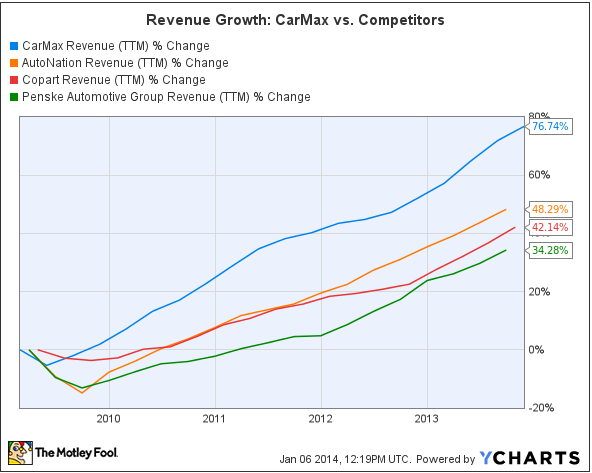

CarMax (KMX 2.02%) has fallen by more than 12% since reporting earnings numbers below Wall Street analysts' expectations on December 20. But the company has a smart and differentiated business model allowing it to outgrow competitors like AutoNation (AN 0.70%), Copart (CPRT 0.10%), and Penske (PAG 2.38%) over the last years. The dip in this high-quality used-car retailer may easily turn out to be a buying opportunity for investors.

The numbers

The market tends to exaggerate its short-term reaction to earnings figures, and that seems to be the case with CarMax. Earnings per share of $0.47 during the quarter were barely below analysts' forecast of $0.48 per share, but the company is still performing quite well.

Revenues increased by 13% to $2.94 billion fueled by a 15% increase in total unit sales and a 10% rise in used unit sales in comparable stores. Total wholesale unit sales increased by 4% and CarMax Auto Finance income grew 16% to 83.9 million during the quarter. Net earnings per diluted share increased by a healthy 15% year over year.

Third-party subprime credit providers accounted for nearly 18% of the company's sales versus 15% in the same quarter of the previous year. Third-party subprime volume has been increasing over the last years, and management has detected a tightening of the credit terms offered to clients late in the quarter. For this reason, the company is planning to launch a small test to learn more about originating and servicing customers who would typically be financed by subprime providers.

Fluctuating credit conditions can always be a source of uncertainty in the auto industry, and this may have been one of the biggest reasons for concern in the recent earnings release.

On the other hand, the company is still delivering strong growth in both sales and earnings. Management plans to open 14 new superstores in the coming year, so things are looking quite well when it comes to growth prospects in the middle term.

The way car buying should be

CarMax is the leading used car dealer in the U.S., and the company has materially outperformed competitors like AutoNation, Copart, and Penske in terms of revenue growth over the last five years. In such an aggressively competitive industry with low profit margins, competitive strength is of utmost importance when making investment decisions.

Source: YCharts.com.

The company's slogan, "The way car buying should be," says a lot about CarMax and its differentiated business strategy. As opposed to the typical high-pressure sales tactics and obscure sales terms used by most competitors, CarMax follows a customer-friendly and transparent approach to the business, which resonates remarkably well among customers.

Sales employees work on fixed commissions, so they make the same amount of money regardless of which car the customer buys. This means they don't have the incentive to push cars that generate higher margins for the company, and they can focus their time and energy on finding the best vehicle for each customer.

CarMax has a no-haggle pricing policy, which makes the negotiation process much simpler and comfortable. The process is also more transparent than at competing companies, the price of the car the customer is buying does not change depending on factors like vehicle trade-ins, and customers get to see the same information as the sales associate on a computer screen.

Salespeople seem to be really happy with CarMax's approach. The company has been in the Fortune "Best 100 Companies to Work For" over the last nine consecutive years. Not surprisingly, a happy and well-incentivized workforce is doing wonders in terms of customer satisfaction: 93% of customers say they would recommend the company to a friend, and that figure has been consistently increasing over the last years.

This customer-centric approach to the business has allowed CarMax to build other sources of competitive strength as it gains market share versus the competition. Brand recognition, inventory variety, economies of scale, and geographical reach are other important factors differentiating CarMax from other industry players and providing superior long-term growth prospects for the company.

Bottom line

CarMax missed earnings by a penny in the last quarter, and fluctuating financing conditions are a relevant risk to watch. However, this high-quality company is still performing strongly. More importantly, it has what it takes to continue outgrowing the competition for years to come. A high-quality vehicle selling at a discounted price is usually considered a buying opportunity. Under a similar criteria, this unique car dealer is looking like a convenient purchase.