Target (TGT -0.05%) and Wal-Mart (WMT 0.18%) are two key players in the retail industry that directly compete against each other. Target has now opened up a new front in its battle with Wal-Mart by rolling out a new prepaid wireless phone service called "Brightspot." Brightspot will offer incentives to keep consumers in the program, and it will utilize T-Mobile's (TMUS -0.19%) network.

Will Target's new initiative prove to be a "bright spot" for the company, or should investors look on with caution? I believe that Target now has the building blocks to mount compelling competition against Wal-Mart's "Straight Talk" program, with T-Mobile being a secondary beneficiary.

Comparison between the two services

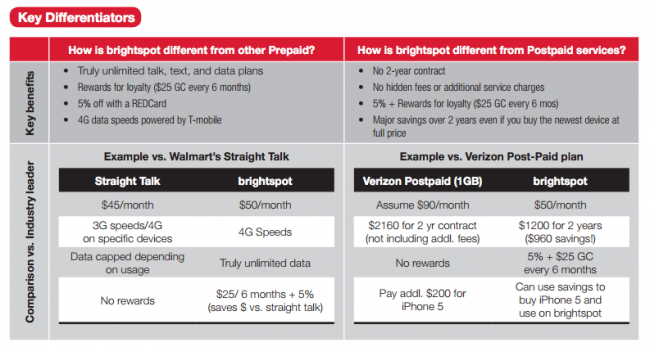

Brightspot is a little more expensive than Wal-Mart's Straight Talk on a monthly basis. Besides that, Brightspot seems to hold key competitive edges over Straight Talk and a Verizon Wireless (VZ -0.10%) postpaid contract plan:

By offering consumers more flexibility with T-Mobile, unlimited data, and a rewards program, Brightspot is sure to turn the heads of many budget-conscious consumers. Wal-Mart, the pioneer of retail wireless phone plans, might need to find a new way to compete in this formerly noncompetitive area.

T-Mobile's gain, Verizon's pain?

As previously mentioned, Target's Brightspot will use T-Mobile's network, so if Brightspot does well then naturally T-Mobile will greatly benefit. The customers of the other major networks might take a second look at switching over to the "un-carrier" as T-Mobile seeks to differentiate itself from big players like Verizon, AT&T, and Sprint. Note that Wal-Mart's "Straight Talk" uses the Tracfone platform, which in turn uses the major networks.

Brightspot will certainly help T-Mobile's bottom line by adding new customers. However, Verizon's rate of new customer growth is probably more than enough to offset any customers the company might lose. Overall, I'm not so sure that Target's Brightspot will really be a thorn in Verizon's side. T-Mobile has a long way to go to pose a significant threat to telecom industry leaders.

What Brightspot means to investors

Target's Brightspot initiative is poised to take some consumers away from Wal-Mart's Straight Talk and help continue to fuel T-Mobile's upswing. However, to how much of an extent this will impact profits for Wal-Mart and Verizon is not certain.

I highly doubt that Target's Brightspot program alone will drastically harm Wal-Mart and Verizon. After all, both Target and Wal-Mart are primarily giant retailers, not cell phone providers. Only a small portion of Wal-Mart's revenue is derived from Straight Talk. Wal-Mart is still the "king of retail" and continues to maintain a profitable business model.

Both Target and Wal-Mart have been in a downward trend over the last few weeks as quarterly sales numbers disappointed. This dip might provide long term buy-and-hold investors with a great entry point. Over the past ten years, both companies have produced impressive gains:

WMT Total Return Price data by YCharts

The key idea to note from the chart is that while Target has returned more value to its shareholders, Wal-Mart has produced a more stable rate of return through both good and bad times. While Target has returned more value to investors, the company is not as well-established as Wal-Mart and has a larger risk factor.

The takeaway

Brightspot is a good business decision on Target's part. However, I think that the retail mobile phone market still has room for more competition and growth for both Target and Wal-Mart. Long-term Wal-Mart investors shouldn't get overly concerned at this point, but they do need to pay attention to this development. Although Wal-Mart and Verizon remain the top dogs in their respective industries, if they don't adapt to consumer needs, they may find themselves slipping to the likes of Target and T-Mobile.