Source: Flickr / chrstpre.

The largest banks are, in a word, enormous. However you feel about it, there's no denying that the consolidation occurring in the industry has continued apace in the aftermath of the financial crisis, with the largest banks growing even bigger in spite of new regulations.

JP Morgan (JPM 0.37%) is the largest of the large. Is its size an asset, or will the bank find it increasingly difficult to succeed?

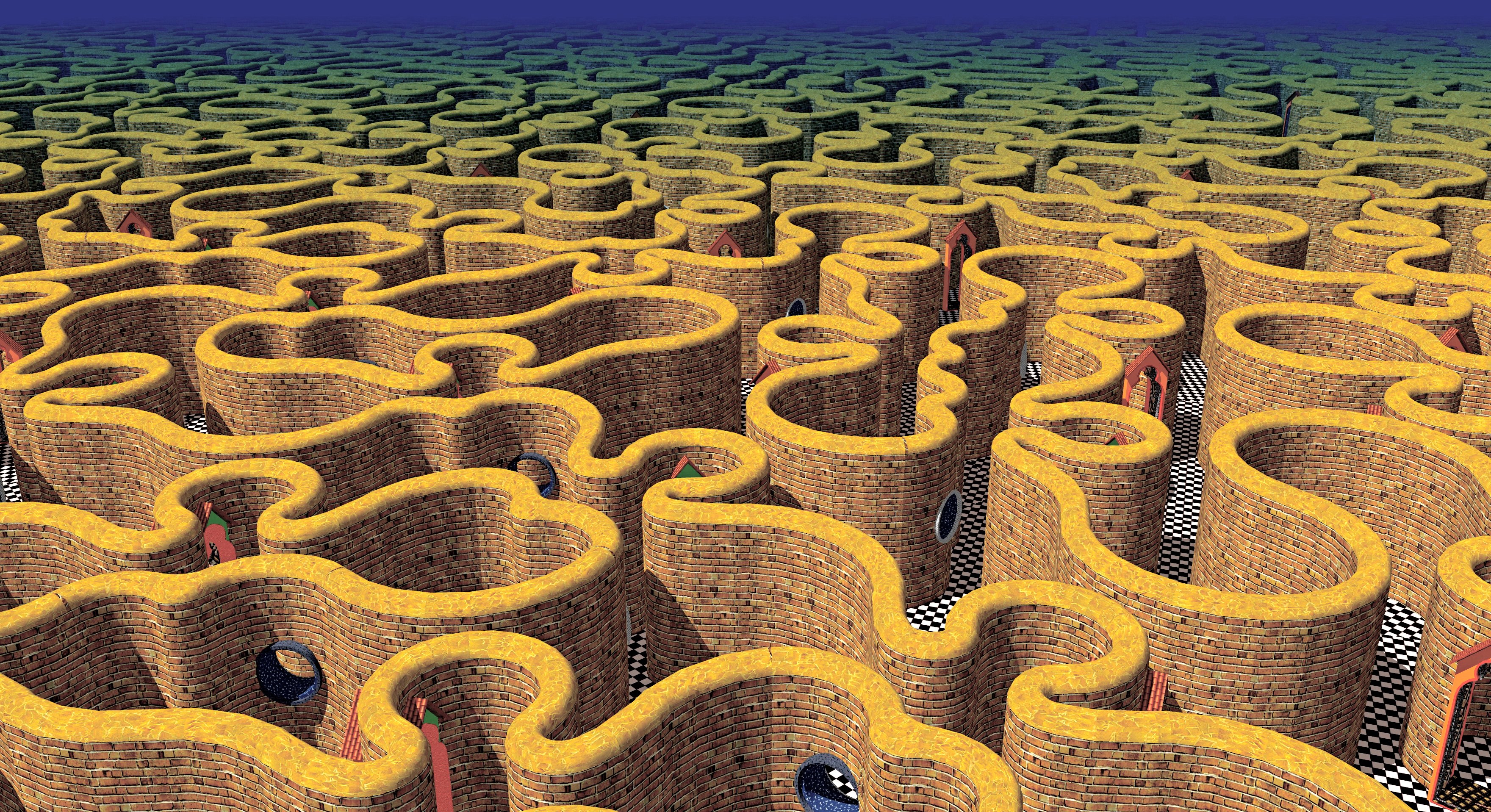

Size creates complexity

Growth has made JP Morgan increasingly bulky and complex. In a 2013 Forbes survey, JP Morgan ranked the third-largest company in the world, behind only the Chinese state-owned bank ICBC and China Construction Bank.

Source: Steve Jurvetson.

Complexity can hide the weak points of an operation until they are too big to ignore. For example, it's hard to forget Jamie Dimon's description of the unfolding London Whale fiasco as a "tempest in a teapot." These were the words of a CEO who seemed wildly out of touch with the actual goings on in his organization. The emergence of one new scandal after another in the past year hasn't exactly helped. From forex to Libor, bank executives around the world are looking more and more uninformed about the operational cancers in their organizations.

Financially, things are little better, and this poses a great risk to investors trying to understand the value of their holdings. An Atlantic article, now a year old but still eerily relevant, sums the subject up nicely: financial executives describe large banks as "complete black boxes", surveyed hedge fund managers overwhelmingly distrust bank risk-weightings, and a partner letter by Peter Singer of Elliott Associates, an investment fund, bluntly states, "There is no major financial institution today whose financial statements provide a meaningful clue" about the risks these institutions are facing.

To be fair, Jamie Dimon does seem keen on the idea of reducing the complexity of his firm, and I would be happy to see him succeed. But where one hand gives the other taketh away: Between the ongoing use and increasing attractiveness of regulatory capital trades, the lingering influence of off-balance-sheet derivatives, and the sheer scale of every activity at a bank this size, it's hard to imagine a situation in which anyone in charge (or anyone investing, for that matter) could feasibly remain comprehensively informed about potential problems at any given time. This does not bode well for the bank's long-term health.

But what about economies of scale?

You might look to economies of scale in search of a silver lining, and certainly there are efficiencies to be had from growing larger. Unfortunately, research by the Bank of England indicates that for banks, economies of scale are probably maximized at around $100 billion in assets.

For the sake of comparison, JP Morgan's December 31, 2013 assets totaled $2.4 trillion. If the Bank of England is right, then Dimon's talk of reducing complexity starts to look a little weak -- even if operations are simplified, they'll still be inefficiently large.

What About New Regulations?

New regulations requiring large banks to hold more capital are a positive step. The question is whether they are adequate to protect the financial system from the systemic risks of too big to fail. Research suggests that capital requirements should be far higher than even the more stringent new rules, especially if you take into account the high degree of asset price correlation in times of crisis.

Thus, in the end, I'm not confident that JPMorgan is a healthy institution for the long-run. Of course, it might enjoy special treatment from the government in times of crisis (despite various attempts to distance the federal government from future bailouts, I don't find this credible), meaning that the bank could survive pretty much anything.

But the fact is, due to its size, any failures by JP Morgan will eventually become our problem, whether it's through more bailouts or simply through the heavy social costs incurred from supporting a bank that's too big to succeed.