Warren Buffett is well known for his mantra of "Boring is beautiful," and John D. Rockefeller is famous for once stating, "Do you know the only thing that gives me pleasure? It's seeing my dividends come in."

As The Motley Fool Million Dollar Portfolio explains: "A truckload of academic studies has shown that investing in companies that pay dividends is just about the best way to earn huge returns over time...And so here's one key takeaway: Dividend-paying companies are surer bets as investments since, on average, they operate in mature industries and enjoy steady flows of earnings."

This article is designed to highlight an industry that is of vital necessity to the global economy, yet most people haven't ever heard of (and those who have probably think it very boring). As I'll soon explain, though, the sound of decades' worth of strong, consistent dividend growth generates an excitement all its own.

Industrial gases: a backbone of the global economy

Industrial gases include atmospheric gases such as oxygen, neon, argon, and krypton as well as specialty gases such as hydrogen, CO2, helium, and acetylene (which are extracted from natural gas).

These gases are used in everything from energy (CO2 is pumped into oil and gas wells to increase pressure and can triple oil and gas output) to medical uses (anesthesia and liquid helium cooling of MRIs) to production of semiconductors and food processing. Such gases are used in steel, glass, chemical production, welding, and throughout petroleum and gas refining.

In essence, industrial gases are a way of investing in the future of the global economy. They directly or indirectly touch every industry. With the International Monetary Fund (IMF) predicting accelerating global economic growth (3% in 2013, 3.6% in 2014 and 3.9% in 2015), companies such as Praxair (LIN -0.11%), Air Products & Chemicals (APD 0.17%), and Airgas (NYSE: ARG) are an excellent way for dividend growth investors to invest in the future of the global economy -- at the right price.

Dividend growth dream stocks

| Stock | yield | dividend growth rate (10 yr CAGR) | Projected 10 yr dividend growth rate |

| ARG | 2% | 25.90% | 12.77% |

| PX | 1.90% | 14.87% | 10.10% |

| APD | 2.50% | 10.29% | 9.30% |

| IND AVG | 2% |

Sources: Yahoo Finance, S&P Capital IQ

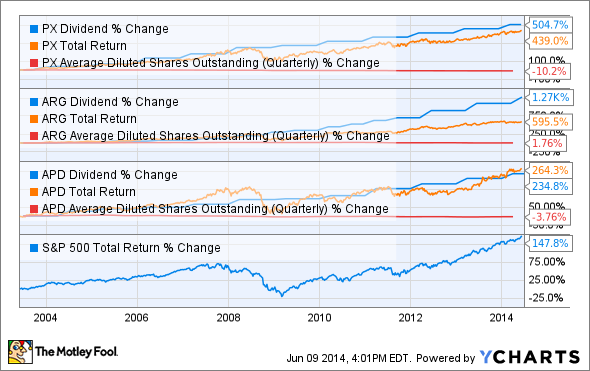

PX Dividend data by YCharts

As seen in the graph and table above, the dividend growth prowess of these companies has resulted in long-term market-trouncing returns. These results don't tell the whole story, though. Airgas, Praxair, and Air Products have raised their dividend 11, 22, and 32 consecutive years, respectively, and Air Products' dividend growth rate has been 11% CAGR during this time).

Analysts at S&P Capital IQ believe that this strong and consistent dividend growth will continue over the next decade, as do I. The reasons for this are several global socioeconomic trends, including population growth, which is spurring the demand for food, technology, and energy.

For example, Air Products & Chemicals is heavily involved with Russian LNG projects and is partnering with Denbury Resources and Valero Energy to capture CO2 out of Valero's Port Arthur refinery. Air Products will provide 50 million cubic feet/day of hydrogen which Valero will use to scrub out CO2. The scrubbed gas will then be piped through Denbury's pipelines to provide CO2 for enhanced oil recovery (EOR) projects along the Gulf Coast. Because the project cuts CO2 emissions, the U.S. Department of Energy is investing $284 million into the experimental venture. If successful, it could provide the model for a nationwide (and international) rollout for CO2 scrubbing and recycling technology.

Meanwhile, Praxair is busy expanding its operations in China, India, Thailand, and South Korea. It sees potential in these areas for 67% sales increases by 2017.

Praxair's growth strategy is multipronged, with management targeting high single-digit revenue growth, 5% annual cost reductions, and a 1%-2% annual share count reduction as part of its highly effective, disciplined capital allocation strategy. Under this strategy, management won't invest in projects unless it anticipates 14%-15% after-tax returns on capital.

Through this approach, Praxair has managed to return 10% of revenues to shareholders (6% in dividends, 4% in net buybacks) and grow its operating cashflows by 11% CAGR over the last 22 years. This was all while converting 25% of revenues into free cash flow.

Unlike Praxair and Air Products & Chemicals, Airgas has set itself up as a one-stop shop. The company offers not only comprehensive industrial gas solutions but also rents welding, metal working, and safety equipment to its 1+million customers -- its largest customer accounts for just 0.5% of sales.

Valuation concerns

| Stock | PE | Historical PE | Historical Premium |

| ARG | 23.4 | 19.9 | 22.40% |

| PX | 22.2 | 19.6 | 21.20% |

| APD | 26.2 | 17.3 | 25.20% |

| IND AVG | 18.3 |

Sources: Morningstar, Fastgraphs

For all the strong fundamentals of Praxair, Airgas, and Air Products & Chemicals and their impressive dividend growth potential, all three companies are trading at high premiums to their own historical P/E ratios, as shown above. This does not necessarily mean that investors shouldn't invest today or that market-beating returns can't be locked in at current valuation, of course; after all, a 2%-2.5% yield and likely double-digit dividend growth over the next decade is well worth considering even at a premium price.

Foolish bottom line

When it comes to building long-term wealth, boring but essential dividend growth companies like Praxair, Airgas, and Air Products & Chemicals make great investments, even when trading at premium valuations. I would certainly recommend that dividend growth investors place all three companies on their watchlists in case of a now overdue market correction. However, this situation may be an appropriate use of one of my favorite principles: buying in thirds. Rather than investing all at once, investors can open a small initial position and purchase more during times of future weakness.