High yielding stocks can be very enticing, especially when bond yields have been so anemic. But, how much risk are you really accepting? Monmouth Real Estate (MNR +0.00%), Whitestone REIT (WSR +0.36%), Rexford Industrial (REXR +1.53%), and Select Income REIT (NYSE: SIR) all have potential concentration risk. However, for one of these companies, I think rather than adding risk, this concentration could represent a huge advantage.

Let's take a closer look

Monmouth Real Estate has been a publically traded industrial REIT since 1968. It has paid out a dividend for 21 years in a row. The current dividend yield is north of 6.5%. The Monmouth portfolio of properties is geographically diverse with 80 properties located in 27 states. Monmouth has a fortress balance sheet. The potential fly in the ointment is that Monmouth is heavily concentrated -- with about 50% of its lease revenue coming from FedEx (FDX 0.20%). The majority of the other tenants are all investment grade, with no other tenant accounting for more than 4% of annual revenue.

The world of e-commerce fulfillment and delivery appears to be a very dynamic space. Amazon.com (AMZN +0.27%) recently announced that the U.S. Postal Service will be its delivery partner for Sundays. This week, Amazon CEO Jeff Bezos unveiled plans for Amazon Prime Air, where an unmanned aerial vehicle would deliver small packages directly from Amazon fulfillment centers -- in as little as 30 minutes after an online order. All of a sudden, there could be another potential risk in being a FedEx landlord.

Whitestone REIT is a small retail REIT that operates 58 properties in just five cities located in three states. Although it is highly concentrated geographically, no single tenant represents more than 1.6% of its annual lease revenue. In fact, Whitestone has 1,200 tenants mostly under 3,000 square feet in its Community Centered Properties -- niche properties serving diverse communities.

The high yield, currently 8.5%, certainly reflects a risk premium. Based upon the earnings conference call for the quarter ending Sept. 30, 2013, the company will have to achieve certain operational goals in order for the dividend to be covered by funds from operations, or FFO.

Additionally, because it's only 85% occupied, one or two large tenant disputes could also impact the ability to fund the current dividend from FFO. The concentration of smaller local tenants in just a few cities contributes to the risk of bad debts and increased leasing and tenant improvement expenses.

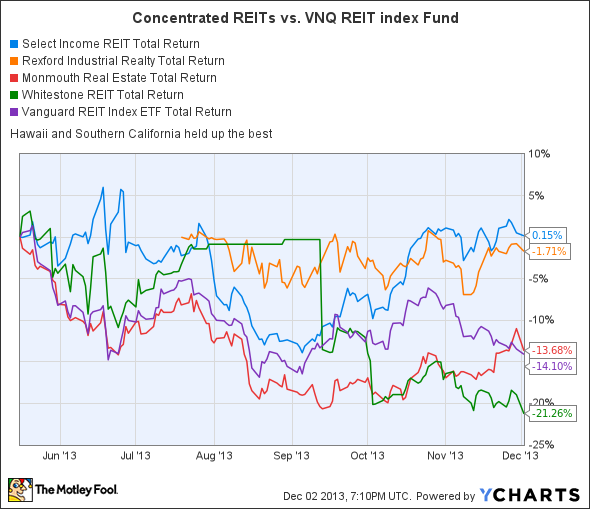

Rexford Industrial is the new kid on the block and has yet to announce a dividend. In spite of that, investors must believe in the business model. As you can see in chart above, Rexford has withstood the recent decline in the REIT sector better than most peers. The Rexford secret sauce is that it owns properties located in Southern California markets. These are mostly infill locations with high barriers to entry restricting additional supply. This results in relatively higher rents.

Rexford has a diverse tenant mix of about 700 tenants. No one tenant occupies a significant amount of square footage. The bad news is that this portfolio is concentrated in a region with seismic risks. The Rexford management team has successfully managed an office portfolio in Southern California in the past. They understand the risks. It is important that you as a potential investor consider them as well.

Breaking all the rules

Select Income REIT is also a relatively new publically traded REIT. However, Select has paid a dividend consistently since its March 2012 IPO. It currently yields about 6.7%. In contrast to Whitestone REIT, the Select distribution payout is well covered at only 60% of FFO. The Select portfolio stands at 95.6% leased, with an average remaining term of 11 years. They've been able to negotiate 50% increase on rents reset in 2012, and so far in 2013.

How is that possible? They are highly concentrated in Oahu, Hawaii, with over 17 million square feet of land leased to credit tenants. These land leases get reset to market rates periodically. They have 229 tenants in Hawaii, but only 12 occupy buildings totaling 550,000 square feet. The land leases are the secret sauce.

Currently, 53% of total company revenue comes from U.S. mainland properties. During 2013, Select acquired 23 additional properties at a very favorable 8.9% cap rate -- with an average remaining lease term of 12 years. The majority are single-tenant triple-net leases, so cash flow is predictable.

Investor takeaway

Usually high concentration of either the tenant mix or geography adds an element of risk for investors looking for steady dividends and an attractive yield. My sense is that Select Income REIT is the rare exception.

The supply of land on Oahu is severely limited. The demand continues to be very strong. The real kicker is that even in the event of a typhoon or other natural disaster, it would not be an issue. The land leases are still in place, and the tenants shoulder that risk. I recommend income investors take a close look at this unique business model. Aloha!