Shares of Under Armour (NYSE: UA) hit a 52-week high on Monday. Let's take a look at how it got there and see if clear skies are still in the forecast.

How it got here

Like most retailers and accessories makers, Under Armour has benefited from consumers' want for brand-name merchandise that won't break the bank. Footwear has similarly fit this bill in recent years and is a primary reason why adidas (OTC: ADDYY) has performed so well. Its moderate price points yet strong global brand appeal make it a must-own for many consumers around the world.

Under Armour's recent growth can be broken into three main points. First, it's had the luxury of a much warmer winter that fueled the trend of getting people exercising earlier (as well as into retail stores to buy Under Armour products). In addition, a move toward a healthier way of life, from how we eat to how often we exercise, has spurred Under Armour's growth. Finally, the fact that it doesn't alienate one target audience over another, but focuses rather on men and women has given the company a much larger audience.

The results thus far have been undeniably strong. In Under Armour's first-quarter report back in April, the company slightly bumped up its sales forecast to growth of 21%-22% while also noting that its operating profit would rise 25%-26% as costs remain under control.

But as everyone knows, succeeding in the retail sector is a privilege, not a right. There are plenty of companies out there looking to take market share from Under Armour. lululemon athletica's (Nasdaq: LULU) action-focused clothing presents a clear and present obstacle for Under Armour, while Nike (NYSE: NKE) and Columbia Sportswear (Nasdaq: COLM) present mixed challenges in footwear and action apparel.

How it stacks up

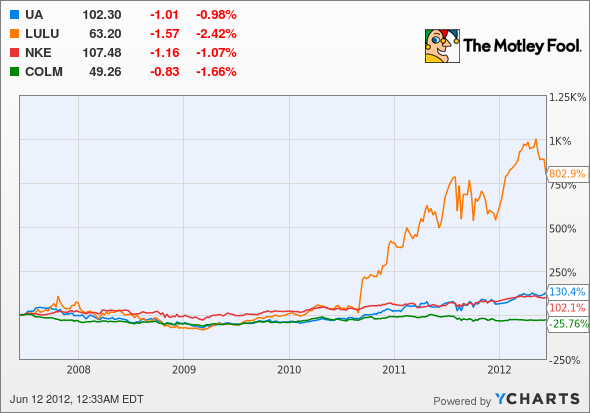

Let's see how Under Armour stacks up next to its peers.

Next to Lululemon and its 800% gain, you can hardly see those other fuzzy lines; but aside from Columbia Sportswear, long-term shareholders are up big from the other three stocks.

|

Company |

Price/ Book |

Price/ Cash Flow |

Forward P/E |

5-Year Revenue CAGR |

|---|---|---|---|---|

| Under Armour | 7.9 | 195 | 33.7 | 27.9% |

| lululemon athletica | 10.3 | 41.9 | 29.8 | 46.4% |

| Nike | 4.8 | 28.4 | 18.3 | 6.9% |

| Columbia Sportswear | 1.5 | 33.3 | 14.1 | 5.6% |

Source: Morningstar, author's calculations, CAGR = compound annual growth rate.

Those are some ugly price-to-cash-flow ratios. As you can see, higher growth rates help support very lofty valuations, but how much longer Under Armour and Lululemon can grow at their exceptionally high rates is the question yet to be answered.

Nike's growth may seem underwhelming next to Under Armour and Lululemon, but its brand strength is surpassed by few companies. In fact, it was Nike that bumped Under Armour out of being the primary sports outfitter for the NFL in 2012.

Columbia Sportswear offers the weakest overall growth among this group, but also the most potential "value" relative to book value and forward earnings. However, weakness in Europe and a warmer winter (since it sells plenty of warm weather gear) have caused the company's sales figures to be flat year over year.

Lululemon's latest quarter highlighted a 53% jump in sales and a huge 179% leap in direct-to-consumer sales. But, what concerned investors was a 370 basis point contraction in gross margins as costs rose.

What's next

Now for the $64,000 question: What's next for Under Armour? That question is going to depend on whether it can keep its costs under control, if it can form strategic partnerships with other prominent companies, and if it can maintain an attractive price point that keeps it competitive with its peers.

Our very own CAPS community gives the company a four-star rating (out of five), with 91.9% of nearly 3000 members expecting it to outperform. Although I have yet to make a CAPScall in either direction, I'm ready to enter a call of underperform on Under Armour.

After lifting the stock up relative to its peers, why would I choose an underperform call? Really it comes down to valuation and margins. From a valuation perspective, Under Armour has been assisted by favorable weather, but it's produced very inconsistent free cash flow of late -- 2011 produced the first cash outflow since 2007. More importantly, Lululemon showed us in its recent quarter the importance of keeping costs under control. While Under Armour has generally done a decent job at that, gross margin has nonetheless been on a slight decline since 2007. Unless Under Armour strikes a multitude of deals, I don't see how its current valuation is justifiable.

Even if Under Armour isn't the right investment for you, you might be interested in reading about three companies our analysts at Stock Advisor feel will outperform in the emerging markets. Get your copy of this latest free special report by clicking here.

Craving more input on Under Armour? Start by adding it to your free and personalized watchlist. It's a free service from The Motley Fool to keep you up to date on the stocks you care about most.