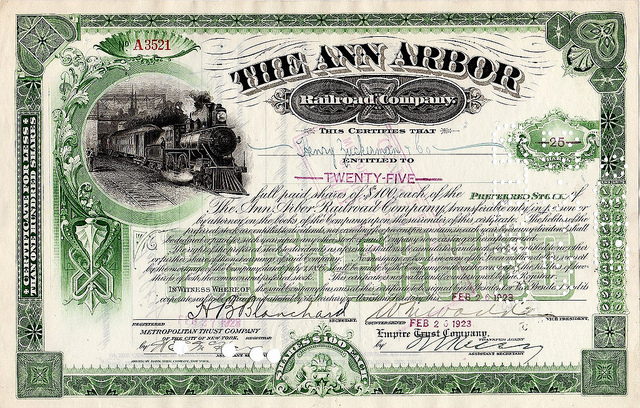

Look closely and you'll see that this is preferred, not common, stock. Photo: Flickr user Wystan.

Common stock and preferred stock are two different things. When you hear people discussing "stocks," they're usually referring to common stock, issued by many thousands of companies. However, many companies also issue preferred stock, which offers some advantages over common stock. A simple way to invest in a bunch of preferred stocks at once is via a preferred stock ETF.

Defining terms

Common stock gives you ownership of a small percentage of a company, and its value changes from day to day as shares are traded on the open stock market. A company's common stock may or may not offer a dividend, and that dividend may be increased, decreased, or eliminated at management's discretion.

Preferred stock, meanwhile, is more like a bond in some ways. It offers a guaranteed dividend (like a bond interest rate), and its dividend yield is typically generous and higher than that of the company's common stock. (Its dividends are taxed as ordinary income, though, rather than being subject to the lower rate like most common-stock dividends.) If the company falls on hard times and goes out of business, holders of preferred stock get to stand in line ahead of common stock holders, hoping to get some small return on their money.

Also like bonds, preferred shares usually offer less potential price appreciation, whereas common stock can rise in value without limit -- or crash. Preferred shares are less volatile, which can be a desirable trait to some investors. This is because their prices, like those of bonds, are more sensitive to interest rate changes than to investor sentiment. Unlike holders of common stock, preferred-stock holders often have no voting rights in the company -- but this isn't a big drawback for many investors.

Clearly, preferred stock can have a place in your portfolio, offering reliable income. To invest in it, though, you might need to study lots of companies' offerings of preferred stock -- or you can take an easier road and just invest in a bunch of them at once via a preferred stock ETF.

The easy way to invest in preferred stock

Exchange-traded funds (ETFs) are a bit of a cross between stocks and mutual funds. They trade like stocks, changing in value throughout the day as they're bought and sold at different prices. By contrast, mutual fund prices are calculated at the end of each trading day.

A share of stock is tied to a single company, but a share of an ETF is a share of a fund that has invested in a range of stocks and/or bonds and other assets. Whereas mutual funds often have minimum initial investment amounts that can be as high as several thousand dollars, you can buy as little as a single share of an ETF, which might cost only a few dollars.

For your consideration, one solid ETF that focuses on preferred stock is the iShares US Preferred Stock ETF (PFF +0.28%). Its dividend is a hefty 6.9%, and over the last year, its shares have bounced around between $36.60 and $40, recently trading for $39.91. Its expense ratio, or annual fee, is 0.47%, which is rather low, especially compared to mutual fund fees, which often top 1%. This ETF has outperformed its benchmark index over the past three- and five-year periods.

The ETF's portfolio recently had about 328 holdings, and it's about 62% weighted toward the financial industry, which is a plus for anyone bullish on that sector and a minus for anyone bearish on it.

Many of the ETF's components have been making solid contributions to its performance. The table below shows the difference in yield between the common and preferred stocks of some of the ETF's components:

|

Stock |

Yield on Common |

Yield on Preferred |

|---|---|---|

|

HSBC Holdings |

4% |

7.6% |

|

Wells Fargo |

2.6% |

6.7% |

|

Citigroup |

0.1% |

6.5% |

|

MetLife |

2.6% |

6.2% |

Sources: Quantum Online, Morningstar.com.

Give preferred stock some consideration for your portfolio if you're seeking significant and relatively steady income.