Investors love stocks that consistently beat the Street without getting ahead of their fundamentals and risking a meltdown. The best stocks offer sustainable market-beating gains, with robust and improving financial metrics that support strong price growth. Does Vector Group (VGR 0.85%) fit the bill? Let's look at what its recent results tell us about its potential for future gains.

What we're looking for

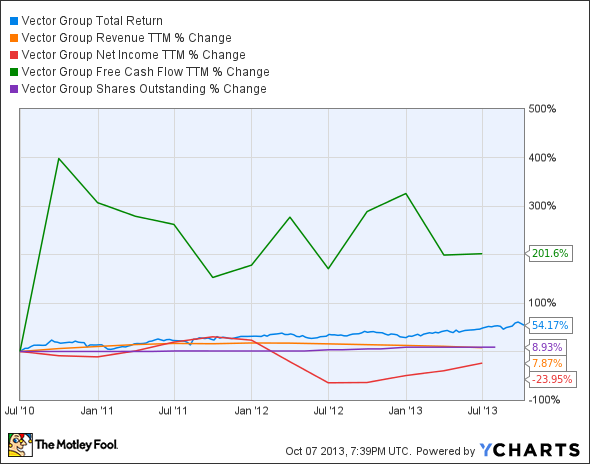

The graphs you're about to see tell Vector's story, and we'll be grading the quality of that story in several ways:

- Growth: Are profits, margins, and free cash flow all increasing?

- Valuation: Is share price growing in line with earnings per share?

- Opportunities: Is return on equity increasing while debt to equity declines?

- Dividends: Are dividends consistently growing in a sustainable way?

What the numbers tell you

Now, let's look at Vector's key statistics:

VGR Total Return Price data by YCharts

|

Passing Criteria |

3-Year* Change |

Grade |

|---|---|---|

|

Revenue growth > 30% |

7.9% |

Fail |

|

Improving profit margin |

(29.5%) |

Fail |

|

Free cash flow growth > Net income growth |

201.6% vs. (24%) |

Pass |

|

Improving EPS |

(18.1%) |

Fail |

|

Stock growth (+ 15%) < EPS growth |

54.3% vs. (18.1%) |

Fail |

Source: YCharts.

*Period begins at end of Q2 2010.

VGR Return on Equity data by YCharts

|

Passing Criteria |

3-Year* Change |

Grade |

|---|---|---|

|

Improving return on equity |

Negative equity |

Fail |

|

Declining debt to equity |

Negative equity |

Fail |

|

Dividend growth > 25% |

15.8% |

Fail |

|

Free cash flow payout ratio < 50% |

226.1% |

Fail |

Source: YCharts.

*Period begins at end of Q2 2010.

How we got here and where we're going

Vector looks a bit burned out today, as it's earned only a single passing grade thanks to a huge spike in free cash flow that started three years ago and hasn't really continued upwards since. Over the past three years, the company's mediocre revenue growth and reduced profit margins have cost it failing grades in several places, and negative equity, combined with unsustainably high payout ratios, contribute further to the poor showing. Despite these weaknesses, Vector's shareholders have enjoyed robust growth over the past three years as investors have sought out "safe" payouts. Is this share-price growth sustainable, or will the cigarettes manufacturer wind up being stamped out? Let's dig a little deeper to see what the future might hold.

Over the past few years, the U.S. tobacco industry has been experiencing emerging threats from health and safety regulation, as well as from huge tax increases. Fool contributor Sean Williams notes that the Food and Drug Administration has tried to force tobacco companies to disclose information about 20 disease-causing chemicals in cigarettes. The Centers for Disease Control and Prevention also launched another massive advertising campaign to spread awareness of the dangerous effects of smoking, which continues to reduce the number of smokers in the United States. In addition, smoking in certain areas has been either limited or entirely prohibited by federal, state, and local authorities. Quite recently, the Obama administration issued a new proposal that will nearly double the federal taxes on cigarettes, which may further reduce smoking rates and hinder Vector's potential revenue growth.

However, despite reducing smoking rates over the past four decades, Vector, as the U.S. fourth-largest cigarette manufacturer, has been able to outperform its rivals by dint of its smaller size -- a rare situation in business. My fellow Fool Dan Dzombak notes that Vector Group capitalizes on a competitive cost advantage stemming from the settlement between Liggett and the U.S. government, which allows it to avoid making tobacco settlement payments to the states and territories until its market share exceeds 1.65%. Vector Group is poised to benefit from its Pyramid discount brand, which recently gained superior brand recognition with a placement in both Wal-Mart and 7-Eleven stores. This could undermine its settlement-avoidance strategy, but a large enough market-share gain might offset this problem.

The company also has the highest dividend yield of the bunch, nearly double that of the larger Lorillard's (LO.DL) current yield of 5%. However, Lorillard has been able to increase its market share to 14.9% at Vector's expense, since its discount Maverick and Old Gold brands are in direct competition with Vector. This could threaten Vector's payouts, which already seem unsustainable at over twice the level of its free cash flow.

Putting the pieces together

Today, Vector Group has few of the qualities that make up a great stock, but no stock is truly perfect. Digging deeper can help you uncover the answers you need to make a great buy -- or to stay away from a stock that's going nowhere.