Chipotle Mexican Grill (CMG +0.29%) has made its investors very happy over the past year, with the stock appreciating 109%. Even if you were late to the party and you invested one month ago, you enjoyed a 25% return. In a non-raging bull market, that would be an excellent return for a year. The question now is whether or not Chipotle can keep its runaway train churning.

Understanding Chipotle

Chipotle has been successful for two primary reasons:

- It uses the highest quality ingredients it can find. This drives many consumers to its locations.

- It offers a unique fine-dining approach to fast food. Unique concepts tend to drive growth, as consumers are always looking for something new and exciting.

Whatever the case may be, Chipotle has been on a tear over the past several years. This doesn't just pertain to the stock, but the underlying business as well.

Recent results

In the third quarter, revenue jumped 18% to $826.9 million with comps improving 6.2%. Comps are the most important number since they don't include new restaurant sales, which can skew growth numbers. The impressive 6.2% comps improvement proves that consumers are returning to Chipotle Mexican Grill on a regular basis. Chipotle also impressed on the bottom line with diluted earnings per share skyrocketing 17.2% to $2.66.

If you look at the bigger picture, Chipotle still delivered strong numbers. For the first nine months of the year, revenue climbed 16.7% to $2.37 billion with comps increasing 4.3% and diluted EPS improving 16.6% to $7.93.

For the fiscal year, Chipotle expects comps to be in the mid-single digits. For fiscal year 2014, comps are expected to be in the low single digits.

By the end of this year, Chipotle will have opened 165 to 180 new restaurants. This is a bullish sign. As many restaurant companies reduce their store count or at least plan on slowing their new store growth, Chipotle Mexican Grill is still pushing full steam ahead. This indicates that the company is highly confident in its ability to remain profitable while still growing the top line. Chipotle doesn't plan on slowing down in 2014, when it plans to open 180 to 195 new restaurants.

One potential negative is that menu prices will likely increase in 2014 due to cost inflation and higher food costs. Consumers are already paying a premium for higher-quality food. If prices increase, this could impact demand, but that isn't likely. Most consumers who fall in love with a brand aren't going to stop eating at that destination due to slight price increase. Some of them won't even notice it.

Chipotle Mexican Grill vs. Taco Bell

Goldman Sachs did a study on these two competitors back in September 2012. This is somewhat old news, but the point here is that momentum is very difficult to contain. After this study showed that Taco Bell's brand equity score moved higher to 64.8 from 62.1 while Chipotle Mexican Grill's brand equity score moved lower to 65.8 from 70.4, many people believed that Taco Bell's parent company Yum! Brands (YUM 0.14%) would outperform Chipotle going forward. Let's take a look at how that turned out:

On the surface, this analysis made some sense. Taco Bell's Cantina Bell Menu and Doritos Locos Tacos were driving more traffic. Ironically, diversification worked against Yum! Brands. When you invest in Yum! Brands, you're also investing in Pizza Hut, Kentucky Fried Chicken, and the performance of those brands in India and China. The avian flu and the questioning of the quality of chicken used at Kentucky Fried Chicken in China drove the stock down. In the long run, this might present a buying opportunity. However, that's a story for another time.

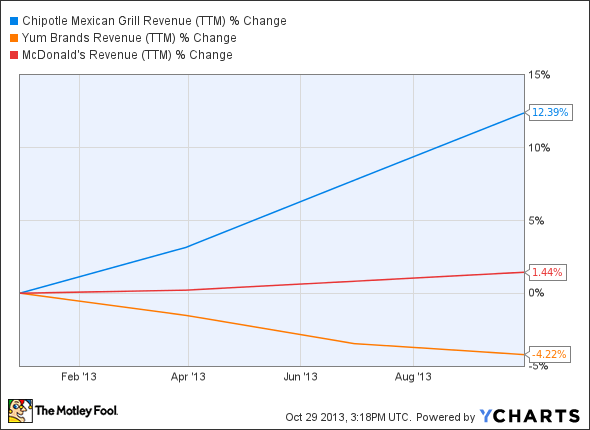

Chipotle might be growing quickly, and Yum! Brands is well diversified, but they both must compete against the most popular quick-service restaurant in the world, McDonald's (MCD +0.80%). Let's see how Chipotle and Yum! Brands stack up against McDonald's on the top line:

CMG Revenue (TTM) data by YCharts.

Chipotle is the fastest-growing company of the three, which should be expected. What might surprise you is that it's also the top performer on the bottom line over the past year:

CMG EPS Diluted (TTM) data by YCharts.

With all these positives for Chipotle, it might seem like a no-brainer investment. There's only one factor that should keep optimism in check -- it's trading at 53 times earnings. If you're looking for growth and you're comfortable with risk, then the valuation isn't a concern. If you're looking for more safety in the restaurant space, then consider some key metrics below:

| Company |

Trailing P/E |

Net Margin |

Dividend Yield |

Debt-to-Equity Ratio |

|---|---|---|---|---|

|

Chipotle Mexican Grill |

53 |

10.07% |

N/A |

0.00 |

|

Yum! Brands |

28 |

8.48% |

2.20% |

1.27 |

|

McDonald's |

17 |

19.97% |

3.40% |

0.88 |

Source: Company financial statements.

Not only is McDonald's the most appealing on a valuation basis, but it's the best of the three at turning revenue into profit, and it yields a generous 3.40%. While it's not growing as fast as Chipotle, it's still growing despite its age.

The bottom line

Chipotle is still growing at a rapid rate. If you're only paying attention to investing in a strong underlying company, then disregard valuation and take a stake for the long haul. You can always add on dips if you're wise enough to invest incrementally. If you're looking for more safety and ultra-safe dividend payments, take a look at McDonald's.