If it's early in the morning and you need a little pick me up to go along with your caffeine fix, watch this quick clip (yes, it pertains to the company featured in this article).

What did you think? Was it disappointing? Invigorating? A ho-hum experience? Even if you were disappointed, you at least have to take into consideration the positive response from other YouTube viewers. Now let's get to why this video is so important.

New technology

Cinemark Holdings (CNK -4.01%) relies heavily on Cinemark XD for growth. Features for Cinemark XD include:

- Wall-to-wall & floor-to-ceiling screens

- Enhanced sound systems

- Digital images presented by Doremi server and Barco DLP projector (brightest light standards in industry, including 2D and 3D pictures)

- Plush seating

Of course, the video above won't do the theatrical experience any justice. In the theatre, Cinemark XD is meant to enhance your senses and make you feel as though you're closer to the action, or part of it.

Cinemark recently opened a Cinemark XD theatre in El Paso, Texas and it's not stopping there. The following are planned locations for other Cinemark XD theatres:

- Marina, CA

- Lakeland, FL

- Lexington, KY

- Lake Charles, LA

- Las Vegas, NV

- McCandless, PA

- Monroeville, PA

- El Paso, TX (another one)

- Pharr, TX

- Temple, TX

- Federal Way, WA

This list is more important than you might think, even if you're not a fan of the visual experience. That's because the digital benefits of Cinemark XD include reduced costs for production and distribution, as well as payroll reduction (no projection booth employees). In other words, Cinemark XD should improve margins which will then aid the bottom line.

Other reasons to be optimistic

In addition to growing technologically, Cinemark is growing geographically. On May 29, Cinemark acquired 32 theatres and 483 screens from Rave, which will extend Cinemark's footprint to New England. However, the real growth comes from Latin America.

For box office share, Cinemark ranks No. 1 in Argentina, No. 2 in Brazil, and No. 2 in Chile. This exposure to Latin America is very important. From 2007-2012, the industry's compounded annual growth rate in North America was just 2.4% versus 14.9% in Latin America. Cinemark's revenue growth for the same time frame was 4.6% domestically and 18.2% in Latin America.

For a better understanding of Cinemark's global exposure, consider that its 264.2 million customers exceeded the 179.6 million attendees for the MLB, NFL, NHL, NBA, and NCAA Football regular seasons combined. In 2007, Cinemark ranked No. 3 for attendance in comparison with other movie theatre companies. In 2012, it ranked No. 1.

Since Cinemark sends out more than 3 million emails each week to potential customers (with coupon offers), there shouldn't be much of a problem with repeat attendance. However, a lot will depend on the quality of movies being offered, which is out of Cinemark's control. Cinemark is also using innovations such as print-at-home ticketing and a lobby bar with beer, wine, and frozen cocktails to help drive attendance.

If you're looking to invest in a movie theatre company, then it might seem like this movie is over and the final credits are rolling. There's nothing left to do but consider an investment in Cinemark. However, one of its peers aims for a different type of growth and it might also present a quality opportunity.

Inorganic growth

Carmike Cinemas (NASDAQ: CKEC) is a domestic company. Therefore, logic would indicate that its growth potential is limited because the domestic market has matured. Carmike Cinemas has come up with a different type of plan to help fuel growth.

In November 2012, Carmike Cinemas acquired 16 entertainment complexes from Rave Review Cinemas. That might not stand out as a groundbreaking move, but this acquisition included seven IMAX (IMAX 2.04%) theatres. In August of this year, Carmike Cinemas also acquired three entertainment complexes from Cinemark. This deal included eight IMAX theatres. Currently, Carmike Cinemas owns 18 IMAX theatres, and it just signed a 10-theatre deal with IMAX for revenue generation on new constructions in the United States.

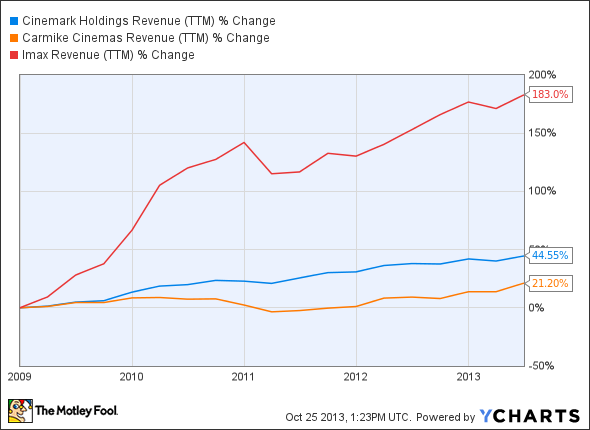

It's apparent that Carmike Cinemas is relying heavily on IMAX's potential. If you happen to be concerned about IMAX's potential, take a gander at its top-line growth over the past five years:

CNK Revenue (TTM) data by YCharts

IMAX also sports a debt-to-equity ratio of 0.07 which indicates that it's growing without the need for leverage. This should be comforting to investors. IMAX doesn't offer any yield, whereas Cinemark yields 3.10%, but Cinemark is highly leveraged with a debt-to-equity ratio of 1.92. Carmike Cinemas doesn't offer any yield and it is even more leveraged, sporting a debt-to-equity ratio of 2.86.

The bottom line

All three companies offer strong growth potential, just in different ways. If the global economy holds its own, then Cinemark's growth should allow it to generate enough cash to pay off debt. This would be a big win for an investor because you would receive a generous yield all the while. Carmike Cinemas has the potential to outgrow its debt, but to a slightly lesser extent since it's operating in a mature market. It also doesn't offer any yield while you wait. If capital preservation is a priority and you want to invest in a company that offers growth potential without being leveraged, consider IMAX.