When Dell

All things considered, HP shares have lost about 15% of their value in 2012 -- right in line with Dell and far below the 2% gain posted by the Dow Jones Industrial Average

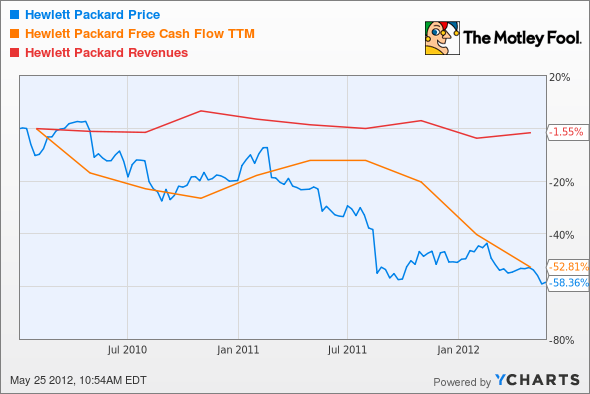

In recent years, HP's sales have been stagnant at best, while cash flows and share prices have plunged. Maybe that's a fair representation of our economy today, but HP is more of a Hail-Mary turnaround story than a solid blue chip nowadays.

Those trends continued unabated in the second quarter. Sales slid 3% year over year, led by sharp declines in consumer printing and enterprise computing. Non-GAAP earnings per share fell 21% year over year to $0.98 per share, and free cash flow was slashed right down the middle to $1.4 billion. HP is still a cash machine, but it is misfiring on almost every cylinder.

In all fairness, CEO Meg Whitman works under a long-term plan, not quarter-to-quarter myopia. Short-term results often suffer when management is working on a bigger picture. But even so, I'm afraid Whitman bit off more than HP could chew with that audacious plan.

You can't make a struggling tech giant suddenly dominate three of the biggest trends on the market, as HP tries to do. It should pick one or two and put its back into a more focused effort. Here's what I'd do if I ran HP:

Sell the printing division, leave information security to third-party specialists, and fire a laser beam at the remaining target markets, namely big data and cloud computing.

By hook, by crook, or by acquisitions, transform the buffet-like HP you see today into a highly specialized giant in a much narrower field. That's how you create a monster that can really own a profitable niche.

These goals go hand in hand and should reinforce one another as HP throws more resources behind them.

Sadly, I don't think Whitman will follow my alternative plan at all. My bearish CAPScall on HP remains firmly in place, and it's working out very nicely so far. Thursday's jump notwithstanding, the stock has fallen more than 16% in 2012. Foolish analysts have found a much more promising stock to buy today. Learn all about "The Motley Fool's Top Stock for 2012" in a special report -- free for a limited time.