Some Pandora (P) investors might be a little confused at the moment. The stock has appreciated 194.8% year to date, yet it has depreciated 0.33% over the past month. A loss of less than 1% is nothing to panic over, especially over the course of a month, but the loss of momentum in the stock price might indicate more concerns about the company's underlying business model and future potential.

Elusive profitability

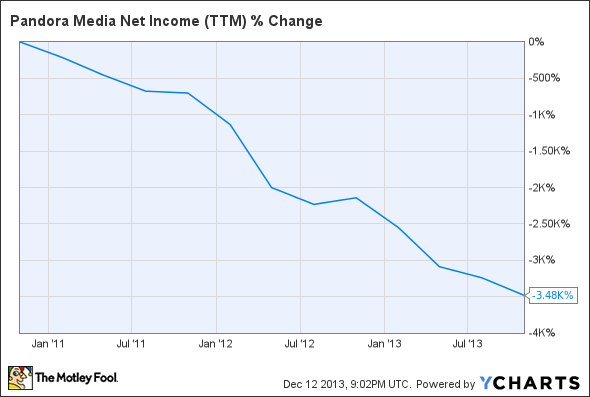

Pandora has seen significant top-line growth over the past five years, to the tune of 416.3%. It's clear that Pandora has strong future potential. However, investors are beginning to wonder when, and how, that potential will translate into actual bottom-line results. While top-line growth has been phenomenal over the past five years, the bottom line has been the polar opposite:

P Net Income (TTM) data by YCharts.

As of Oct. 31, Pandora's active users totaled 70.9 million, an increase from a total of 65.6 million as of Jan. 31. While this increase should inspire at least a little confidence in the company's future prospects, Pandora's content acquisition costs increase with each listener hour, regardless of whether or not revenue is being generated.

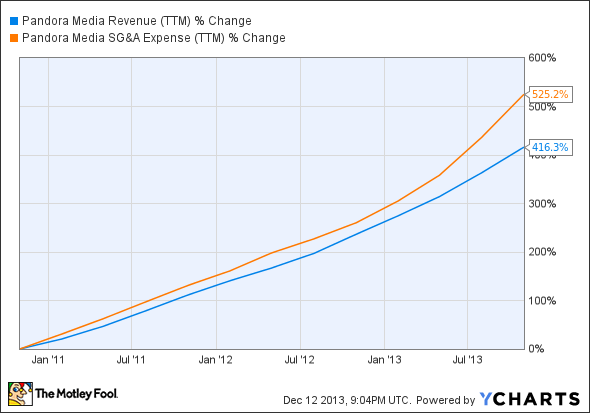

One good way to examine a company's health (though there are many ways to do so) is to see if revenue is outpacing SG&A expenses. Consider Pandora's top-line performance versus SG&A expenses over the past five years:

P Revenue (TTM) data by YCharts.

That's a wide gap that might take years to close. Pandora even stated on its most recent 10-Q that it expects annual losses in the near term.

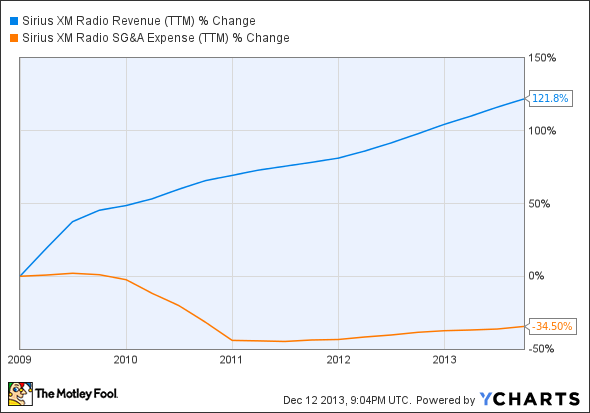

If you're reading about Pandora, then there's a good chance that you also follow Sirius XM (SIRI -4.43%). If that's the case, then consider the difference in revenue versus SG&A expenses for Sirius XM versus Pandora:

SIRI Revenue (TTM) data by YCharts.

Apple (AAPL 0.52%), with its iRadio pre-installed in all Apple devices, is yet another threat to Pandora. While Apple offers a lot more than iRadio, the ultimate goal here is to find the best investment. Apple is broadly diversified, and its revenue has clearly outpaced its SG&A expenses over the past five years:

AAPL Revenue (TTM) data by YCharts.

Apple and to a lesser degree Sirius XM are more solidified and profitable companies. However, you may want the most top-line growth potential, which often leads to the most stock appreciation. Yet Pandora's relentless top-line growth isn't guaranteed to continue, and if it falters, there isn't anything to buoy the stock price.

Important numbers

Apple is an enormous company. It currently has a market cap of $505 billion. It also generated $53.67 billion in operating cash flow over the past 12 months. This cash flow is what makes Apple so powerful, allowing it to make large reinvestments in its business while also returning capital to shareholders. For instance, Apple currently yields 2.30%.

Sirius XM is a much smaller company than Apple, with a market cap of $21.32 billion. However, Sirius still generates positive cash flow. Over the past year, it generated $1.04 billion in operating cash flow. Therefore, Sirius also has significant capital to reinvest in its business, especially since it doesn't pay a dividend. However, Sirius' balance sheet with $720.47 million in cash and short-term equivalents versus $3.71 billion in long-term debt isn't as healthy as Apple's balance sheet with $40.59 billion in cash and short-term equivalents versus $16.96 billion in long-term debt.

With those numbers in mind, consider that Pandora, with a market cap of $4.95 billion, generated negative operating cash flow of $2.44 million over the past year. As you might have guessed, it doesn't offer any yield; it can't afford to pay a dividend. The good news is that Pandora's balance sheet is spectacular, with $447.83 million in cash and short-term equivalents and no long-term debt. This is a tremendous positive because interest on debt won't impede the company's top-line potential. However, if Pandora doesn't drive positive cash flow, it will need to use this cash to reinvest in its business.

Perhaps the most important number of all is 82%. That's the percentage of total revenue that stems from advertising for Pandora. The advertising market is cyclical. If it sours, which based on historical trends will eventually happen, Pandora will find itself in even more of an uphill battle on the profitability side.

The bottom line

Of these three companies, Pandora offers the most growth potential, but this top-line potential comes with extreme risk. Whether to invest in the company or not is up to your own due diligence as well as your risk tolerance. Personally, I would opt for Sirius XM or Apple, with Apple being the top choice due to its significant cash flow, healthy balance sheet, broad product diversification, strong global brand, and decent yield.