"This place is more expensive that New York!"

That's not something you hear every often. But that's exactly what San Francisco is.

For the last three quarters, the city by the bay has supplanted New York as the least affordable housing market in the United States -- and there are a few clues as to how it got so expensive.

Source: Jeff Gunn.

Each quarter, the National Association of Homebuilders (NAHB) and Wells Fargo release the Housing Opportunity Index (HOI) which attempts to measure what the most and least affordable housing markets in the United States are. San Francisco supplanted 18-time defending champion New York beginning in the fourth quarter of 2012 and has remained there ever since.

The HOI determines of all the homes sold in the quarter, what percentage of them were actually considered to be affordable based on the median income in the area. In the second quarter of this year, the median family income in San Francisco was $101,200 -- which was the fifth highest in the U.S.

But the average home price was the most in the U.S., tipping the scales at $781,000, which was 22% higher than second-place San Jose. All of this means the NAHB determined that only 19.3% of homes sold in San Francisco were affordable.

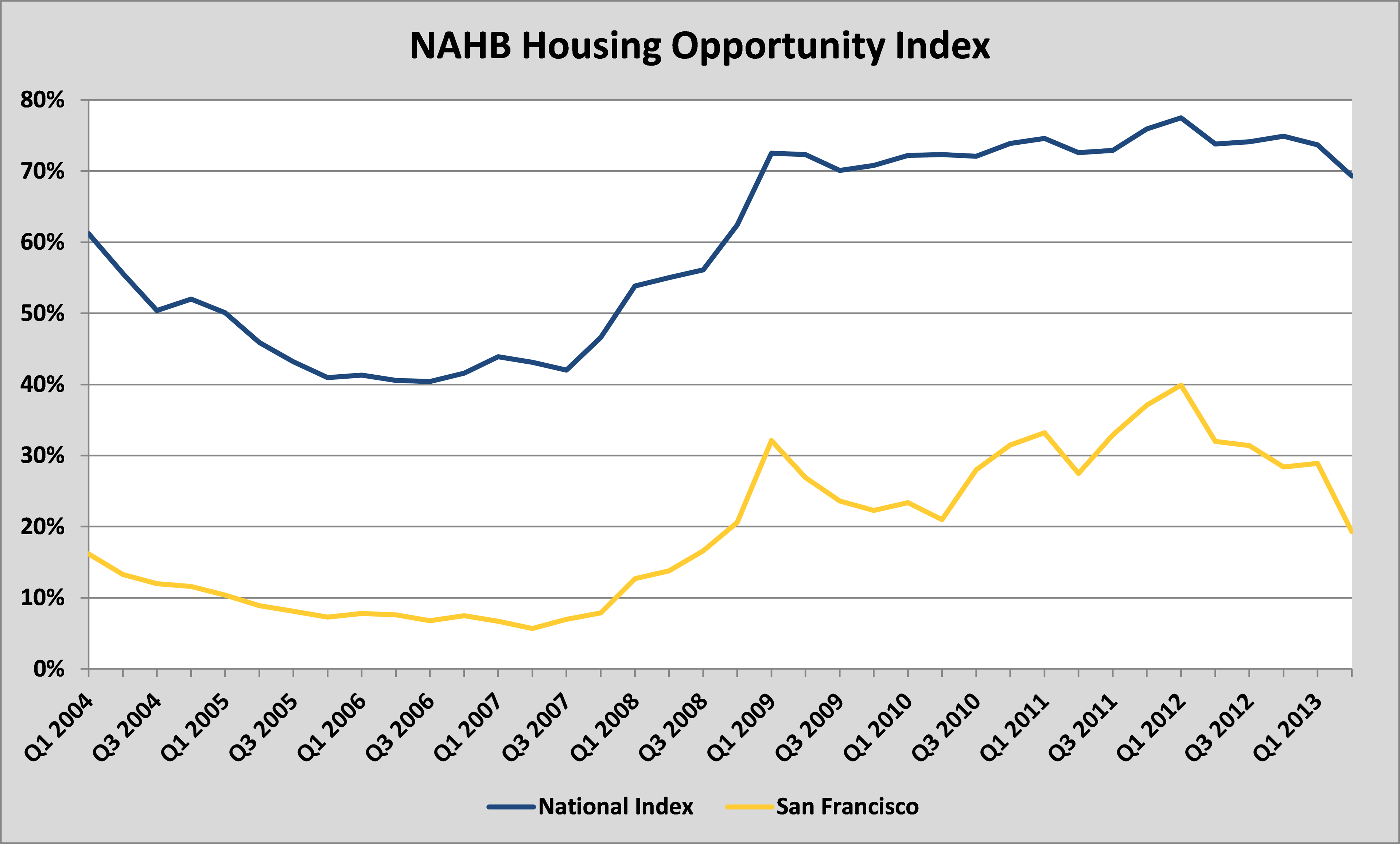

Yet San Francisco has long lagged the affordability of the broader U.S., as shown in the chart below:

Source: NAHB.

Many in that area and beyond want to know why things are so much different there than almost everywhere else in the country -- and a few data points gives us insight into why that is.

It's more than demand

Surprisingly, while San Francisco is often thought of as a rapidly growing city, from 2003-2012, its population only grew by 6.5%, compared to the broader United States population growing by a little over 8%. Although it is the hub for major companies like Wells Fargo, Oracle, Chevron, Facebook, and Visa, San Francisco hasn't been a hub of population growth.

So, if it's not the demand that is pushing up home prices, what is it that has caused prices to rise so dramatically?

In a broader conversation about the real estate industry with Forde Britt, a commercial real estate agent with the Nichols Company in Charlotte, he highlighted that with residential homes, their prices are a function of the actual size of the city, the population growth, and importantly the ease and ability of homebuilders to be able to build new homes.

