Investors love stocks that consistently beat the Street without getting ahead of their fundamentals and risking a meltdown. The best stocks offer sustainable market-beating gains, with robust and improving financial metrics that support strong price growth. Does Garmin (GRMN 0.29%) fit the bill? Let's take a look at what its recent results tell us about its potential for future gains.

What we're looking for

The graphs you're about to see tell Garmin's story, and we'll be grading the quality of that story in several ways:

- Growth: Are profits, margins, and free cash flow all increasing?

- Valuation: Is share price growing in line with earnings per share?

- Opportunities: Is return on equity increasing while debt to equity declines?

- Dividends: Are dividends consistently growing in a sustainable way?

What the numbers tell you

Now, let's take a look at Garmin's key statistics:

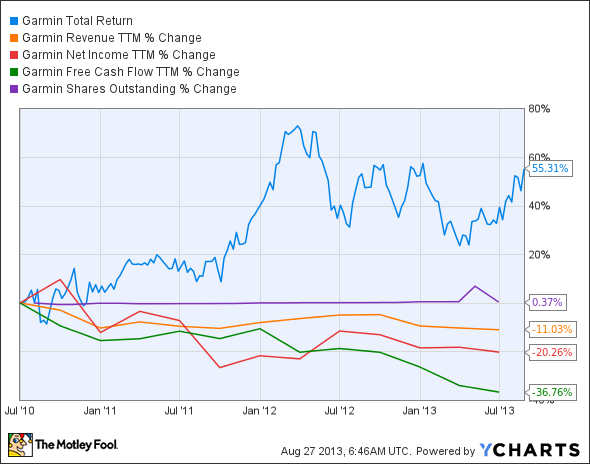

GRMN Total Return Price data by YCharts

|

Passing Criteria |

3-Year* Change |

Grade |

|---|---|---|

|

Revenue growth > 30% |

(11%) |

Fail |

|

Improving profit margin |

(10.4%) |

Fail |

|

Free cash flow growth > Net income growth |

(36.8%) vs. (20.3%) |

Fail |

|

Improving EPS |

(18.2%) |

Fail |

|

Stock growth (+ 15%) < EPS growth |

55.3% vs. (18.2%) |

Fail |

Source: YCharts. * Period begins at end of Q2 2010.

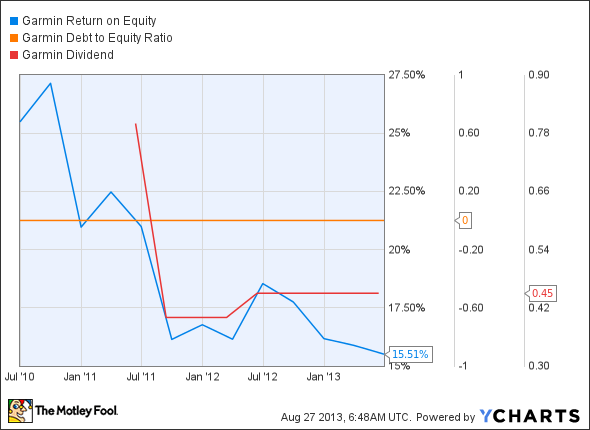

GRMN Return on Equity data by YCharts

|

Passing Criteria |

3-Year* Change |

Grade |

|---|---|---|

|

Improving return on equity |

(39.2%) |

Fail |

|

Declining debt to equity |

No debt |

Pass |

|

Dividend growth > 25% |

(43.8%) |

Fail |

|

Free cash flow payout ratio < 50% |

64% |

Fail |

Source: YCharts. * Period begins at end of Q2 2010.

How we got here and where we're going

Garmin can't seem to navigate itself out of a deep hole today -- the GPS-device manufacturer earns only one out of nine possible passing grades. One of the falling grades only happened because net income growth has surpassed the growth of free cash flow during our tracked period, but Garmin's free cash flow numbers are actually higher than its net income. Will Garmin's fundamental weaknesses catch up to it in the end? Let's dig a little deeper to find out.

In its second-quarter earnings, Garmin beat analyst estimates on both top and bottom lines. However, low expectations aren't much to write home about, and Garmin is still below levels set in 2010. Millions of people have been using smartphones and tablets as GPS devices, replacing Garmin's legacy products, which has posed a substantial threat to its long-term business. Even so, Goldman Sachs analysts have recently upgraded Garmin's stock from sell to neutral, thanks to the release of a new line of action camera products known as VIRB and VIRB Elite. This is a highly competitive market, and Garmin has none of the brand loyalty held by fans of GoPro, which has been racing ahead with new (if somewhat flawed) action cameras in recent years. I'd be surprised if the company gains enough traction to knock off industry leaders.

Fool contributor Chris Neiger notes that Garmin has launched a portable heads-up display unit (HUD) for car windshields. This new GPS device will help Garmin turn smartphones and tablets into allies, as it can be paired with a smartphone via Bluetooth wireless connections. This is an intriguing product, but, as Neiger also points out, Mazda is implementing HUD display tech directly into its cars. Garmin may not have much of a window for adoption before these systems catch on with automakers.

Putting the pieces together

Today, Garmin has few of the qualities that make up a great stock; but no stock is truly perfect. Digging deeper can help you uncover the answers you need to make a great buy -- or to stay away from a stock that's going nowhere.