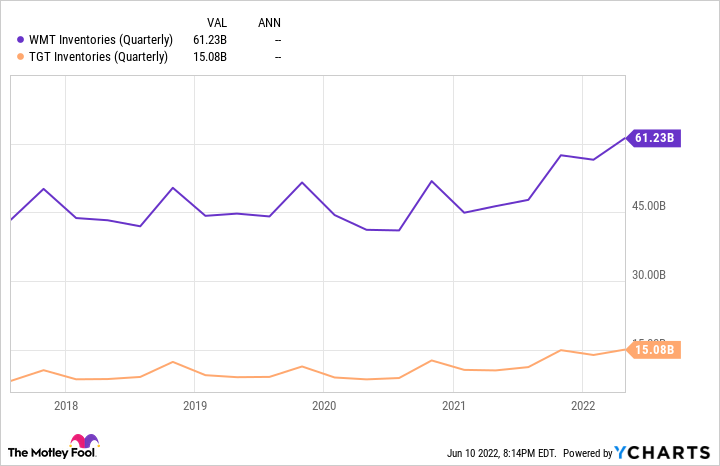

WMT Inventories (Quarterly) data by YCharts.

What this could all mean for Tilly's investors

Earlier in June, Target and Walmart noted they had more inventory than they felt comfortable holding. Target has already begun aggressive cost-cutting measures to reduce the total. Walmart said it would do so more thoughtfully. Regardless, it is further evidence that an operating environment where retailers were cramming to secure enough inventory to meet insatiable customer appetites has normalized.

That means Tilly's shareholders can no longer reasonably expect the specialty retailer to report record sales and profits. Management appears to understand these new conditions too and will likely adjust accordingly.