Investors love stocks that consistently beat the Street without getting ahead of their fundamentals and risking a meltdown. The best stocks offer sustainable market-beating gains, with robust and improving financial metrics that support strong price growth. Does Cree (CREE +0.00%) fit the bill? Let's take a look at what its recent results tell us about its potential for future gains.

What we're looking for

The graphs you're about to see tell Cree's story, and we'll be grading the quality of that story in several ways:

- Growth: Are profits, margins, and free cash flow all increasing?

- Valuation: Is share price growing in line with earnings per share?

- Opportunities: Is return on equity increasing while debt to equity declines?

- Dividends: Are dividends consistently growing in a sustainable way?

What the numbers tell you

Now, let's take a look at Cree's key statistics:

CREE Total Return Price data by YCharts.

|

Criteria |

3-Year* Change |

Grade |

|---|---|---|

|

Revenue growth > 30% |

75.5% |

Pass |

|

Improving profit margin |

(66.7%) |

Fail |

|

Free cash flow growth > Net income growth |

327.6% vs. (37%) |

Pass |

|

Improving EPS |

(44.3%) |

Fail |

|

Stock growth (+ 15%) < EPS growth |

(13.8%) vs. (44.3%) |

Fail |

Source: YCharts. *Period begins at end of Q1 2010.

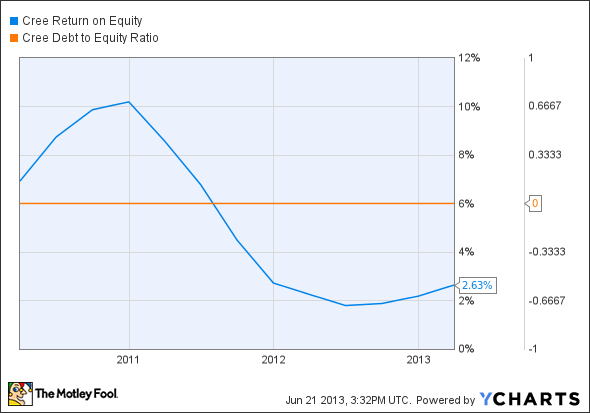

CREE Return on Equity data by YCharts.

|

Criteria |

3-Year* Change |

Grade |

|---|---|---|

|

Improving return on equity |

(62%) |

Fail |

|

Declining debt to equity |

No debt |

Pass |

Source: YCharts. *Period begins at end of Q1 2010.

How we got here and where we're going

Cree doesn't look particularly strong at the moment, as it's earned only three out of seven passing grades. However, strongly improving free cash flow could point to better days ahead for the LED lighting manufacturer. Is the future brighter for Cree than these results indicate? Let's dig deeper.

Cree's three-year stock chart might seem ugly, but the company has surged to one of the best trailing-12-month performances on the market this year. Optimism seems to abound regarding Cree's ability to find big sales in more moderately priced energy-saving LED bulbs -- but as my fellow Fool Sean Williams points out in the linked article, that doesn't necessarily justify the stock growth Cree's enjoyed in recent months. Its sales are projected to improve by 17% this year and next, but shares have gained almost 150% over the past year. That's a lot of additional expectation.

Cree still has to contend with Philips Electronics (PHG +0.75%), which unveiled a higher-watt LED bulb earlier this year that appears to outperform anything Cree's produced. Both companies are working hard to bring LED lighting costs down, which might well eat into Cree's margins even as sales grow. That hasn't yet affected Cree's bottom line, as the company's forward profit guidance for the soon-to-be-reported quarter came in right in the range analysts were expecting, representing a maximum quarter-over-quarter EPS growth rate of 18% -- but a minimum of no growth at all. Cree's distribution deal with Home Depot appears to be paying off, albeit slowly and steadily. However, some analysts remain skeptical that Cree can fend off Philips' charge of the LED light brigade, regardless of any exclusive sales outlets.

Putting the pieces together

Today, Cree has some of the qualities that make up a great stock, but no stock is truly perfect. Digging deeper can help you uncover the answers you need to make a great buy -- or to stay away from a stock that's going nowhere.