He highlighted that San Francisco was one of the most notoriously difficult areas to build a home, noting; "If you look at San Francisco -- there are so many regulations, it makes it very hard to put new supply on the ground. It's a very lengthy and expensive process... which leads to a constrained supply and the average person can't afford to buy a home there."

In addition, Dr. Enrico Moretti a professor of economics at UC Berkley noted in an op-ed in the San Francisco Gate that, "data from 2,649 municipalities indicate that San Francisco's housing policies are among the most restrictive in the United States. We limit new construction through stringent land-use restrictions, incredible delays and lawsuits challenging proposed developments."

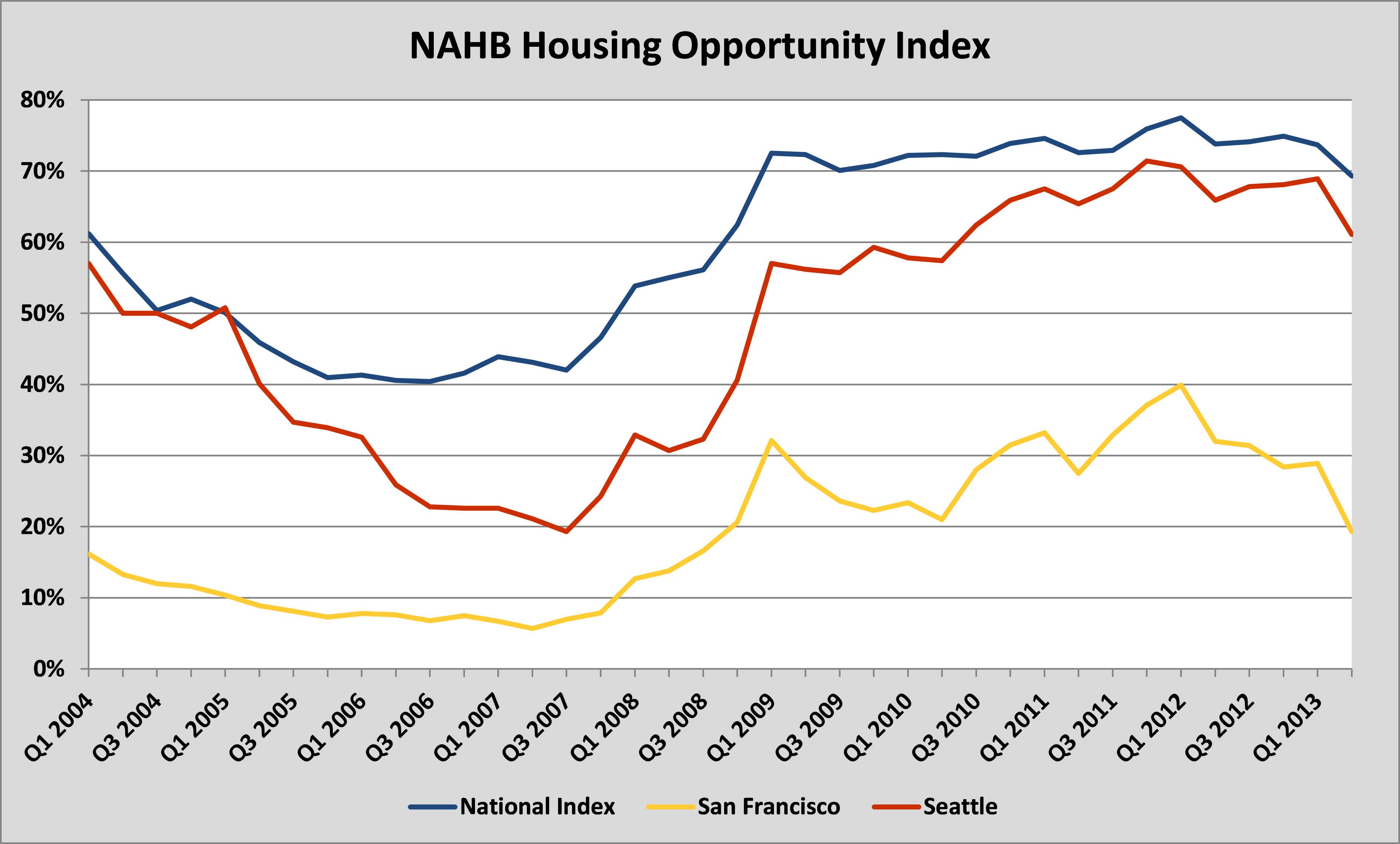

Dr. Moretti compares San Francisco to Seattle, noting, "Other progressive cities show us the advantages of an alternative approach. Job growth and housing demand growth in the high-tech mecca of Seattle have been even stronger than San Francisco's."

The data difference between the two cities is striking. From 2010 to 2012, the San Francisco and Seattle areas each added about 120,000 residents. Yet San Francisco has only had 10,000 new housing permits issued, whereas Seattle has had 26,000 new permits issued. In this, we see it is not simply demand that matters -- but also the willingness and ease to actually get the permits needed to build new houses.

Source: NAHB.

Looking back to the HOI, we can see the gap between houses that were affordable to the residents in Seattle stood at 19% in the third quarter of 2007, compared to 7% for San Francisco. Yet that gap of 12% has more than tripled since then, as Seattle now stands at 61%, versus 19% in San Francisco, a difference of 42%.

In all of this, it is vitally important to understand home prices are subject not only to the market forces of supply and demand, but that supply can be influenced by restrictive regulations that make it difficult for the average homebuyer to purchase a home at a reasonable and fair price.