Back in 2009, investors hoping to escape the market's volatility and cash in on big dividends flocked to Realty Income (NYSE: O) and National Retail Properties (NYSE: NNN) and were rewarded with a monster 150% total return.

However, with interest rates on the rise over the last year, you may be wondering if these safe havens can hold up against an all-out rising interest rate assault. My contention is that these companies business model, mixed with historical precedent, proves interest rates will have little to no baring on Realty Income and National Retail's future success.

The business model

Realty Income and National Retail fund property purchases through selling new shares of stock or borrowing money by issuing notes and bonds. Of the two, borrowing money is certainly linked with interest rates. If lower interest rates favor the borrower, we'd expect to see property acquisition increase more when rates are low, as compared to a higher interest rate environment.

However, that doesn't seem to be the case. Realty Income and National Retail grew assets between 2004 and 2007, when rates were rising. And again between 2009 and 2012, when interest rates were low.

The two companies looked strongest before and after the financial crisis -- which peaked in 2009. From this, we can see that REITs correlate better with the strength of the economy, rather than strictly interest rates.

What about the dividend?

Higher interest rates can increase borrowing costs -- perhaps cutting into profits and lowering the companies dividend?

That, again, doesn't seem to be the case. Short-term rates (LIBOR) as well as longer-term rates (10-year U.S. Treasury bonds) have been up and down over the last decade, but Realty Income and National Retail's dividend has steadily increased.

Do interest rates affect anything?

REITs aren't bonds, but they trade like bonds. Meaning, interest rates will influence stock prices. Here's why: U.S. Treasury bonds are as close to a guaranteed investment as you'll find. Therefore, for a more risky investment to be worth taking, there has to be a greater yield -- or, at least a greater potential yield.

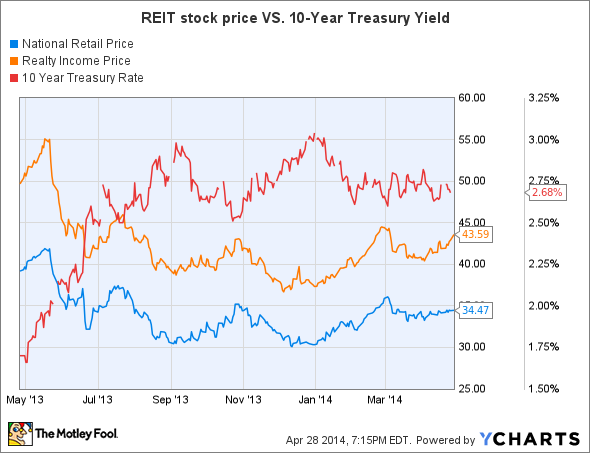

So, if the yield on Treasury bonds rise, a REIT's dividend yield has to increase to compensate risk. Since Realty Income and National Retail can't magically grow income, the stock price falls. If the dividend is constant and the stock price decreases, the dividend yield increases. Conversely, if U.S. Treasuries fall, a REITs stock price will rise, and the dividend yield will shrink.

Ultimately, Realty Income and National Retail's stock price -- as shown in the chart below -- will inversely follow the movements of U.S. Treasury yields. This allows the REIT's dividend yield to always be a few percentage points higher than those of Treasuries.

The bottom line

The goal of every investors should be to buy great businesses for less than they're worth. The second piece to that puzzle is greatly affected by interest rates. When interest rates rise, the price per share of Realty Income and National Retail falls. The less investors have to pay, the greater the potential return over time.

With that said, Realty Income and National Retail's stock represent shares of an underlying business. Businesses that have proven the ability to grow assets, earnings, and increase their dividend over time with limited correlation to interest rates.

For that reason, long-term investors shouldn't be worried about interest rates. However, they should be weary of rising rates opening up an opportunity to buy at attractive prices.