The evolution of Wal-Mart (WMT +1.23%) as a global retailer fascinates those who wonder how much more the company can scale its operations before seeing diminished returns on its attempts to grow. Last week, management lowered its full-year revenue increase projection to 2%-3%, from an earlier forecast range of 5%-6%. The company also adjusted the range of its EPS guidance, from $5.20-$5.40 to $5.10-$5.30, which works out to be a marginal 1.9% reduction.

While the company plausibly attributed its lowered sales forecast to "current global business trends" and continued grief from "anticipated currency exchange rate fluctuations," and logically cited a

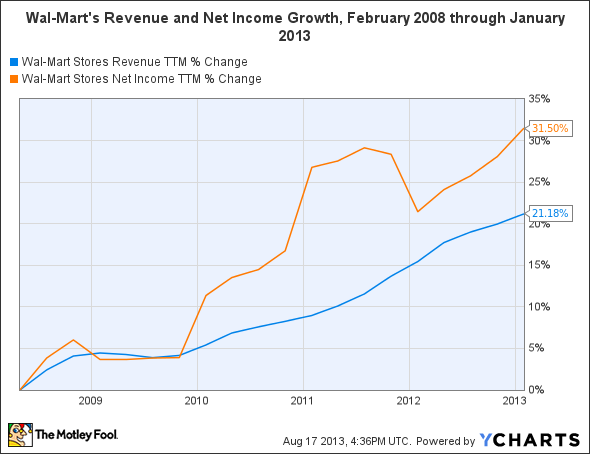

"challenging sales and operating environment" for its adjustment of projected earnings, the truth is that both Wal-Mart's top- and bottom-line growth have been in deceleration mode for some time. Below is a postcard from Wal-Mart's recent past:

WMT Revenue TTM data by YCharts.

The dates correspond to Wal-Mart's fiscal year-end, which is Jan. 31 of each year. While Wal-Mart was a dominant retail company in 2003, it still had elbow room in its quest for expansion. Revenues that year were $244.5 billion, and the company owned 4,688 store units worldwide under its various banners. Today, Wal-Mart's annual revenues are approaching the half-trillion-dollar mark, at $469.2 billion, and it now operates 10,773 units worldwide.

WMT Revenue TTM data by YCharts.

Note the first year featured on the chart, fiscal 2009, includes most of the first year of the Great Recession (2008). The two charts together demonstrate how, over the last 10 years, Wal-Mart's revenue and earnings growth rates have each decreased more than 50%.

An obvious path to future growth

Not coincidentally, Wal-Mart is starting to devote a finer focus to its e-commerce sales. The company does not disclose its annual e-commerce revenues, but according to an estimate by e-commerce research organization Internet Retailer, the company's 2012 online sales were approximately $7.7 billion. Wal-Mart CEO Michael Duke affirmed that Wal-Mart is targeting $10 billion in e-commerce sales in the current fiscal year. Working backward from this number, it appears that Internet Retailer's estimates are likely correct, as Neil Ashe, president of Wal-Mart's global e-commerce operations, has affirmed that the company's e-commerce sales are growing at a 30% clip in the first half of the fiscal year.

Not an end, but a tactical means

Wal-Mart's e-commerce goal is not to replace its physical store structure over the long term, but to build a meaningful revenue stream that will act as a lever to adjust margin flexibility for the rest of the business. The company's current business model turns out a very predictable net profit margin that ranges between 3% and 4% in any given quarter. With the addition of significant online sales, the company could boost this margin in a meaningful way for its shareholders.

The concept is analogous to a type of decision-making undertaken primarily by manufacturers, known as "Cost-Volume-Profit," or CVP analysis. A company that uses CVP seeks to identify when, during a given time period, all fixed costs and certain variable costs are covered, and the organization is at or beyond its break-even point. As a manufacturer, once you've written checks for building rent, utility bills, insurance payments, payroll, etc. during the month, you have more flexibility to accept or reject orders based on their profitability.

Furthermore, once you've hit your desired profit for the month, you can be more aggressive in pricing to attract further sales, as all profit from that point on is incremental -- gravy, if you will. E-commerce for Wal-Mart will be the means by which the company can promote additional sales during each month to augment its running profit.

Note that this is quite different from the business model of online competitor Amazon.com (AMZN 1.78%), which is sacrificing current margin in order to scale into an ever-larger retailer, with the promise of consistent profits at some undefined point in the future.

How Wal-Mart will find the gravy

Wal-Mart is on a hiring and acquisition march to improve its global e-commerce platform. The company aims to integrate e-commerce capabilities with existing inventory and distribution systems, as well as to maximize potential revenue from online customer visits.

One of the company's recent acquisitions, Silicon Valley-based Inkiru, develops predictive analysis software that can be used to tailor offers to customers in real time, as well as make offers based upon supply chain and merchandise optimization. In other words, the acquisition enables Wal-Mart to sell based on each customer's history and real-time activity online, as well as promote items that may have overstayed their welcome in the company's inventory, or are gaining traction with other consumers.

One advantage the company has over Amazon is the ability to incentivize a customer to make a visit to a brick-and-mortar store after an online purchase, with either a targeted offer or simply the promotion of a local store sale. Thus an online transaction can have a greater lifetime value for Wal-Mart than its immediate profit contribution. Acquisitions such as Inkiru will hone and refine this capability.

How much e-commerce revenue is optimal?

If Wal-Mart's e-commerce sales continue to grow at their current rate of 30% per year, the annual online tally will reach close to $30 billion between four and five years from now. Assuming that overall growth rates stay the same, Wal-Mart's total revenue will hit approximately $525 billion. E-commerce sales will represent roughly 5% of total revenue, and at that level, the online toolkit will be substantial enough for management to affect revenue and profit margin in any given month or quarter, with some feeling of control.

At that point, every percent of net income that e-commerce can contribute to the total results will be worth about $5.2 billion. And this puts into perspective the criticism Wal-Mart has received recently in the press for supposedly having lost the e-commerce race to Amazon. On this topic, the company probably isn't losing too much sleep: if you add up Amazon's cumulative profits from inception through the end of June of this year, you'll find the company earned $2.0 billion over 19 years. Wal-Mart nets this amount every six weeks. For Wal-Mart shareholders, these numbers provide every reason to remain patient as it builds its e-commerce engine.