A dollar store, also known as a variety store, is one which sells products at prices lower than those asked by traditional retail outlets. Such stores sell a wide variety of low-priced items ranging from jewelry to electronic appliances.

These stores rose to prominence after the recessionary phase of 2008. Post-recession, many customers traded down from regular retail channels and moved to such discount retailers. This brought about a change in consumer preferences and transformed them into bargain hunters. Moreover, factors like slow economic growth in the US have clearly favored the growth of these discount retailers. Among these, Dollar General (DG -0.36%) has emerged as the sole leader in this retail category and has become the first choice among the masses.

The Backstory

Dollar General has been delivering value to shoppers for over seven decades now. It offers products that are frequently used and replenished such as food, snacks, and health and beauty aids at low everyday prices in convenient neighborhood locations. With 10,866 stores in 40 states, it has more retail locations in the U.S. than any other discount retailer. Being the largest among all of the dollar stores, it is growing bigger every day while helping people save money.

The Report Card

In the last four quarters, the company has not just met analysts' estimates but has exceeded them three out of four times. It has had a good year so far as well, with its stock up by 25%. Although the company reported a disappointing last quarter, it did have some solid growth plans lined up to push its revenue figures. It succeeded in reporting an excellent second quarter results early this month.

Beating consensus estimates, the company reported adjusted earnings per share of $0.77 as compared to the analyst estimates of $0.74 per share, while revenues rose to $4.39 billion as compared to the consensus estimates of $4.35 billion. Same-store sales increased by 5.1% while total sales increased by 11.3% in the quarter. Net income increased by 15% and earnings per share increased by 17% as compared to the same quarter last year.

"Dollar General delivered another solid quarter. We are very pleased with the increase in customer traffic in our stores. We continue to grow our market share and believe that our second quarter results position us well to deliver our financial outlook for the year," said Rick Dreiling, Dollar General's chairman and CEO said during Dollar General's recent earnings release.

The company seems to be in line with its target of opening around 635 new stores and relocating about 550 stores this year. In the recent quarter, Dollar General began testing tobacco sales in 50 of its stores in Florida after looking at the increasing demand for tobacco in the competitors' stores. It was definitely a smart move by the company to push revenue figures. There was an increase of $3 per purchase with stores which sold tobacco as compared to those which did not. The stores reported a 33% increase in tobacco sales compared to what was planned by the company. Thanks to these results, the company has decided to make tobacco available in more than 10,500 locations across the U.S., looking forward to an additional revenue growth of $36 million from its tobacco business by the end of 2013.

The Competition

Family Dollar Stores (FDO.DL) and Dollar Tree Stores (DLTR -0.57%) are the two major competitors of Dollar General. Family Dollar has been finding it difficult to maintain its margins recently. The company received a downgrade from Deutsche Bank owing to its weak outlook. Although it produced decent third-quarter results, its same-store sales are expected to increase by a mere 2%.

Furthermore, the company's plan of opening 500 plus stores this year to touch the 23,000 total store count looks a bit alarming to me. The company's margins aren't showing any significant signs of improvement and opening of new stores means additional expenses. This could further worsen the situation as the company had cut its guidance in the recent past, adversely affecting investor confidence. Looking forward, Family Dollar's sales of discretionary products along with its margins seem to remain under pressure in the fourth quarter.

Dollar Tree, on the other hand, reported some impressive numbers with net sales of $1.86 billion. It was an 8.8% increase compared to the same period last year. The company also reported profits which were up by 10%. Smart expansion plans along with the right strategies have helped Dollar Tree to stay ahead of the competition. It has succeeded in attracting customers to its stores with stationery, candies, and other merchandise offered at the single price point of $1. The company looks well positioned from the increase in sales and expects single-digit same-store sales growth for its third quarter. Earnings per share of around $0.55 and revenue of about $1.9 billion are also expected.

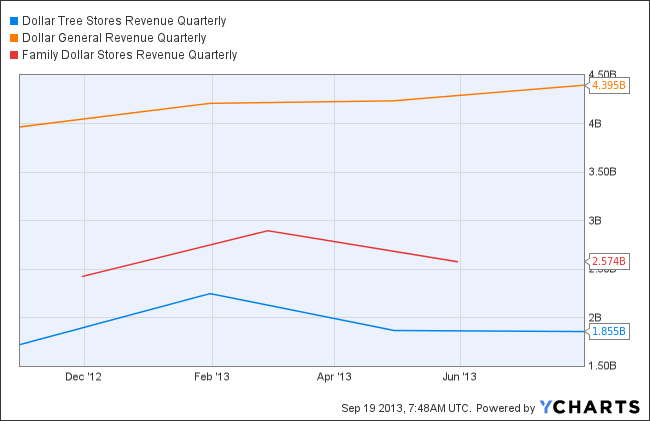

The graph below clearly shows Dollar General's dominance in quarterly revenue growth compared to its peers:

DLTR Revenue Quarterly data by YCharts.

Foolish Takeaway

As I pointed out earlier, there has been a recent change in the consumer behavior that has favored the growth of these discount retailers. This behavior is expected to persist, helping these retailers grow at an annual growth rate of 7% through the year 2020. Moreover, there are international expansion plans on the cards which can prove to be another long-term opportunity for these retailers. This expansion, especially in the Canadian markets, will definitely help push sales figures to newer heights. All in all, several growth opportunities exist for Dollar General in the future. I recommend a buy at current prices.