Thor Industries (NYSE: THO) may not be a household name, but it has been a long-term winner. In fact, it's one of the largest manufacturers of RVs in North America, owning 37% market share in traveler/fifth wheel segments, and 25% market share in the motorized segment.

Thor has been performing well in almost every facet of its business as of late, and according to the Recreational Vehicle Industry Association, industry trends are likely to remain strong. But it's possible that another recreational vehicle company, such as Harley-Davidson (HOG 1.21%), or another lesser-known company, offers a better long-term investment opportunity.

All-mighty Thor

While this Thor doesn't possess an invincible hammer, it has established an impressive track record. The stock has appreciated 87% over the past three years, primarily due to heightened demand. Below are some interesting numbers for the calendar year through June 30 (year over year):

|

Wholesale & Retail |

Performance |

|---|---|

|

Towable Wholesale Shipments |

Up 8.5% |

|

Motarized Wholesale Shipments |

Up 42.3% |

|

Towable Retail Registrations |

Up 7.9% |

|

Motorized Retail Registrations |

Up 50.1% |

Thor attributes this impressive performance to rising consumer confidence, strong performances in the real estate and stock markets, improved credit availability, as well as continuous (yet slow) job gains and income prospects. These are positives, but the company's reliance on such trends also proves that discretionary income plays a big role in the company's success. Therefore, investors are going to experience a great deal of volatility, which isn't for everyone.

Industry trends

The aforementioned Recreational Vehicle Industry Association expects wholesale shipments across all RV segments to increase 11.7% in 2013, and 4.7% in 2014.

These predictions are based on the massive amount of retiring baby boomers, and more people reaching the ideal RV purchase age range of 55-70.

According to the Recreational Vehicle Industry Association, the number of people in the United States between the ages of 55-70 will reach 56 million by 2020 -- 27% higher than in 2010. Therefore, even if the macroeconomic environment weakens, it's possible for this trend to offset that weakness.

Traveling at different speeds

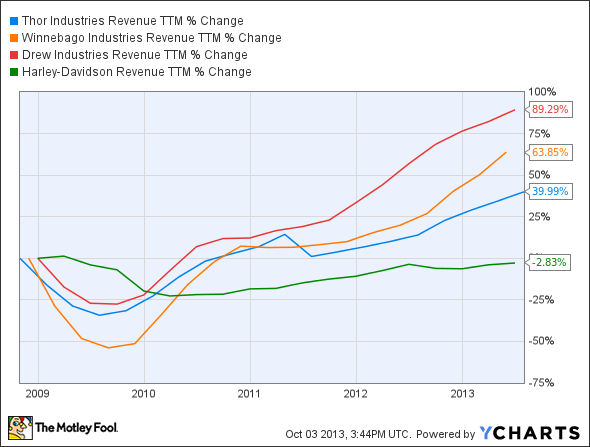

If you look at top-line performance over the past five years, then you will see that Thor is in the middle of the pack compared to Winnebago Industries (WGO +0.35%), Drew Industries (DW +0.97%), and Harley-Davidson.

THO Revenue TTM data by YCharts

However, if you look at bottom-line comparisons, you'll see that there's more disparity:

THO EPS Diluted TTM data by YCharts

Harley-Davidson has been the most impressive on the bottom line. Many investors and analysts credit that change to CEO Keith Wandell, who took over back in 2009 and made several improvements, including product efficiency and the divesture of non-core brands. Others will argue that Wandell simply had great timing by taking the CEO position at the bottom of the Great Recession. But the bottom line is that he's gotten the job done.

Harley-Davidson owns approximately 50% market share for motorcycles, which is an extraordinary number. And I must admit to being wrong on Harley-Davidson several months ago. I feared that macroeconomic conditions wouldn't favor a company so reliant on discretionary income, but that was too short-sighted. Harley-Davidson is a top-tier brand name with strong management, which should lead to long-term success.

As far as Winnebago is concerned, the name is to RVs what Kleenex is to tissues. The company owns 20% market share in RVs, and its return on equity is a whopping 45.61%. Therefore, when you invest in Winnebago, the company is making wise decisions with your money.

Drew Industries has outperformed all aforementioned companies over the past decade, and the stock has appreciated 153% over the past three years. The company sells components for RV vehicles and manufactured homes, giving it more diversification and a little more resiliency than other companies mentioned in this article.

There's one big advantage to investing in Thor and Harley-Davidson over Winnebago or Drew Industries: dividends. Currently, Thor yields 1.20%, and Harley-Davidson yields 1.30%.

However, Thor has a debt-free balance sheet, whereas Harley-Davidson sports a debt-to-equity ratio of 1.96. High debt loads have the potential to impede growth potential and reduce cash flow, which could eventually negatively impact the amount of capital returned to shareholders.

It's all good

Thor, as well as the other three companies mentioned in this article, are all long-term winners. And based on industry trends, demand is likely to increase. The biggest concern is the macroeconomic environment. It's possible that a struggling economy and weak consumer will lead to extreme volatility at certain points over the next several years. Therefore, you should only invest in one of these names if you're scaling into a position, or if you can handle these types of swings. You can travel far with Thor and its peers, but it could be a long and windy road.