Warren Buffett, the chairman and CEO of Berkshire Hathaway (NYSE: BRK-A) (NYSE: BRK-B) is a household name, and according to Bloomberg, he has an estimated net worth of $59.3 billion, making him the fourth wealthiest person on the planet-- but there are five things you may not know about the affectionately titled "Oracle of Omaha."

1. Harvard turned him down

Warren Buffett is rightly characterized as a hometown guy from the Midwest who has a particular affinity for Cherry Coke, McDonald's, and See's Candy (all businesses he owns shares of, or has owned in the case of McDonald's) -- but he is also outrageously intelligent.

Buffett graduated high school at age 16 and promptly enrolled in Ivy League stalwart the University of Pennsylvania, but transferred closer to home to the University of Nebraska after two years. Upon graduating college in 1950, he applied to Harvard business school, and then went to Chicago to be interviewed by a Harvard alum. A 1988 Fortune magazine story chronicles the interview like this:

"What this representative of higher learning surveyed, Buffett says, was ''a scrawny 19-year-old who looked 16 and had the social poise of a 12-year-old.'' After ten minutes the interview was over, and so were Buffett's prospects of going to Harvard. The rejection stung."

2. He learned the most from a guy you've likely never heard of

When it comes to Buffett, it'd be easy to think that arguably the greatest investor to live would have learned his principals from the other titans of American industry like John Rockefeller, Andrew Carnegie, or Henry Ford, but he instead credits a professor at Columbia: Benjamin Graham.

Buffett read The Intelligent Investor in college, studied under him at Columbia, and although he was rejected at first (even despite offering to work for free), Buffett was ultimately offered a job under Graham in 1954. While their pupil-student relationship did not last an extended period of time, it left an indelible impact on Buffett, with him going so far as saying;

I benefited enormously from the intellectual generosity of Ben Graham, the greatest teacher in the history of finance, and I believe it appropriate to pass along what I learned from him, even if that creates new and able investment competitors for Berkshire just as Ben's teachings did for him.

3. He's really good at what he does

OK -- so Warren Buffett has nearly $60 billion, and it is easy to think that maybe he just lucked his way into his massive fortune, or simply caught a few lucky breaks. Think again.

