Many investors have soured on McDonald's (MCD -0.42%) recently. This is logical on the surface. After all, regardless of how McDonald's is trying to recast itself in consumers' eyes as a" quick-service restaurant," it's still seen as a "fast-food chain." This especially works against it given the rise of the health-conscious consumer. Sorry, McDonald's, but perception is everything.

However, the irony about some investors souring on the company is that they appear to be behind the curve. These investors are looking at what has already taken place and selling their McDonald's shares. In order to be a successful long-term investor, you need to look ahead.

Top-line performance lags

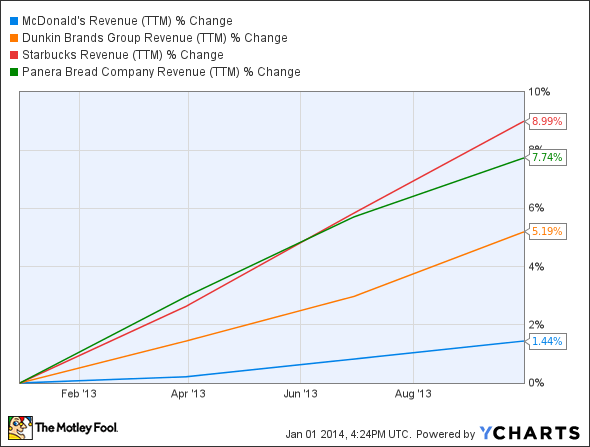

McDonald's isn't as exciting of an investment as in the past because of other growth franchises, such as Starbucks (SBUX -1.02%), Dunkin' Brands (DNKN), and Panera Bread (PNRA). As far as Starbucks goes, some people see it as more of a value play these days. Based on the company's top-line performance over the past year, I would have to disagree:

McDonald's revenue (trailing 12 months) data by YCharts.

Starbucks infiltrates upscale urban and suburban areas with incredible precision, and now that the company is attracting more than just the college and professional crowds, partially thanks to offering more breakfast and lunch items, it has an opportunity to expand into all areas. Therefore, there is still much room for growth. Also consider that these menu changes will attract more families at current locations, which should lead to increased sales.

Getting back to McDonald's, it has been the weakest top-line performer of the four over the past year, which might lead you to think that McDonald's isn't the best investment option of the group. From a growth-potential standpoint, you would be correct. But the best growth potential doesn't always equate to the best overall investment.

Keeping up with the competition

McDonald's now offers high-quality coffee, made with 100% arabica beans. And the coffee is freshly brewed every 30 minutes. This has the potential to steal market share from Starbucks, but it won't be easy. Starbucks customers are extremely loyal, and McDonald's isn't known for offering a high-end and comfortable atmosphere like Starbucks. Restaurant modernizations for McDonald's should help, but it's going to take a long time.

McDonald's has a better chance of stealing market share from Dunkin' Brands, whose Dunkin' Donuts tends to attract more middle-income consumers. If McDonald's can successfully market its McCafe to the correct audiences, then more potential exists here. However, McDonald's might need to worry about Dunkin' Brands more than Dunkin' Brands needs to worry about McDonald's. That's because McDonald's restaurants can be found in almost every city and town in the country. Dunkin' Donuts is expanding west domestically, looking to add 330 to 360 new locations this year alone. The novelty alone will help attract crowds. It's up to Dunkin' Brands to keep those customers.

On the food side, McDonald's needs to offer more healthy items. Despite having 33,510 locations versus Panera Bread's 1,541 locations, McDonald's knows that Panera Bread shouldn't be underestimated. Its healthy menu offerings are ideal for today's health-conscious consumer. Panera Bread's food is in high demand, which, combined with an atmosphere similar to Starbucks (free Wi-Fi and customers can stay as long as they want) has led to consistent growth.

McDonald's has made several changes to attract more health-conscious families, including 1% low-fat milk, water, 100% orange juice, and Minute Maid 100% apple juice boxes. As far as McDonald's versus Panera Bread, McDonald's is on the right track, but its Favorites Under 400 list (under 400 calories) isn't going to cut it perception-wise since the list still includes unhealthy items like cheeseburgers, french fries, and chicken McNuggets.

So... why be bullish on McDonald's?

It's a different kind of bullish

Most investors are impatient and aiming for the most growth potential so they can make a quick buck. This can work. Actually, it can work several times in a row and lead to tremendous wealth gains, especially in the current stock market environment. However, it will eventually get you. Growth companies that run into surprise trouble sell off faster than a hungry Greyhound chasing a lure.

McDonald's might not be a top-notch growth story anymore, but its approach is geared toward sustainable and profitable growth, and it's currently working toward that goal with a methodical and unrushed approach to menu adaptation and restaurant modernization. Perhaps most important for long-term investors is that McDonald's generates a ton of cash flow ($7.1 billion over the past year), which means consistent share buybacks as well as generous and safe dividend payments. McDonald's currently yields 3.3%. This is much higher than Starbucks at 1.3% and Dunkin' Brands at 1.6%. Panera Bread doesn't offer a dividend.

All four of these companies are of high quality. They're just for different types of investors. If you happen to want safety (resiliency to downside economic and stock market moves) and capital returns to shareholders without sacrificing moderate growth potential, then McDonald's is likely the best option for you.