Investors love stocks that consistently beat the Street without getting ahead of their fundamentals and risking a meltdown. The best stocks offer sustainable market-beating gains, with robust and improving financial metrics that support strong price growth. Does Pengrowth Energy (NYSE: PGH) fit the bill? Let's take a look at what its recent results tell us about its potential for future gains.

What we're looking for

The graphs you're about to see tell Pengrowth's story, and we'll be grading the quality of that story in several ways:

- Growth: Are profits, margins, and free cash flow all increasing?

- Valuation: Is share price growing in line with earnings per share?

- Opportunities: Is return on equity increasing while debt to equity declines?

- Dividends: Are dividends consistently growing in a sustainable way?

What the numbers tell you

Now, let's take a look at Pengrowth's key statistics:

PGH Total Return Price data by YCharts

|

Passing Criteria |

3-Year* Change |

Grade |

|---|---|---|

|

Revenue growth > 30% |

16% |

Fail |

|

Improving profit margin |

(161.2%) |

Fail |

|

Free cash flow growth > Net income growth |

(99.3%) vs. (120.2%) |

Pass |

|

Improving EPS |

(110.6%) |

Fail |

|

Stock growth (+ 15%) < EPS growth |

(42%) vs. (110.6%) |

Fail |

Source: YCharts. * Period begins at end of Q1 2010.

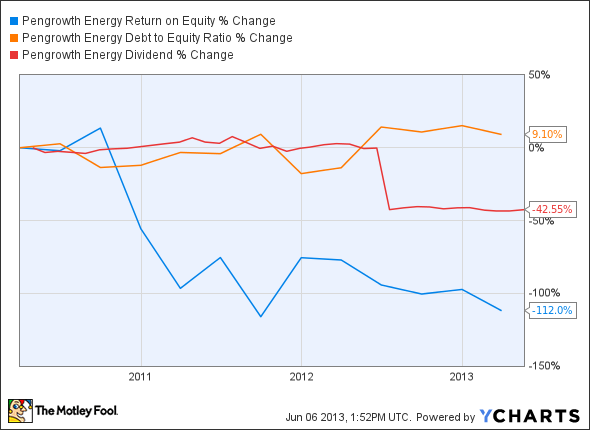

PGH Return on Equity data by YCharts

|

Passing Criteria |

3-Year* Change |

Grade |

|---|---|---|

|

Improving return on equity |

(112%) |

Fail |

|

Declining debt to equity |

9.1% |

Fail |

|

Dividend growth > 25% |

(42.6%) |

Fail |

|

Free cash flow payout ratio < 50% |

9,266% |

Fail |

Source: YCharts. * Period begins at end of Q1 2010.

How we got here, and where we're going

This is rather ugly performance, as Pengrowth musters a single passing grade only because of a numeric technicality. Sure, free cash flow hasn't declined as fast as net income, but neither result is looking good lately. Pengrowth hasn't had a great time since converting to corporate status as a result of Canadian legal changes to the tax treatment of royalty trusts. Its dividend remains quite high, but that hasn't been enough to stave off big losses for long-term shareholders. Is a rebound on the horizon, or is this high-yielder flashing the ominous value trap signals for the foreseeable future?

The rebound may have already happened. In fact, Pengrowth's shares are up 23% since my fellow Fool singled out the company as a potential low-priced value play back in January. Sean liked Pengrowth's laser focus on the Lindbergh bitumen project, and its efforts to divest non-core assets, which could turn around flagging metrics and make Pengrowth a smaller, but more profitable, Canadian oil play. Pengrowth made earlier efforts to play with oil's big boys in the Alberta shale -- Devon Energy (NYSE: DVN) and ExxonMobil (NYSE: XOM) already have major holdings in the region, and Pengrowth picked up a smaller driller a year ago to compete.

One thing investors need to watch is Pengrowth's sky-high payout ratio, which, at present levels, is clearly unsustainable. Pengrowth's asset sales will help paper over the shortfall in the near term, but it's not good policy to pay out so much in the middle of a major exploration project. The company has no plans to cut its dividend, in spite of anticipated production declines in the near term, which stands in stark contrast to competitor Penn West (NYSE: PWE), which slashed its dividend by nearly half in a wide-ranging announcement earlier this week. Both Pengrowth and Penn West trade at substantial discounts to book value, but at least Pengrowth's monster dividend gives investors something more substantial while waiting for big exploration projects to bear fruit. However, given the company's multi-year weakness, it will take a strong stomach, and a very firm belief in Pengrowth's prospects, to jump in today.

Putting the pieces together

Today, Pengrowth has few of the qualities that make up a great stock, but no stock is truly perfect. Digging deeper can help you uncover the answers you need to make a great buy -- or to stay away from a stock that's going nowhere.