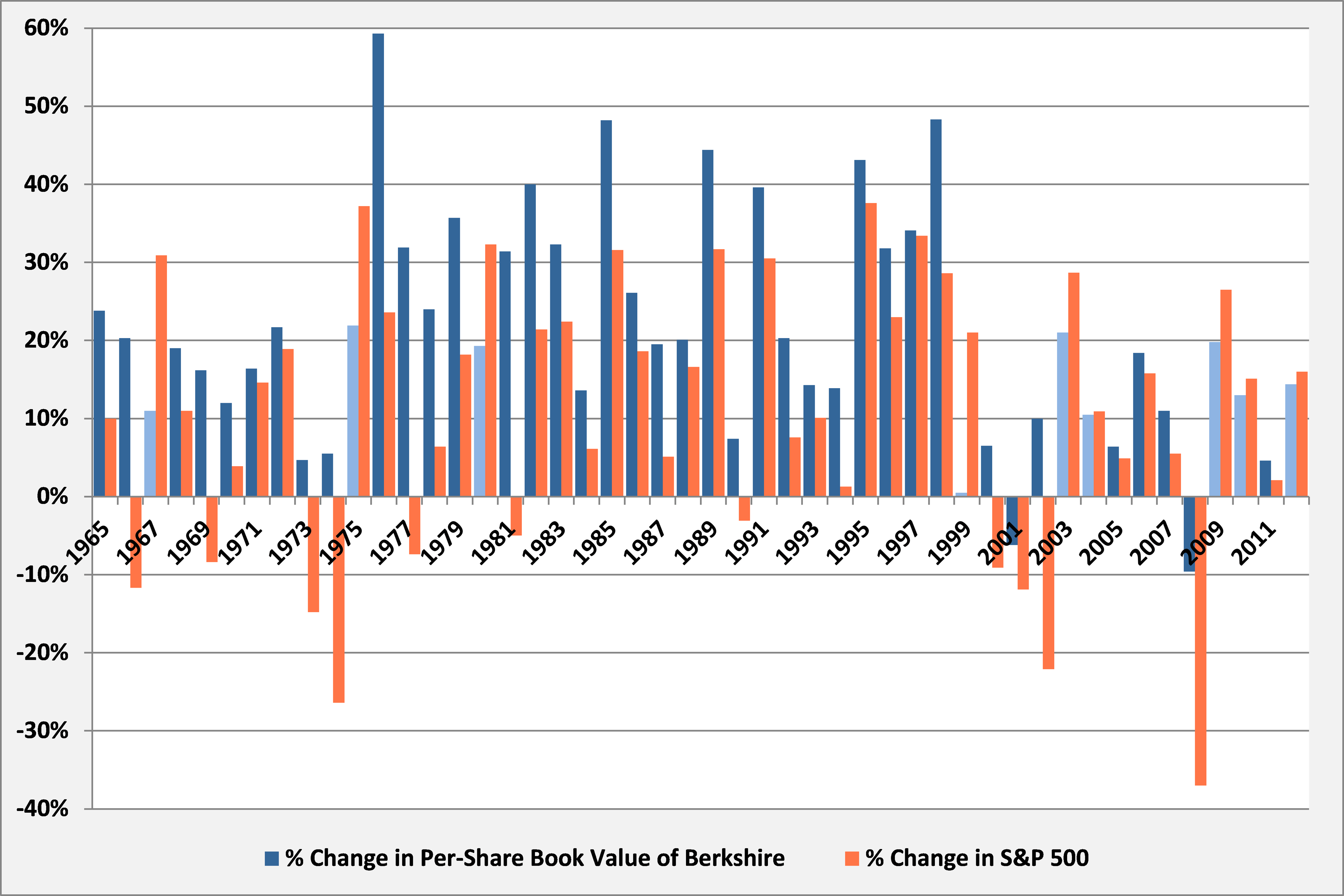

On the contrary, Buffett has delivered one of the most remarkable and consistent strings of outsized returns. From 1965 to 2012, a period of 48 years, Buffett's company, Berkshire Hathaway, has delivered an astounding 19.7% annual growth in its book value per share, compared to a return on 9.4% for the S&P 500. While that certainly doesn't sound like much of a difference, if you'd invested $100 in the S&P 500 on January 1, 1965, you'd have $7,433. If you'd put that same $100 into Berkshire Hathaway? $586,417.

The chart below shows the average annual return for Berkshire Hathaway compared to the S&P 500, with the years in which Buffett didn't beat the market highlighted in light blue:

Source: Berkshire Hathaway Annual Letter to Shareholders.

Only twice has Berkshire Hathaway's book value per share gone down, compared to 11 for the S&P 500, and it has failed to beat the market just 9 of the 48 times. But in the years following those where Buffett hasn't beaten the market, the company has grown its book value on average by 12.2%, compared to just 6.7% at the S&P 500.

While the likelihood of someone beating the market in a single year is tough to come by, if it is a little worse than a coin flip, at 40%, the odds of doing it for 39 of 48 tries is 1 in every 195,766,514.

4. His father was a four-time congressman

Warren Buffett has spent most of his life not engaging in many political discussions. However, the same was not true of his dad, Howard Buffett, who was a four-time congressman.

His father was not simply a congressman, though -- he too was an investor and a successful businessman who gave Buffett his first $20 when he was six years old. Buffett would later turn that $20 into $120 through diligent saving and scheming of business opportunities, and would buy his first three shares of stock when he was 11 years old.

Warren even named his son Howard, and once said, "I had two mentors: my dad, Howard Buffett, and Ben Graham. Here were these two guys who I revered and who over the years gave me tons of good advice."

Certainly Buffett learned a lot from Graham -- but you cannot discount what he learned from his father.

5. He doesn't consider himself the most important person at Berkshire

It's easy to think that the above sentence is a flat-out lie, but as it turns out, Buffett doesn't consider himself the most important person at his own company. Perhaps that title instead belongs to Ajit Jain, the head of Berkshire Hathaway's Reinsurance division, who Buffett has remarked, "If Charlie [Munger -- the second in command at Berkshire Hathaway], I and Ajit are ever in a sinking boat -- and you can only save one of us -- swim to Ajit," while also adding, "It is impossible to overstate how valuable Ajit is to Berkshire. Don't worry about my health; worry about his."

While I may not have the answer to who exactly Buffett would say is the most important person at Berkshire, I think we all know that truly he is the most important person, but his humility keeps him from believing it. And that is what I most admire about Buffett. Although he will go down as one of the greatest investing minds and practitioners to ever walk the planet, he maintains his grounding living in Omaha, staying in his modest home that cost him $31,500 in 1958, and heaping praise on those around him.

Regardless of what you think of capitalism or investing, Buffett is someone whose book we could all take a page out of, and not simply as it relates to investing, but living as well.