Shares of WebMD (Nasdaq: WBMD), the online health care portal, hit a 52-week low yesterday in reaction to a less-than-stellar earnings report. Let's take a look at how the company got here to find out whether the long-term prognosis is terminal.

How it got here

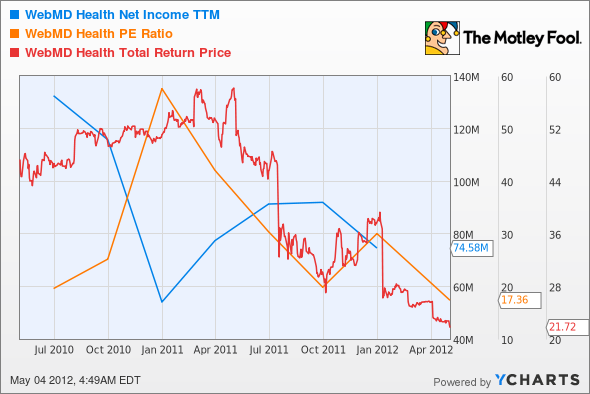

WebMD has been moving lower for a year now, starting with a big drop last summer followed by another plunge in November on weak forward guidance. The pain continued with a virtual stock-price heart attack in January after its efforts to find a buyer ended in embarrassing failure, and last month saw another humiliation as the market all but scoffed at WebMD's efforts to buy back shares. Since announcing its buyback intentions, WebMD's share price has not once reached the $26 high end of its anticipated $150 million buyback.

Despite meeting expectations for first-quarter results, more lousy forward guidance drew another pitiful reaction from investors. It's all added up to send shares to not only 52-week lows, but five-year lows as well:

WBMD Total Return Price data by YCharts.

The health information sector has been lousy in general, but WebMD has been among the worst performers, only narrowly beating out Allscripts (Nasdaq: MDRX) thanks to a similarly moribund first-quarter earnings report that just wound up looking comparatively worse to the market than WebMD's.

What you need to know

While no company offers quite the breadth of WebMD's vast and regularly updated health information database directed at both consumers and professionals, it's also debatable as to whether or not any one company needs to. As the table below shows, companies that offer health information as an ancillary service have generally outperformed WebMD in the past few years.

|

Company |

P/E Ratio |

Annualized 3-Year Earnings Growth |

Net Margin (TTM) |

|---|---|---|---|

| WebMD | 27.4 | (14.0%) | 8.9% |

| Allscripts | 30.3 | 41.4% | 4.5% |

| Aetna (NYSE: AET) | 8.8 | 15.9% | 5.6% |

| UnitedHealth (NYSE: UNH) | 11.6 | 10.4% | 5.0% |

| Google (Nasdaq: GOOG) | 18.5 | 14.3% | 27.1% |

Source: Yahoo! Finance.

Part of WebMD's more recent underperformance comes from the gradual correcting of what the market saw as too high a valuation. A drastic dip in net income that began two years ago never really reversed, causing investors to lose faith in the company's future:

WBMD Net Income TTM data by YCharts.

Meanwhile, Allscripts offers professional-focused health care information services, Aetna and UnitedHealth both make private health-information portals available to large captive audiences, and even web-information gateway Google has begun making its presence felt in the health information industry. Information on its own doesn't offer much of a moat, and WebMD's responses to the competition haven't earned the trust of many investors -- except, perhaps unsurprisingly, corporate raider Carl Icahn, who recently doubled his stake in the company. His involvement might just be shareholders' best hope for gains in the near future.

What's next?

Where does WebMD go from here? That will depend on whether or not the company can turn its dwindling financial fortunes around, or whether or not Carl Icahn goes all in. The Motley Fool's CAPS community has given WebMD a meager two-star rating, with a third expecting the stock to continue its 52-week trend. The majority hopes for a recovery, but they're not particularly confident about it.

Looking to invest like a billionaire but not sure Icahn's got his eyes on the right prize? Take a look at The Motley Fool's special free report: "The Stocks Only the Smartest Investors are Buying." Beat the 1% at their own game with one under-the-radar outperformer in an elite group of compelling stocks you can buy at great prices today. Click here to get your free information now.