Investors love stocks that consistently beat the Street without getting ahead of their fundamentals and risking a meltdown. The best stocks offer sustainable market-beating gains, with robust and improving financial metrics that support strong price growth. Does Walgreen (WBA -1.18%) fit the bill? Let's look at what its recent results tell us about its potential for future gains.

What we're looking for

The graphs you're about to see tell Walgreen's story, and we'll be grading the quality of that story in several ways:

- Growth: Are profits, margins, and free cash flow all increasing?

- Valuation: Is share price growing in line with earnings per share?

- Opportunities: Is return on equity increasing while debt to equity declines?

- Dividends: Are dividends consistently growing in a sustainable way?

What the numbers tell you

Now, let's look at Walgreen's key statistics:

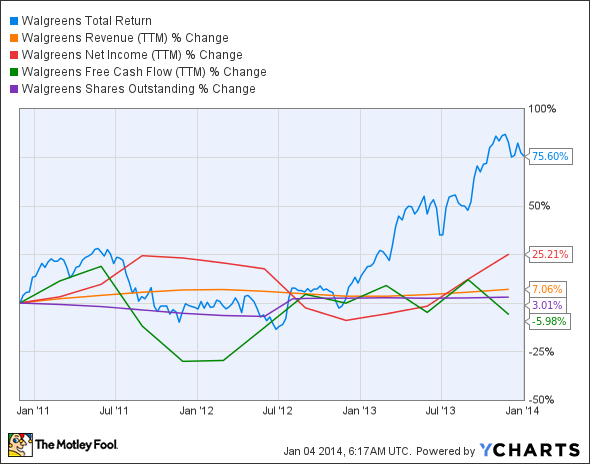

WAG Total Return Price data by YCharts

|

Passing Criteria |

3-Year* Change |

Grade |

|---|---|---|

|

Revenue growth > 30% |

7.1% |

Fail |

|

Improving profit margin |

17% |

Pass |

|

Free cash flow growth > Net income growth |

(6%) vs. 25.2% |

Fail |

|

Improving EPS |

26.5% |

Pass |

|

Stock growth (+ 15%) < EPS growth |

75.6% vs. 26.5% |

Fail |

Source: YCharts.

*Period begins at end of Q4 (Nov.) 2010.

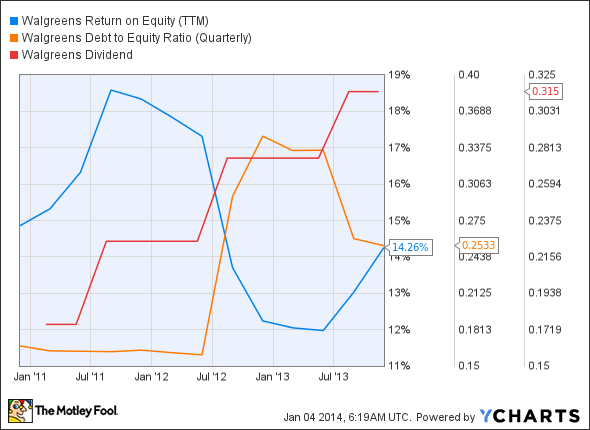

WAG Return on Equity (TTM) data by YCharts

|

Passing Criteria |

3-Year* Change |

Grade |

|---|---|---|

|

Improving return on equity |

(4%) |

Fail |

|

Declining debt to equity |

51.5% |

Fail |

|

Dividend growth > 25% |

80% |

Pass |

|

Free cash flow payout ratio < 50% |

41.6% |

Pass |

Source: YCharts.

*Period begins at end of Q4 (Nov.) 2010.

How we got here and where we're going

We looked at Walgreen last year, and it has dropped one passing grade in its second assessment to finish with a modest four out of nine possible passing grades. Walgreen's free cash flow growth has collapsed over the last year, but it can still maintain healthy dividend payouts at current levels. More worrying is that Walgreen's stock growth has outpaced the gains in its net income, which demonstrates investor confidence but which might also indicate a looming correction if the company's fundamentals fail to rise. How might Walgreen push its fundamentals higher on the heels of Obamacare's rollout? Let's dig a little deeper to find out.

In the latest quarter, Walgreen's top and bottom lines improved by 6% and 66%, respectively, thanks to staggering growth in its prescription business, which now accounts for more than 64% of total sales. Fool contributor Travis Hoium points out that Walgreen is poised to capture a large amount of the prescription market due to rapid urbanization across the U.S. However, Walgreen's pharmacy segment may fall short of rival CVS Caremark's (CVS -0.65%) highly integrated business model, which includes both pharmacy stores and pharmacy benefit management solutions, and which tends to provide superior negotiation and scale advantages over its industry peers.

Walgreen and CVS have been putting forth huge efforts to diversify their businesses away from the traditional retail pharmacy model. Fool contributor Anh Hoang notes that Walgreen has lucrative partnerships with Alliance Boots, the leading European integrated wholesale retailer, and AmerisourceBergen, a U.S. pharmaceutical service wholesaler, which could give it the heft to demand lower pricing from drug manufacturers. By contrast, CVS' faster adoption of margin-friendly health care services such as MinuteClinics, which are expected to number 10,500 locations by 2017, could deliver substantial service revenue growth in the next few years. Smaller peer Rite Aid (RAD -51.21%) continues to shut unprofitable locations, focus on cost control, and introduce more generic drugs, which could lure cost-conscious consumers from the market leaders. Fool contributor Todd Campbell notes that the generic drugs market could gain significant traction as a number of high-profile patents expire. CVS is already pushing hard in this direction, as it recently entered into a partnership with Cardinal Health (CAH 0.26%), creating the U.S. largest generic sourcing entity.

CVS, Walgreen and Rite Aid are all trading at similar forward P/E levels (14.5, 15.7 and 14.9, respectively), but Walgreen sports the highest dividend yield of the trio, making it the first choice for yield-hungry investors:

WAG Dividend Yield (TTM) data by YCharts

Recent changes to the insurance market as a result of Obamacare have caused a boom in the number of in-store health care clinics in the U.S. Walgreen's Take Care clinics are now available at around 400 locations as compared to 350 in 2012, and are expected to rise at a faster rate in the coming years. Since the Affordable Care Act is expected to add 30 million people to insurance rolls, smaller grocery-focused players such as Kroger have also been looking to expand their health-care footprints and resources. Seniors, the formerly uninsured, and existing health care consumers should make greater use of retail health-care clinics for immunizations, chronic care, and cold and flu diagnosis and treatment. Fool contributor Lee Samaha notes that Walgreen has even teamed up with Theranos to launch lab testing service inside its stores.

Putting the pieces together

Today, Walgreen has some of the qualities that make up a great stock, but no stock is truly perfect. Digging deeper can help you uncover the answers you need to make a great buy -- or to stay away from a stock that's going nowhere.