Averaging 9.4% annualized gains since 1965, the S&P 500 Index (^GSPC 1.02%) has outperformed the great majority of individual investors, hedge fund managers, and even our beloved activist investors. Whether they're day traders, technical analysis experts, self-proclaimed contrarians, or even buy and hold Fools, it is often difficult to outperform the index on a yearly basis. Making things worse, many investors are pulling their hair out worrying about their investments. Consider J.P. Morgan and his famous quote, "Sell to your sleeping point." Too simple right? Perhaps, yet this holds tremendous merit, as it can have a profound impact on the average investor's decision making.

However, with the aid of dividends, stock buybacks, and huge moats, it is possible for the average investor to own stocks, sleep well, and outperform the market all in one fell swoop. Today we will take a look at 3 stocks to buy for the long term, helping you sleep like a baby.

Moats

Starting with the first of two dividend aristocrats in this article, we have Minnesotan conglomerate, 3M Company (NYSE: MMM). Providing everything from its famous Post-it notes and Scotch tape to various health care solutions and a wide array of industrial products -- the company's largest and fastest growing segment -- 3M boasts a moat that is rivaled by none. Accounting for one third of 3M's 2012 sales, its industrial segment has been on a tear lately, growing sales by 13% annually over the last 3 years. Better yet, the segment's operating income has spiked by 22% each year over the same time frame. By comparison, the company's smaller health care and consumer segments grew by only 6% and 8% respectively. However, there is huge upside potential remaining in these two segments, as only 20% of their sales come from developing countries, whereas 3M's company wide sales in developing markets are closer to 35%.

With our second dividend aristocrat, we have the personal care juggernaut that is Kimberly-Clark (NYSE: KMB). Holding a wide variety of well known brands such as Kleenex, Huggies, Kotex, Scott paper towels, and Cottonelle, the company is one of many behemoths in the personal care arena. While Kimberly-Clark may not have the immediate top-line growth capabilities of a company like 3M, it offers an incredibly safe investment as it provides nothing but essential products for day to day life. While that in itself is a tremendously boring investing thesis, it is what makes a company with a huge moat so powerful. Aiming for revenue growth of 3%-5% and earnings-per-share growth in the high single digits, Kimberly-Clark will continue to dive into new markets and broaden its market share across the globe.

Representing my only selection outside of the dividend aristocrat realm, we have global payments company, Visa (NYSE: V). While Visa does not qualify as a dividend aristocrat due to its fairly new existence on the stock market, it has made a dividend payment in each year of its life as a public company. However, what Visa lacks in historical dividend payments, it makes up for with a global payment network that gives the company one of the biggest moats in all the investing world. Posting annual revenue growth of 12% and EPS growth of 40% yearly since its inception, Visa has proven to be a dominant force. Perhaps the most exciting aspect of Visa's future, is its No. 1 catalyst -- the simple fact that roughly 85% of the world's transactions are still done via cash or check.

Buybacks and Dividends

As promised earlier, here are the other two exciting aspects of owning these low stress companies: ample share buybacks and big dividend payouts.

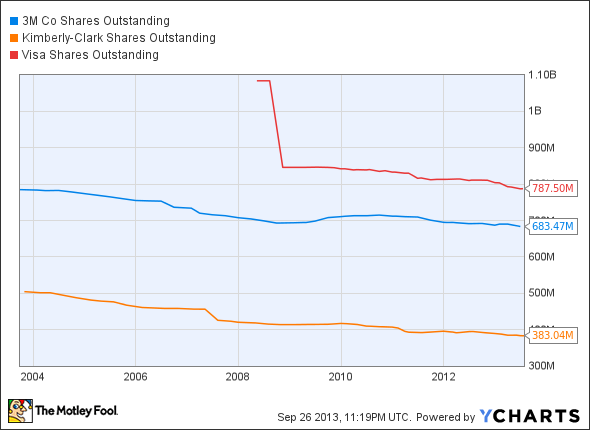

MMM Shares Outstanding data by YCharts

Over the last 10 years, it is clear to see each companies intentions as each has dramatically reduced its number of shares outstanding. In just the third quarter alone, Visa bought back almost $1 billion in shares. Similarly, 3M expects to buyback $3.5 billion-$4.5 billion in 2013, which it believes will add 1%-2% to EPS on its very own. Finally, with Kimberly-Clark planning to clear $1.2 billion worth of stock in 2013, it is blatantly evident that these three companies are willing and able to return money to its shareholders.

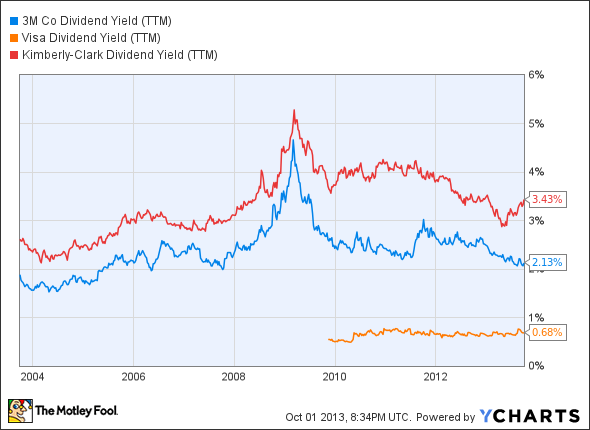

Furthermore, here is the dividend growth of each company over the last decade.

MMM Dividend Yield (TTM) data by YCharts

MMM Dividend data by YCharts

With payout ratios of 66%, 38%, and 15% for Kimberly-Clark, 3M, and Visa respectively, all three companies are in a strong position to continue growing their dividends far into the future.

Foolish Conclusion

All too often investors refuse to pay a premium for safe, wide moat stocks, opting to choose "cheaper," yet more dangerous investments. Let's do ourselves a favor and avoid getting burnt this time -- buy on the dips with these three stocks and sleep easy.