Investors love stocks that consistently beat the Street without getting ahead of their fundamentals and risking a meltdown. The best stocks offer sustainable market-beating gains, with robust and improving financial metrics that support strong price growth. Does Disney (DIS +1.09%) fit the bill? Let's look at what its recent results tell us about its potential for future gains.

What we're looking for

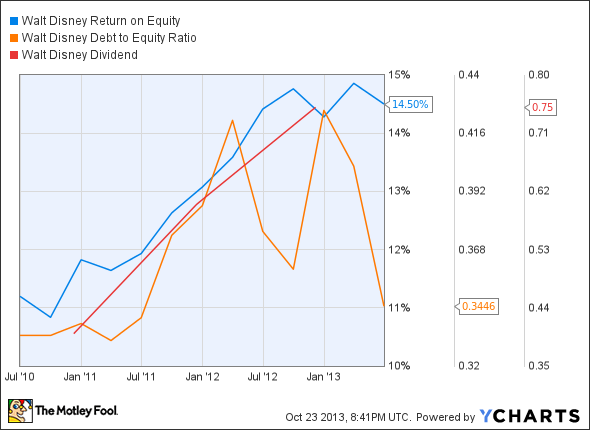

The graphs you're about to see tell Disney's story, and we'll be grading the quality of that story in several ways:

- Growth: Are profits, margins, and free cash flow all increasing?

- Valuation: Is share price growing in line with earnings per share?

- Opportunities: Is return on equity increasing while debt to equity declines?

- Dividends: Are dividends consistently growing in a sustainable way?

What the numbers tell you

Now, let's look at Disney's key statistics:

DIS Total Return Price data by YCharts

|

Passing Criteria |

3-Year* Change |

Grade |

|---|---|---|

|

Revenue growth > 30% |

15.9% |

Fail |

|

Improving profit margin |

28.4% |

Pass |

|

Free cash flow growth > Net income growth |

32.1% vs. 48.8% |

Fail |

|

Improving EPS |

59.9% |

Pass |

|

Stock growth (+ 15%) < EPS growth |

125.7% vs. 59.9% |

Fail |

Source: YCharts.

*Period begins at end of Q2 2010.

DIS Return on Equity data by YCharts

|

Passing Criteria |

3-Year* Change |

Grade |

|---|---|---|

|

Improving return on equity |

29.5% |

Pass |

|

Declining debt to equity |

3.6% |

Fail |

|

Dividend growth > 25% |

71.5% |

Pass |

|

Free cash flow payout ratio < 50% |

24% |

Pass |

Source: YCharts.

*Period begins at end of Q2 2010.

How we got here and where we're going

We first looked at Disney last year, and it has lost one grade in its second assessment, finishing with only five out of nine possible passing grades. As we saw last year, the company's free cash flow growth has not quite been able to keep pace with its net income. The company also raised a modest amount of debts which costs it that additional failing grade in this year's test. Disney could do better, but how much better? Let's dig deeper to find out.

Disney's shares have soared nearly 40% this year thanks to a combination of blue-chip branding and a highly defensible premium content position that enables it to charge higher fees to cable companies. Its broadcast options are also strong -- Disney's new Marvel-universe TV series, Agents of S.H.I.E.L.D., currently on its ABC network, has crushed CBS's (CBS +0.00%) hit drama NCIS with its third-week ratings. Fool contributor Travis Hoium also notes that Disney's ESPN brand remains the most valuable cable network, well ahead of any competitor.

On the other hand, Disney's recent release The Fifth Estate was a complete flop on the box office, which could impact Disney's next earning report not unlike the way John Carter sunk Disney's profitability last year. However, this one bomb won't be enough to torpedo investor's confidence in Disney's diverse entertainment empire, especially considering the slate of Marvel blockbusters still upcoming, to say nothing of the fact that Star Wars is now part of the Disney stable. Disney's control of these two world-famous franchises also gives them additional options for rides in their theme parks, which have yet to fully utilize Marvel's universe.

Fool contributor Matt Thalman notes that Disney is also making some excellent moves in the gaming business. The company sold more than 1 million copies of the figurine-based Disney Infinity since its launch in August, and it is well-positioned to take advantage of the critical holiday season. Disney is learning from the runaway success of Activision Blizzard's (ATVI +0.00%) Skylanders, which Fool contributor Jason Hall notes is already a billion-dollar franchise despite lacking the huge name-brand recognition of Disney's deep stable of characters. Disney is a much larger company, but that also means it has a legitimate shot at outpacing Activision in the figurine-gaming space.

Putting the pieces together

Today, Disney has some of the qualities that make up a great stock, but no stock is truly perfect. Digging deeper can help you uncover the answers you need to make a great buy -- or to stay away from a stock that's going nowhere.