Source: Wikimedia Commons

June 18, 2014 is bound to be a big day for investors who own a piece of FedEx (FDX -0.21%), which is expected to report revenue and earnings for the fourth quarter of its 2014 fiscal year. Heading into earnings, some investors are probably wondering whether to stick with the company or whether it might make more sense to sell it and buy into shares of United Parcel Service (UPS 0.53%) instead.

Analysts have modest expectations for FedEx

For the quarter, analysts expect FedEx to report revenue of $11.66 billion. If this forecast turns out to be accurate, it will represent a 2% improvement from the $11.44 billion management reported the same quarter a year earlier. Although this growth rate is respectable for a company on track to hit $45.4 billion in revenue for the year, its performance for the quarter would be half the 4% improvement seen from the fourth quarter of 2012 to the same quarter in 2013.

| Forecasted | Last Year's | |

| Revenue | $11.66 billion | $11.44 billion |

| Earnings/Share | $2.36 | $2.13 |

Source: Yahoo! Finance

Looking at profits, the situation looks a bit nicer. If analysts are correct about FedEx, then the company will likely report earnings per share of $2.36, an impressive 11% gain compared to the $2.13 management reported during the fourth quarter of 2013. In addition to benefiting from higher revenue, it's likely the logistics giant will see margins improve as its FedEx Express' $1.6 billion profit improvement plan revs up and as severe winter weather has subsided.

Is UPS a better play?

The past few years have been very kind to FedEx. Between 2009 and 2013, the company saw its revenue climb 25% from $35.5 billion to $44.3 billion. Most of this improvement took place between 2010 and 2011, when the business's top line expanded by 13% because of a 14% jump in sales in its FedEx Express segment from $21.6 billion to $24.6 billion and its FedEx Ground segment, which grew 14% as well from $7.4 billion to $8.5 billion.

FDX Revenue (Annual) data by YCharts

FedEx's growth in recent years has even outpaced United Parcel Service, the company's largest rival. Over the past five years, UPS saw its revenue increase 22% from $45.3 billion to $55.4 billion. In its most recent annual report, UPS revealed that the largest percentage gainer from a revenue perspective has been its International Package segment, which boasted a 28% spike in sales from $9.7 billion to $12.4 billion during this period.

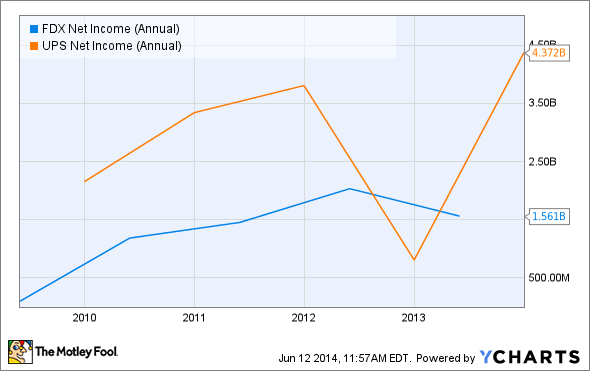

During this five-year timeframe, FedEx's profits improved at an even more impressive rate than its revenue has. Between 2009 and 2013, the company's net income soared 1,493% from $98 million to $1.56 billion. Excluding the business's impairment charges from both years, its net income rose a more modest 36% from $1.20 billion to $1.62 billion. The disparity between its revenue growth and earnings growth stemmed from its aggregate cost of revenue and operating expenses falling from 94.5% of sales to 94%.

FDX Net Income (Annual) data by YCharts

UPS has also done pretty well for itself from an earnings standpoint. Between 2009 and 2013, the logistics provider saw its net income jump 122% from $2.15 billion to $4.37 billion. Excluding a small impairment booked by management in the first quarter of its 2009 fiscal year, the company's bottom line still managed to expand by 93% as higher revenue was complimented by a reduction in cost of revenue and operating expenses from 91.6% of sales to 87.3%.

Foolish takeaway

Based on the data provided, it seems as though Mr. Market's expectations for FedEx are low... perhaps too low. Over the past five years, the logistics business has seen a nice rise in sales and a pretty strong showing in profits. Moving forward, it's difficult to tell if management can maintain this trend, but it's hard to argue against the company.

Perhaps the only downside to investing in FedEx comes from its rival, United Parcel Service. From a sales perspective, UPS has lagged FedEx slightly, but when you look at profits, UPS has led the way (after adjustments.) While this isn't necessarily indicative of management's ability to maintain this trend, the company's track record in recent years should at least make it an attractive prospect for further analysis.