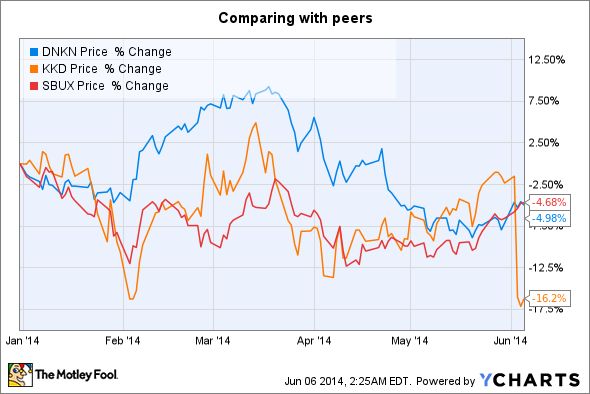

The record-setting snow accumulation and extended winter weather disrupted guest-traffic as customers were confined to their homes. Guest-traffic has been declining since March 2012 , and a bad weather only made matters worse for restaurant chains. Dunkin' Brands (DNKN), the owner of Dunkin' Donuts and Baskin Robbins, quickly put the blame on the weather for its lackluster first-quarter results. Let's take a look at its results and see how it stacks up against the likes of Starbucks (SBUX 0.47%) and Krispy Kreme Doughnuts (KKD).

Mixed results

Dunkin' Brands sells more than 1.8 billion cups of hot and iced coffee globally every year. It had a difficult start to fiscal 2014 due to the inclement weather, which disrupted sales at its restaurants. In the first quarter, the company missed consensus estimates on both revenue and earnings. It reported earnings per share of $0.33 on revenue of $171.9 million.

However, on the bright side, revenue jumped 6% versus the year-ago period, despite the bad weather. Same-store sales, or comps, at Dunkin' Donuts in the U.S. increased 1.2% versus the year-ago quarter. The company added 69 net new Dunkin' Donuts in the U.S. during the first quarter. However, investors weren't impressed with the sequential drop in revenue and the stock took a beating after the results.

Growth strategies

California is the Mecca of coffee in the U.S., boasting of three out of the top 12 "most caffeinated" cities in the U.S. Dunkin Donuts is ahead of its schedule to open its first restaurant in California by the end of 2014 . It plans to expand to more than 1,000 stores in the state.

There are three headwinds that the franchisee units in the U.S. have to cope with. First, there's continued economic uncertainty with quick service restaurant, or QSR, customers. Second, there's stiff competition in the breakfast-and-coffee categories from peers. Finally, there might be a legislative impact of minimum wage and health care issues. Dunkin' has strategies in place to brave the impact of these headwinds.

For example, it launched the DD perks rewards program on Jan. 27. Those who enroll for this earn points for every Dunkin' run. The program now has 750,000 members in a short time of just three months. The weekly spending of Dunkin' Perks members is higher than Dunkin' card holders, who are yet to join the program. It is still early days, but the membership count is expected to grow to 2.5 million by the end of 2014 . This will drive revenue going forward as customers become more loyal and keep coming back.

Another initiative is the launch of online ordering of cake at Baskin Robbins in the U.S., which started in April. In addition, Dunkin' Brands is focused on customer service, product marketing and innovations like DD Perks. It is also beefing up seasonal menu offerings.

In order to add seasonal menu items, Dunkin' Donuts recently teamed up with its sister brand, Baskin Robbins, to serve iced coffee . The new flavors on offer are Cookie Dough Iced Coffee and Jamoca Almond Fudge Iced Coffee. This is in addition to the popular Butter Pecan Iced Coffee. This will help Dunkin' combat stiff competition in the industry during the spring season.

What's the competition up to?

Krispy Kreme has transformed into a successful company over the last decade, climbing out from insolvency risks. However, just like Dunkin' Brands, its fiscal 2015 first-quarter results bore the brunt of the bad weather. It was not surprising that it missed consensus estimates on both top- and bottom-lines.

Krispy Kreme's comps declined 1.5% versus the year-ago period . Investors were not impressed as the company lowered its fiscal 2015 earnings view to the range of $0.69-$0.74 per share from $0.73-$0.79 per share earlier.

Starbucks shares have lost around 5% year-to-date. However, it is still a force to reckon with. Starbucks posted record revenue of $2.9 billion during the second quarter of fiscal 2014. This was on the back of global comps growth of 6% versus the year-ago period, representing the 17th consecutive quarter of comp growth of 5% or greater. Its strong international footprint, as compared to its peers, enabled it to ward off the negative impact of inclement weather in the U.S.

The bottom line

Although Dunkin' has got off to a choppy start in the new fiscal year, its performance can improve in the future on the back of several strategies that it has adopted. Store expansion, a loyalty program, and menu innovations will enable Dunkin' to come out of its slump. Investors should consider adding Dunkin' Brands to their portfolio as it looks like a good deal on the pullback.