Another earnings season is upon us, and it's a make-or-break time for most publicly held companies. If a company exceeds Wall Street's expectations for revenue and earnings, its stock price could be off to the races. On the other hand, any shortfall could spell disaster. Up Monday: Coeur d'Alene Mines

Analysts expect the precious metals miner to report $230.71 million in revenue and $0.34 in EPS, which is a whopping 143% improvement over last year's reported $0.14 a share for the same quarter. If the company meets its revenue target, it'll mark a 15.6% increase from last year's $199.62 million.

Let's see how those figures compare with some of Coeur d'Alene's competitors, including Newmont Mining

|

Company |

Reporting Date |

Revenue |

EPS |

|---|---|---|---|

| Newmont | April 26 | $2.64 billion | $1.07 |

| Pan American Silver | May 9 | $230.28 million | $0.46 |

| Hecla | May 8 | $85.13 million | $0.05 |

| Silvercorp | May 9 | $47.45 million | $0.06 |

When looking at earnings quality, we at The Motley Fool have two databases -- EQ Scan and EQ Score -- that help us uncover cash flow and revenue recognition issues. Smart financial officers can use several techniques to manipulate financial results, and manipulation of any of the three financial statements usually affects the other two. But a critical eye on these statements can often uncover trends that could be important to help investors protect against losing their hard-earned money. The EQ Score database assigns an index rank to the company, from 1, for the lowest quality, to 5, for the highest. As the company's financial status changes over time, the database adjusts its rank and illuminates trends that will affect earnings quality going forward. Coeur d'Alene is not ranked in the EQ Score database, but based on relevant metrics, this stock's earnings quality would likely be around a 4 or even a 5. Let's see why.

CDE Revenues data by YCharts

Coeur d'Alene's income statement metrics are bright indeed, with revenues, GPM, EBITDA, and EPS all showing positive trends over the last two years. All four metrics track well with one others. Some of this obviously could be the result of rising precious metals prices, but silver has not doubled in price during the past two years. In other words, some of the revenue trend is due to increased production and sales of ore. Because revenue minus the COGS equals the gross margin, we can see that Coeur d'Alene has shaved nearly 20 percentage points off of COGS since April 2010, or added 20 points to the GM.

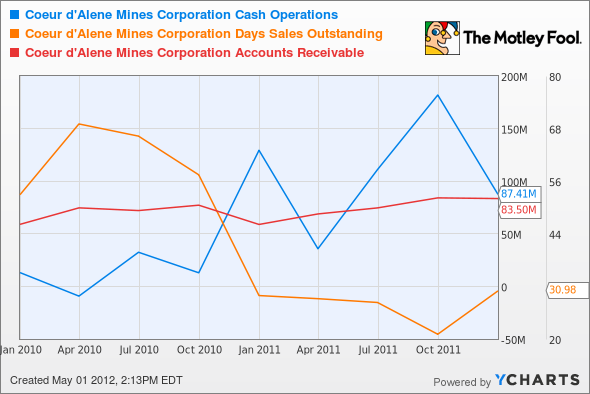

CDE Cash Operations data by YCharts

The second chart shows that Coeur d'Alene's cash from operations, days sales outstanding, and accounts receivable. DSO indicates a great improvement in cash collections, evidenced by the reduction from a high of 68 days to the current 31 days, and also by the rising CFO trend line. The good news is that A/R has remained relatively flat and because revenue is rising, it means that more cash is being collected. Of course the rising CFO trend line supports this thesis. The stable A/R trend line also means that Coeur d'Alene is in all likelihood not being overly aggressive with revenue recognition because if it were then A/R would probably be expanding. Overall, working capital trends look positive.

In the hierarchy of metrics that affect earnings quality, revenue is at the top of the chart, and cash flow is more important that net income. In other words, Wall Street tends to focus on the wrong metric as the basis for its recommendations to buy, hold, or sell a stock.

Coeur d'Alene is a relatively small mining company that has shown greatly improved revenue and margins in the last two years without red flags being raised concerning the quality of those revenues and margins. The company's stock price has fallen since Feb. 28 from $30.22 down to $21.66 currently. Coeur d'Alene has a trailing P/E of 21.30. Last year's earning came in at $1.37, and analysts expect the company to earn $1.93 a share this year, a 40.88% bump up. If Coeur d'Alene meets estimates for this quarter, the market could look very favorably on this stock.

All that glitters is not gold, but if the company meets expectations, then this silver miner could put some sparkle in your portfolio. As always, prudent Fools should make investment decisions based on consideration of earnings quality.